Share This Page

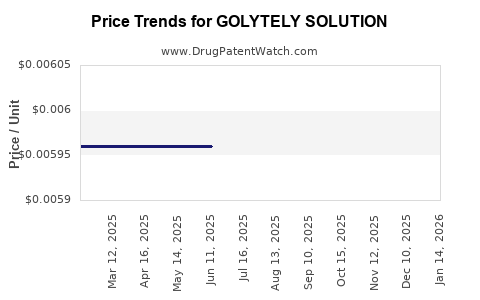

Drug Price Trends for GOLYTELY SOLUTION

✉ Email this page to a colleague

Average Pharmacy Cost for GOLYTELY SOLUTION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GOLYTELY SOLUTION | 52268-0100-01 | 0.00597 | ML | 2025-12-17 |

| GOLYTELY SOLUTION | 52268-0100-01 | 0.00597 | ML | 2025-11-19 |

| GOLYTELY SOLUTION | 52268-0100-01 | 0.00597 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GOLYTELY SOLUTION

Introduction

GOLYTELY SOLUTION, a widely used bowel preparatory agent, plays a pivotal role in gastrointestinal diagnostic procedures such as colonoscopy and surgical interventions. Its active composition, typically polyethylene glycol (PEG) based, ensures effective bowel cleansing with minimal systemic absorption. The global demand for GOLYTELY, driven by increasing screening rates and a rising prevalence of gastrointestinal disorders, underscores significant market opportunities. This analysis evaluates market dynamics, competitive landscape, regulatory factors, and price trajectories to aid stakeholders in making informed strategic decisions.

Market Overview

The GOLYTELY market is primarily segmented based on application, end-user, and geographic region. The dominant application remains colonoscopy preparation, accounting for over 70% of total sales, fueled by rising colorectal cancer screening programs worldwide. End-user sectors include hospitals, clinics, and outpatient surgical centers, with hospitals leading owing to their extensive procedural volume.

The global gastrointestinal procedures market is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next five years, influenced by health awareness initiatives and technological advancements. The increasing adoption of minimally invasive procedures further amplifies demand for effective bowel preparation solutions like GOLYTELY.

Market Drivers

1. Rising Prevalence of Gastrointestinal Diseases

Increased incidences of colon cancer, inflammatory bowel disease, and other GI disorders expand the need for accurate diagnostics, consequently boosting demand for bowel cleansing agents. According to the World Health Organization, colorectal cancer ranks as the third most common cancer globally, emphasizing the importance of colonoscopy procedures.

2. Screening Program Expansion

Government health initiatives, especially in developed nations, advocate routine colonoscopy screenings for early cancer detection. For example, the U.S. Preventive Services Task Force recommends screening starting at age 45-50, thereby increasing procedural volumes annually.

3. Technological and Formulation Innovations

Advancements in formulation—such as reduced-volume, flavored, and low-sodium variants—and improved tolerability have expanded patient compliance, leading to broader adoption.

4. Growing Aging Population

Elderly demographics are more susceptible to gastrointestinal disorders, contributing to higher demand for bowel prep solutions.

Competitive Landscape

Major players include Salix Pharmaceuticals (a subsidiary of Bausch Health), Ferring Pharmaceuticals, Norgine Pharmaceuticals, and local generic manufacturers. Salix, with GOLYTELY, holds a significant market share owing to brand recognition and extensive distribution networks. Generic renditions and over-the-counter (OTC) options are becoming increasingly prevalent, intensifying price competition.

Regulatory Environment

Regulatory agencies such as the FDA in the U.S. and EMA in Europe enforce stringent safety and efficacy standards. Recent updates involve guidelines on labeling, pediatric use, and risk communication related to electrolyte imbalance and dehydration risks. The regulatory landscape influences market entry strategies and pricing policies, favoring innovation and safety.

Pricing Dynamics and Projections

Historical Pricing Trends

Historically, branded GOLYTELY prices have hovered in the range of $200-$300 per treatment kit in the U.S., with variations based on regional pricing and reimbursement policies. Generics, once introduced, have driven prices downward by approximately 20-30%, increasing market accessibility.

Current Market Pricing Factors

Factors influencing current pricing include manufacturing costs, regulatory compliance, distribution logistics, and competitive pressures. Pricing also varies based on formulation improvements and packaging sizes, with smaller, patient-friendly packs commanding premium margins.

