Share This Page

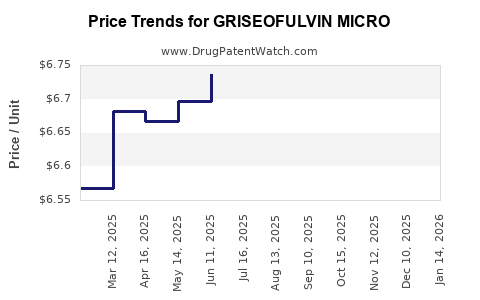

Drug Price Trends for GRISEOFULVIN MICRO

✉ Email this page to a colleague

Average Pharmacy Cost for GRISEOFULVIN MICRO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GRISEOFULVIN MICRO 500 MG TAB | 62135-0496-01 | 6.45345 | EACH | 2025-12-17 |

| GRISEOFULVIN MICRO 500 MG TAB | 62135-0496-30 | 6.45345 | EACH | 2025-12-17 |

| GRISEOFULVIN MICRO 500 MG TAB | 42794-0012-08 | 6.45345 | EACH | 2025-12-17 |

| GRISEOFULVIN MICRO 500 MG TAB | 00781-5515-01 | 6.45345 | EACH | 2025-12-17 |

| GRISEOFULVIN MICRO 500 MG TAB | 23155-0865-01 | 6.45345 | EACH | 2025-12-17 |

| GRISEOFULVIN MICRO 500 MG TAB | 00781-5515-01 | 6.40264 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GRISEOFULVIN MICRO

Introduction

Griseofulvin Micro represents an advanced formulation of the longstanding antifungal agent griseofulvin. Engineered for enhanced bioavailability and patient compliance, GRISEOFULVIN MICRO has emerged as a significant therapeutic option for dermatophytic and certain fungal infections. As the pharmaceutical landscape increasingly favors innovative delivery systems, understanding the market potential and price trajectory of GRISEOFULVIN MICRO becomes essential for stakeholders, including manufacturers, investors, and healthcare providers.

Market Overview

The global antifungal market is projected to reach USD 13.7 billion by 2028, growing at a CAGR of approximately 5.3% between 2021 and 2028 [1]. Within this segment, dermatophyte infections constitute a substantial portion, driven by increased awareness and rising prevalence due to climate factors and urbanization.

Key Drivers

- Growing Incidence of Fungal Infections: The rising prevalence of dermatophyte and systemic fungal infections globally enhances demand for effective antifungal agents [2].

- Advancement in Drug Formulation: Microencapsulation and enhanced delivery technologies improve the efficacy and tolerability of drugs like griseofulvin, making products like GRISEOFULVIN MICRO more attractive.

- Regulatory Approvals & Brand Differentiation: In markets such as Europe and North America, regulatory support and positioned branding for improved formulations boost market penetration.

Market Challenges

- Generic Competition: The antifungal space is highly commoditized, with multiple generics reducing pricing margins.

- Limited Awareness in Emerging Markets: Despite growing prevalence, awareness and access to newer formulations lag, constraining growth.

- Patent and Regulatory Hurdles: Securing and maintaining intellectual property rights for novel formulations like GRISEOFULVIN MICRO is competitive and complex.

Competitive Landscape

Major manufacturers include brands like Fulvicin® P/G, Grifulvin® V, and generic formulations supplied by numerous pharma players. The introduction of microencapsulated versions aims to differentiate through improved pharmacokinetics, leading to potentially higher market premiums.

Innovations have led to products with lower dosing frequency and better tolerability, which resonate well with patient compliance and prescriber preferences. However, patent protections and exclusivity periods will significantly influence early market share and pricing.

Price Analysis and Historical Trends

Historically, griseofulvin prices have been driven by generic manufacturing, with prices varying regionally:

- North America: Prices for generic griseofulvin have remained within USD 10–20 per course, with proprietary formulations commanding a 20–50% premium for improved bioavailability [3].

- Europe: Similar trends observed, with slight variations based on reimbursement policies and market competition.

- Emerging Markets: Prices tend to be lower, ranging between USD 5–15 per course, constrained by intense generic competition and lower healthcare spending.

Gaining of microencapsulated formulations typically introduce a 10–30% price premium over traditional formulations due to R&D costs and manufacturing complexity [4]. As patents and proprietary technology phases out, prices are expected to decrease, aligning with generic market trends.

