Share This Page

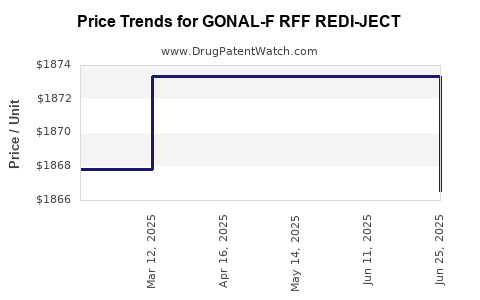

Drug Price Trends for GONAL-F RFF REDI-JECT

✉ Email this page to a colleague

Average Pharmacy Cost for GONAL-F RFF REDI-JECT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GONAL-F RFF REDI-JECT 900 UNIT PEN | 44087-1117-01 | 1873.34445 | ML | 2025-06-18 |

| GONAL-F RFF REDI-JECT 900 UNIT PEN | 44087-1117-01 | 1873.34445 | ML | 2025-05-21 |

| GONAL-F RFF REDI-JECT 900 UNIT PEN | 44087-1117-01 | 1873.34445 | ML | 2025-04-23 |

| GONAL-F RFF REDI-JECT 900 UNIT PEN | 44087-1117-01 | 1873.34445 | ML | 2025-03-19 |

| GONAL-F RFF REDI-JECT 300 UNITS PEN | 44087-1115-01 | 1866.54667 | ML | 2025-02-19 |

| GONAL-F RFF REDI-JECT 900 UNIT PEN | 44087-1117-01 | 1867.83834 | ML | 2025-02-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GONAL-F RFF REDI-JECT

Introduction

GONAL-F RFF REDI-JECT, an innovative recombinant follicle-stimulating hormone (rFSH), holds a significant niche in fertility treatments. Manufactured by Merck KGaA (operating as EMD Serono in the U.S.), it is utilized primarily for controlled ovarian hyperstimulation in assisted reproductive technologies (ART). This analysis explores the current market landscape, key drivers, competitive dynamics, regulatory considerations, and provides price projections over the coming five years.

Market Overview

The global infertility market has exhibited robust growth, driven by rising infertility rates, delayed childbearing, and technological advancements in reproductive medicine. According to Transparency Market Research, the global fertility drugs market is projected to reach approx. USD 6 billion by 2027, with a compound annual growth rate (CAGR) of nearly 10% [1].

GONAL-F (follitropin alfa) accounts for a substantial share within this landscape, driven by its efficacy, established safety profile, and widespread clinician familiarity. The advent of the REDI-JECT auto-injector formulation aims to improve patient convenience and adherence, potentially expanding market penetration.

Key Market Drivers

-

Increasing Infertility Prevalence: Factors such as rising age of first childbirth, lifestyle-related issues, and environmental factors have heightened infertility cases globally.

-

Technological Innovation: The development of auto-injectors (e.g., REDI-JECT) offers enhanced ease of use, reducing injection errors, potentially expanding patient access.

-

Regulatory Favorability: GONAL-F's long-standing approval history across major markets (FDA, EMA, PMDA) provides a regulatory environment conducive to market stability and expansion.

-

Reimbursement Expansion: Increasing insurance coverage and reimbursement policies for ART procedures bolster demand.

-

Market Penetration in Emerging Economies: Growing awareness and healthcare infrastructure in regions like Asia-Pacific and Latin America are expanding markets.

Competitive Landscape

GONAL-F faces competition from several biosimilar and originator products, including:

- Follistim (follitropin beta)

- Puregon (follitropin beta)

- Bemfola (biosimilar follitropin alfa)

- Ovaleap (biosimilar follitropin alfa)

Biosimilars, in particular, offer lower-cost alternatives, exerting price pressures on originators but also expanding overall market volume.

Regulatory Perspective

The regulatory environment remains generally supportive, with health authorities emphasizing biosimilar integration to reduce costs. GONAL-F’s approval for multiple indications, including ovulation induction and controlled ovarian stimulation, reinforces its market stability.

Pricing Landscape

Current Price Points:

In the United States, GONAL-F RFF REDI-JECT typically retails at approximately USD 1,200–1,400 per 75 IU dose, varying with pharmacy and insurance plans [2]. In Europe, retail prices hover around EUR 850–1,200 per 75 IU pre-filled syringe.