Projected Price Trends

Forecasts indicate a gradual decline in average per-treatment costs due to rising generic competition and healthcare cost containment strategies. Over the next five years, prices are expected to decrease by approximately 10-15% globally, with variances based on regional economic conditions and reimbursement policies.

Future Market Pricing Outlook

- Developed Markets (e.g., US, Europe): Expect slight price reductions driven by generic penetration and value-based care initiatives. Premium formulations with improved tolerability may sustain higher prices temporarily.

- Emerging Markets (e.g., Asia-Pacific, Latin America): Prices may stabilize or even increase due to demand growth, limited local manufacturing capabilities, and import dependencies, leading to higher costs for consumers.

Market players might adopt tiered pricing models, offering basic generics at lower prices while maintaining premium formulations for specific segments. The expansion of OTC availability could further compress prices.

Market Challenges and Opportunities

Challenges

- Regulatory Restrictions: Stringent safety warnings may limit formulary inclusion or affect pricing.

- Competitive Pressures: Entry of generics significantly impacts revenue streams.

- Patient Compliance Factors: Tasteless, tolerable formulations are essential to maintain adherence, influencing product development costs.

- Supply Chain Disruptions: Raw material shortages and logistics issues can inflate costs and impact pricing.

Opportunities

- Innovative Formulations: Developing low-volume, flavored, or pediatric-friendly options can command premium pricing.

- Digital Health Integration: Utilizing digital platforms for patient education and adherence may enhance product uptake and loyalty.

- Geographic Expansion: Entering emerging markets with tailored pricing strategies can unlock new revenue streams.

- Partnerships and Alliances: Collaborations with healthcare providers and insurers can facilitate broader distribution and reimbursement coverage.

Strategic Recommendations for Stakeholders

- Invest in Formulation Innovation: Focus on improving tolerability and convenience to command higher prices.

- Monitor Regulatory Trends: Stay abreast of safety communication and labeling requirements to optimize market access.

- Balance Price and Volume: Leverage generic competition to optimize revenue, possibly through strategic price differentiation.

- Expand Geographic Presence: Capitalize on rising screening programs in emerging markets with region-specific pricing models.

- Enhance Supply Chain Resilience: Secure sourcing of raw materials and streamline logistics to control costs.

Key Takeaways

- The GOLYTELY market is poised for steady growth driven by rising gastrointestinal screening and aging populations.

- Price trajectories are expected to decline modestly over the next five years, influenced heavily by commoditization and generic competition.

- Innovation in formulation and expanding geographic markets offer avenues to sustain premium pricing strategies.

- Stakeholders should focus on balancing affordability with differentiated offerings to maximize margins.

Conclusion

The GOLYTELY solution market presents a balanced landscape of growth opportunities and pricing challenges. By understanding evolving regulatory environments, technological advances, and regional dynamics, pharmaceutical companies and healthcare providers can navigate market complexities effectively. Strategic investments in product innovation, market expansion, and supply chain optimization will be crucial for capitalizing on projected demand growth while maintaining competitive pricing.

FAQs

1. What factors most influence the pricing of GOLYTELY solutions?

Pricing is impacted by manufacturing costs, regulatory compliance, competition from generics, formulation innovations, regional economic factors, and reimbursement policies.

2. How is the entry of generics affecting GOLYTELY pricing?

Generic competition has led to a decline of approximately 20-30% in branded product prices, increasing market accessibility and pressuring brand dominance.

3. Are there significant regional differences in GOLYTELY pricing?

Yes, developed countries tend to have higher prices due to regulatory and reimbursement frameworks, while emerging markets may see lower prices but higher import costs.

4. What upcoming innovations could impact the GOLYTELY market?

Advancements include low-volume, flavored, pediatric-specific formulations and combination preparations, which could enhance patient compliance and allow for premium pricing.

5. What strategic moves should manufacturers consider in this market?

Investing in formulation improvements, expanding into underserved markets, forming strategic alliances, and managing cost efficiencies are recommended to sustain profitability.

Sources:

- World Health Organization. "Global Cancer Statistics." 2022.

- U.S. Preventive Services Task Force. "Colorectal Cancer Screening Recommendations." 2022.

- MarketWatch. "Gastrointestinal Drugs Market Size, Share & Trends." 2023.

- FDA Guidelines. "Safety and Labeling Updates for Bowel Preparation Solutions." 2022.

- Industry Reports. "Pharmaceutical Market Dynamics in Gastrointestinal Drugs." 2023.

More… ↓