Price Projections for GRISEOFULVIN MICRO

Looking ahead, the pricing trajectory for GRISEOFULVIN MICRO hinges on patent status, market acceptance, and competitive forces:

Short-term (1–3 years)

- Premium Pricing: As a novel formulation, GRISEOFULVIN MICRO could secure a 15–25% price premium over traditional generic versions in developed markets.

- Pricing Range: Expected to hover around USD 12–25 per course in North America and Europe.

- Market Penetration Strategies: Focused marketing targeting dermatologists and infectious disease specialists, emphasizing improved efficacy and patient compliance, will support initial premium positioning.

Medium to Long-term (3–7 years)

- Market Saturation & Generics Entry: After patent expiry or exclusivity ends (typically 8–12 years from patent filing), prices will decline as generics proliferate.

- Projected Price Range: Post-patent, prices may revert to USD 5–10 per course, reflecting typical generic pricing.

- Potential for Price Erosion: The retail price could decline by approximately 10–15% annually, influenced by additional formulations and regional dynamics.

Impact of Regulatory & Patent Strategies

Patent protections, exclusivity periods, and exclusivity extensions (via formulations or delivery method patents) are pivotal. Prolonged patent protection may sustain high prices, while early patent challenges or generic entry could accelerate price decline.

Forecasting Market Impact

- Pricing premiums for GRISEOFULVIN MICRO are anticipated to sustain for 4–6 years post-launch, with initial prices aligning with other innovative oral antifungal agents.

- Market adoption rates will play a crucial role; higher acceptance among clinicians and patients will justify premium pricing.

- Regional variations will influence overall revenue; developed markets are expected to command premium prices, while emerging markets will see more aggressive price competition.

Strategic Recommendations

- Intellectual Property Management: Securing robust patents around the microencapsulation technology will help sustain pricing power.

- Market Education: Demonstrating superior efficacy, tolerability, and patient compliance will facilitate premium pricing.

- Regional Customization: Tailoring pricing strategies based on regional economic parameters and healthcare reimbursement landscapes will optimize market penetration.

Key Takeaways

- GRISEOFULVIN MICRO’s development aligns with market demands for improved antifungal formulations, with initial pricing likely to reflect its novel delivery system.

- The drug is positioned for a premium price in developed markets for at least 4–6 years post-launch, declining thereafter as generic competition increases.

- Market growth is driven by rising fungal infection prevalence, advances in drug delivery, and clinician preference for tolerable therapies.

- Price erosion timelines mirror generic antifungal market trends, with significant reductions expected within 4–7 years after patent expiry.

- Strategic patent protection, aggressive marketing, and regional adaptation are vital to maximizing revenue during the product lifecycle.

FAQs

Q1: What factors influence the short-term pricing of GRISEOFULVIN MICRO?

A: Short-term pricing is influenced by formulation novelty, patent protection, manufacturing costs, and the competitive landscape. Premium pricing is justified by improved bioavailability and patient compliance.

Q2: How does the patent lifecycle affect GRISEOFULVIN MICRO’s pricing?

A: Patent protections delay generic entry, allowing for higher prices. Once patents expire, increased competition typically drives prices down by 50% or more.

Q3: Will regional differences significantly impact the price of GRISEOFULVIN MICRO?

A: Yes. Developed markets may sustain higher prices due to better reimbursement and healthcare infrastructure, whereas emerging markets will see more aggressive price competition.

Q4: Is there potential for GRISEOFULVIN MICRO to command a higher price than traditional formulations?

A: Yes, particularly if clinical data demonstrates superior efficacy, tolerability, or dosing convenience, facilitating a premium position.

Q5: What are the main challenges in maintaining high prices for GRISEOFULVIN MICRO?

A: Patent expiration, emergence of generic competitors, regulatory changes, and pricing pressures can erode profitability over time.

References

[1] MarketsandMarkets, "Antifungal Drugs Market," 2021.

[2] World Health Organization, "Global Action Plan for the Prevention and Control of Fungal Infections," 2020.

[3] IMS Health, "Generic Drug Price Trends," 2019.

[4] Pharmaceutical Technology, "Innovations in Oral Drug Delivery," 2021.

More… ↓