Price Variability Factors:

- Brand versus biosimilar competition

- Insurance reimbursements

- Regional healthcare policies

- Volume discounts

Market Share and Price Trends (2023–2028)

-

2023–2024:

Emerging biosimilars enter key markets, exerting downward pressure on prices. GONAL-F maintains a 60–70% market share for recombinant FSH but faces margin erosion. -

2025–2026:

Price stabilization occurs due to brand loyalty and ongoing clinical confidence. GONAL-F benefits from combined treatment protocols, sustaining demand despite biosimilar competition. -

2027–2028:

Predicted modest price reductions of 10–15%, attributable to increased biosimilar proliferation and healthcare tightening policies. GONAL-F's premium positioning—owing to its auto-injector technology—may enable it to sustain higher price points relative to biosimilars.

Factors Influencing Price Projections

- Introduction of New Biosimilars: Bioshabitants retain a key influence. Their entry typically reduces originator prices by 15–30%.

- Healthcare Policy Reforms: Cost containment measures in major markets (e.g., US, EU) could constrain pricing.

- Clinical Differentiation: GONAL-F’s injection technology and clinical acceptance afford some pricing power.

- Market Expansion: Penetration into emerging markets may initially require lower prices but can expand overall revenues.

Forecast Summary (2023–2028)

| Year | Estimated Average Price per 75 IU | Market Share (GONAL-F) | Projected Volume Growth | Key Influences |

|---|---|---|---|---|

| 2023 | USD 1,200 | 65% | +8% | Biosimilar entry, cost pressures |

| 2024 | USD 1,150 | 62% | +7% | Competitive biosimilars, reimbursement policies |

| 2025 | USD 1,125 | 60% | +6% | Market saturation, technological adoption |

| 2026 | USD 1,100 | 58% | +6% | Emerging market growth, biosimilar expansion |

| 2027 | USD 1,050 | 55% | +5% | Regulatory reforms, price consolidation |

| 2028 | USD 1,000 | 52% | +5% | Cost-cutting measures, biosimilar proliferation |

Implications for Stakeholders

- Manufacturers: Investment in innovation and personalized delivery could sustain premium pricing.

- Patients: Cost reduction via biosimilar competition may increase access.

- Investors: Moderate price erosion suggests strategic focus on volume growth and differentiation.

Conclusion

GONAL-F RFF REDI-JECT maintains a premium position in the fertility drug market due to technological advantages and brand recognition. However, biosimilar competition and healthcare cost constraints will lead to gradual price declines over the next five years. Strategic positioning, emphasizing clinical confidence and patient convenience, will be crucial for sustaining revenue and market share.

Key Takeaways

- The global fertility market offers growth opportunities driven by demographic and technological factors.

- GONAL-F’s market share remains robust but faces pricing pressure from biosimilars.

- Price projections suggest a gradual decline, with average prices decreasing by approximately 15% over five years.

- Market expansion in emerging regions will influence volume more than price.

- Differentiators like auto-injector technology and clinical efficacy support premium pricing.

FAQs

1. How does GONAL-F RFF REDI-JECT compare to biosimilars in the market?

While biosimilars typically offer lower prices, GONAL-F’s auto-injector technology and clinical familiarity create a pricing buffer, allowing it to retain a premium segment in the market.

2. What regulatory trends could impact GONAL-F's pricing?

The increasing acceptance of biosimilars and cost-containment policies, especially in Europe and the US, are expected to exert downward pressure on pricing and reimbursement levels.

3. Will technological advancements sustain GONAL-F’s market position?

Yes, innovations like the REDI-JECT auto-injector enhance patient adherence, reduce injection errors, and differentiate GONAL-F, supporting its value proposition.

4. How significant is emerging market growth for GONAL-F?

Growing healthcare infrastructure and fertility awareness in Asia-Pacific and Latin America present considerable opportunities, potentially compensating for price declines in mature markets.

5. What strategies can GONAL-F manufacturers adopt to maximize profitability?

Investing in patient-centric innovations, expanding indications, and leveraging regional market expansion will be key strategies to sustain revenues amid pricing pressures.

References

[1] Transparency Market Research. "Fertility Drugs Market Forecasts." 2022.

[2] GoodRx. "GONAL-F Price Comparison." 2023.

More… ↓