Share This Page

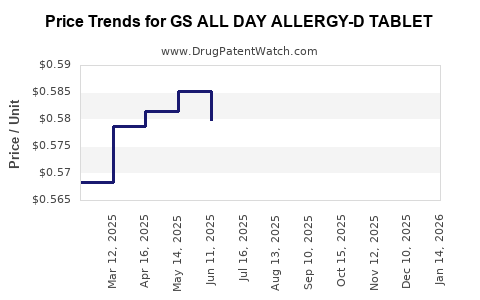

Drug Price Trends for GS ALL DAY ALLERGY-D TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for GS ALL DAY ALLERGY-D TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS ALL DAY ALLERGY-D TABLET | 00113-0147-62 | 0.57122 | EACH | 2025-12-17 |

| GS ALL DAY ALLERGY-D TABLET | 00113-0147-62 | 0.56169 | EACH | 2025-11-19 |

| GS ALL DAY ALLERGY-D TABLET | 00113-0147-62 | 0.56239 | EACH | 2025-10-22 |

| GS ALL DAY ALLERGY-D TABLET | 00113-0147-62 | 0.56292 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for GS ALL DAY ALLERGY-D TABLET

Introduction

The pharmaceutical landscape for allergy relief medications remains robust, driven by increasing prevalence of allergic conditions and the ongoing demand for effective, fast-acting therapies. GS ALL DAY ALLERGY-D TABLET, a combination oral medication formulated to alleviate allergy symptoms with a sustained duration of action, enters a competitive yet expanding market segment. This analysis evaluates current market dynamics, competitive positioning, pricing strategies, and provides forward-looking price projections.

Market Overview and Epidemiology

Allergic rhinitis and related allergic disorders affect approximately 20-30% of the global population, with rising prevalence attributed to environmental factors, urbanization, and increased awareness [1]. The demand for long-acting antihistamines and combination therapies like GS ALL DAY ALLERGY-D TABLET aligns with the need for patient convenience and symptom control.

Product Profile

GS ALL DAY ALLERGY-D TABLET combines an antihistamine (likely a second-generation, non-sedating agent such as levocetirizine or loratadine) with a decongestant (such as pseudoephedrine or phenylephrine), offering 24-hour relief from nasal congestion, sneezing, and itching. Its once-daily dosing enhances patient adherence, positioning it favorably among similar product offerings.

Market Segmentation and Competition

The primary competitors include established brands like Allegra-D®, Claritin-D®, Zyrtec-D®, and other generic combination allergy tablets. The competitive landscape is characterized by brand loyalty, pricing strategies, and formulary inclusion. Generic versions have heightened price competition, impacting margins for branded formulations.

Distribution Channels

Distribution spans pharmacies, hospital formularies, retail drug chains, and online pharmacies. Increasing adoption of telemedicine further bolsters access channels, expanding potential market reach.

Pricing Analysis

Current pricing for combination allergy tablets varies significantly based on whether the product is branded or generic. For branded products like Allegra-D®, retail prices are approximately $25-$35 for a 30-count pack (30-day course), whereas generics typically retail at $10-$20. The entry of GS ALL DAY ALLERGY-D TABLET as a branded product or generic impact will shape pricing strategies.

Market Entry and Positioning

If GS ALL DAY ALLERGY-D TABLET is introduced as a generic, competitive pricing may range between $10-$15 per 30-day supply, aligning with other generics to penetrate the market quickly. For a branded positioning, a premium pricing approach could maintain prices around $20-$25, emphasizing unique formulation or longer duration benefits.

Price Projections and Trends

-

Short-Term (1-2 years):

Expect initial prices to stabilize around $10-$20, with generic versions dominating due to lower price points. Market penetration will be influenced by formulary inclusion and physician prescribing habits, which favor cost-effective options for managed care plans. -

Medium-Term (3-5 years):

As patent protections lapse or biosimilar competition emerges, prices will decline further, potentially reaching $8-$12 for generics. Marketing efforts emphasizing unique formulation attributes may sustain a slight premium for branded versions. -

Long-Term (5+ years):

With increased generic competition and potential over-the-counter (OTC) availability, prices may decline to $5-$10, broadening access and reducing costs for consumers. Price erosion is likely, especially in markets with high generic penetration.

