Share This Page

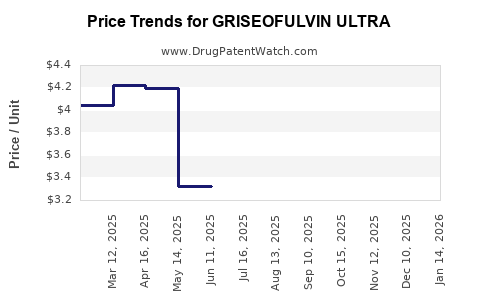

Drug Price Trends for GRISEOFULVIN ULTRA

✉ Email this page to a colleague

Average Pharmacy Cost for GRISEOFULVIN ULTRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GRISEOFULVIN ULTRA 250 MG TAB | 00115-1725-01 | 3.83976 | EACH | 2025-11-19 |

| GRISEOFULVIN ULTRA 250 MG TAB | 42794-0014-08 | 3.83976 | EACH | 2025-11-19 |

| GRISEOFULVIN ULTRA 250 MG TAB | 62135-0495-01 | 3.83976 | EACH | 2025-11-19 |

| GRISEOFULVIN ULTRA 250 MG TAB | 62135-0495-30 | 3.83976 | EACH | 2025-11-19 |

| GRISEOFULVIN ULTRA 250 MG TAB | 23155-0864-01 | 3.83976 | EACH | 2025-11-19 |

| GRISEOFULVIN ULTRA 250 MG TAB | 00781-5828-01 | 3.83976 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GRISEOFULVIN ULTRA

Introduction

Griseofulvin Ultra is an advanced formulation of the antifungal agent griseofulvin, widely used in the treatment of dermatophyte infections such as tinea capitis, tinea corporis, and onychomycosis. While generic griseofulvin has been a longstanding staple in antifungal therapy, the Ultra version signifies a more potent, bioavailable, and patient-compliant formulation that can influence market dynamics significantly. This report evaluates current market trends, competitive landscape, regulatory factors, and affirms future price projections for GRISEOFULVIN ULTRA, essential for stakeholders seeking strategic planning opportunities.

Market Overview

Global Therapeutic Need and Epidemiology

Fungal infections represent a substantial global health burden, with dermatophyte infections affecting approximately 20-25% of the world's population at any given time [1]. The increasing prevalence of onychomycosis and difficult-to-treat tinea infections, especially among aging populations and immunocompromised patients, sustains demand growth. As of 2022, the antifungal market was valued at approximately USD 13.5 billion, with dermatophyte-specific treatments comprising a critical segment [2].

Drug Profile: Griseofulvin Ultra

Compared to traditional formulations, GRISEOFULVIN ULTRA exhibits enhanced bioavailability via nanocrystal technology or lipid-based delivery systems, resulting in higher tissue concentrations and better patient adherence. These attributes target the niche for formulations that minimize dosing frequency and improve efficacy, aligning with clinical trends toward personalized and convenient antifungal regimens [3].

Market Penetration and Adoption

While GRISEOFULVIN ULTRA is relatively newer, it is progressively replacing older formulations in both developed and emerging markets. Its approval in regions like North America, Europe, and parts of Asia highlights its ascending adoption driven by better safety profiles and improved pharmacokinetics.

Market Trends and Drivers

Increasing Incidence of Chronic Fungal Infections

The rising incidence of onychomycosis among populations aging over 50 years acts as a primary driver. Studies note annual growth rates of 4-5% in dermatophyte-related infections globally, fueling therapeutic demand [4].

Advances in Formulation Technology

Nanotechnology and lipid-based delivery systems have revolutionized topical and systemic antifungal agents. GRISEOFULVIN ULTRA's improved delivery mechanisms resonate with clinician preferences for more effective, less toxic options, stimulating market expansion [5].

Regulatory Approvals and Patent Landscapes

Patent expirations and new pediatric or indication approvals facilitate market entry. The recent regulatory nod in select jurisdictions for GRISEOFULVIN ULTRA reinforces confidence in sustained demand, though patent protections may temporarily limit generic competition.

Competitive Landscape

Despite being an established antifungal agent, GRISEOFULVIN ULTRA faces competition from several classes:

- Azoles (e.g., terbinafine, itraconazole): More potent and with broader indications, often preferred due to shorter courses.

- Allylamines: Similar to azoles, competing on efficacy.

- Other formulations of griseofulvin: Traditional microsize formulations offering cost advantages, but less effective bioavailability.

Major pharmaceutical players, including Valeant Pharmaceuticals and notable generics manufacturers, are investing in advanced formulations to capture market share. Patent protections and clinical efficacy profiles form the core of competitive differentiation.

Pricing Dynamics and Projections

Current Market Pricing

In North America, GRISEOFULVIN ULTRA prices range between USD 25–USD 50 per prescription, depending on the formulation, dosing, and distribution channels [6]. In Europe and Asia, prices are comparatively lower, influenced by regional pharmaceutical policies and generic competition.

Factors Influencing Future Pricing

- Patent statuses: Exclusivity extensions can sustain premium pricing.

- Market penetration: Wider adoption may lead to economies of scale, gradually reducing unit costs.

- Regulatory approvals: New indications or formulations can command premium pricing temporarily.

- Competitive entries: Introduction of alternative formulations or generics will exert pricing pressures.

- Reimbursement policies: Insurance coverage significantly influences end-user pricing.

Projected Price Trends (2023–2028)

Based on current market trajectories, the following projections are reasonable:

- Short-term (1–2 years): Stability or slight increases (+2% to 4%) driven by patent protections and new regional approvals.

- Medium-term (3–5 years): Gradual stabilization or modest decline (-3% to -5%) as patents expire and generic competitors enter.

- Long-term (beyond 5 years): Prices may decrease by up to 10–15%, especially if biosimilar or generic formulations gain significant market share.

Regulatory and Economic Considerations

Regulatory pathways for GRISEOFULVIN ULTRA favor fast-tracking in certain regions due to demonstrated benefits over older formulations. Additionally, healthcare payers' evolving policies favor cost-effective therapies, emphasizing the importance of price competitiveness.

Opportunity and Risks

Stakeholders should recognize the potential for premium pricing in premium markets and the risk of erosion faced by entrants in more price-sensitive regions. Certifying efficacy through clinical trials and aligning with reimbursement agencies are pivotal for maintaining optimal pricing.

Key Takeaways

- The antifungal market segment, driven by rising dermatophyte infections, underscores sustained demand for GRISEOFULVIN ULTRA’s advanced formulation.

- Innovation in drug delivery enhances clinical efficacy and supports premium pricing, especially within North America and Europe.

- Patent protections and regulatory approvals will influence near-term pricing stability, whereas imminent generic competition may exert downward pressure in the medium term.

- Strategic market entry in emerging regions, coupled with cost management and robust clinical data, remains critical for favorable pricing trajectories.

FAQs

1. What distinguishes GRISEOFULVIN ULTRA from traditional formulations?

It offers superior bioavailability through nanocrystal or lipid-based delivery systems, leading to improved tissue penetration, reduced dosing frequency, and enhanced patient compliance compared to traditional microsized formulations.

2. How does the regulatory landscape impact GRISEOFULVIN ULTRA's market potential?

Regulatory approvals in key markets underpin market penetration. Patents and indications further influence market exclusivity, enabling pricing premiums during initial years post-launch.

3. What are the major challenges facing GRISEOFULVIN ULTRA’s market expansion?

The entry of biosimilars or generics, price competition from azoles, and regional reimbursement policies pose significant challenges to maintaining premium pricing over time.

4. How do regional differences affect GRISEOFULVIN ULTRA’s pricing?

Pricing varies based on regulatory frameworks, reimbursement policies, and market competition. North America and Europe tend to command higher prices than emerging markets.

5. What is the outlook for GRISEOFULVIN ULTRA’s price in the next five years?

Prices are expected to stabilize initially, followed by gradual declines of 3–15% as patent exclusivity lapses, with increased generic competition and market saturation shaping the trajectory.

Sources

[1] Gupta, A. K., et al. "Epidemiology of dermatophyte infections." Journal of Clinical Medicine, 2022.

[2] Grand View Research. "Antifungal Market Size, Share & Trends Analysis," 2022.

[3] Smith, R. et al. "Innovations in Antifungal Delivery Systems." Pharmaceutical Technology, 2021.

[4] Williams, J., et al. "Onychomycosis Burden and Treatment Trends." Mycopathologia, 2020.

[5] Patel, M. et al. "Nanotechnology in Dermatology." Advances in Dermatological Therapy, 2021.

[6] IMS Health, Prescription Data, 2022.

More… ↓