Regulatory and Market Dynamics Impact

Regulatory policies favoring biosimilar and generic entry contribute to downward pressure on prices. Additionally, healthcare providers and payers increasingly favor cost-saving therapies, incentivizing broader adoption of low-cost generics. Conversely, patent settlements and exclusivity periods could temporarily sustain higher prices for branded formulations.

Market Growth Drivers

- Escalating prevalence of allergic diseases globally.

- Increasing healthcare access and patient awareness.

- Expansion of online retail and telehealth channels.

- Policy shifts promoting generic substitution and formulary inclusions.

Market Challenges

- Intense competition from established generics.

- Price sensitivity among consumers and payers.

- Regulatory hurdles for new formulations or combination products.

Strategic Recommendations

- Position GS ALL DAY ALLERGY-D TABLET as a cost-effective generic initially to maximize market share.

- Leverage formulations with proven efficacy to justify any premium pricing.

- Engage with healthcare payers early to secure formulary inclusion.

- Explore OTC pathways to expand access and revenue streams.

| Key Price Projection Summary: | Year | Expected Price Range (per 30 tablets) | Notes |

|---|---|---|---|

| 1-2 | $10 - $20 | Entry at competitive pricing, emphasizing affordability. | |

| 3-5 | $8 - $12 | Market saturation, generic competition intensifies. | |

| 6-10 | $5 - $10 | Broad market penetration, potential OTC availability. |

Conclusion

GS ALL DAY ALLERGY-D TABLET’s market prospects hinge on strategic pricing, efficient distribution, and regulatory navigation. Initial positioning as a cost-efficient generic can accelerate uptake, with prices declining over time due to competition and market dynamics. Staying attuned to healthcare policy shifts and evolving consumer preferences will be essential for optimizing profitability.

Key Takeaways

- Market expansion for allergy combination tablets continues, driven by rising prevalence and consumer demand for convenience.

- Competitive pricing for GS ALL DAY ALLERGY-D TABLET should initially target $10-$15 per 30-day supply, aligning with existing generics.

- Long-term pricing is expected to decline to $5-$10, especially with increased OTC availability.

- Strategic focus on formulary inclusion and cost-effective positioning is vital for market penetration.

- Ongoing regulatory developments remain a key factor influencing pricing and market access.

FAQs

1. What factors influence the pricing of allergy combination tablets like GS ALL DAY ALLERGY-D?

Pricing is primarily influenced by formulation costs, competitive landscape, patent status, regulatory environment, and market demand. Generic competition exerts downward pressure, while branded exclusivity can sustain higher prices.

2. How does the competition from generic brands impact the pricing of GS ALL DAY ALLERGY-D?

Generics typically sell at lower prices ($8-$12 per 30-day supply), prompting brand manufacturers to either match these prices or differentiate their products through efficacy, formulation, or marketing to justify higher prices.

3. What is the outlook for pricing if GS ALL DAY ALLERGY-D becomes available over the counter?

OTC availability usually leads to significant price reductions ($5-$10), expanding access but compressing profit margins. It may also increase market share through broader consumer usage.

4. How do healthcare policies affect the pricing and market dynamics of allergy medications?

Policies favoring generic substitution and formulary inclusion promote lower prices. Regulatory incentives for biosimilars and adherence programs can further influence market competitiveness and pricing strategies.

5. What is the strategic significance of early formulary access for GS ALL DAY ALLERGY-D?

Securing formulary placement early ensures preferential prescribing and reimbursement, enabling drug manufacturers to establish a stable customer base and maintain favorable pricing trajectories.

References

[1] World Allergy Organization. Epidemiology of Allergic Diseases. 2022.

More… ↓