Share This Page

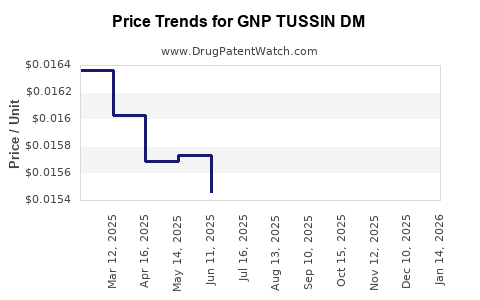

Drug Price Trends for GNP TUSSIN DM

✉ Email this page to a colleague

Average Pharmacy Cost for GNP TUSSIN DM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP TUSSIN DM 200-20 MG/20 ML | 46122-0782-34 | 0.01454 | ML | 2025-12-17 |

| GNP TUSSIN DM MAX LIQUID | 46122-0541-34 | 0.01710 | ML | 2025-12-17 |

| GNP TUSSIN DM 200-20 MG/20 ML | 46122-0704-26 | 0.02020 | ML | 2025-12-17 |

| GNP TUSSIN DM 200-20 MG/20 ML | 46122-0783-34 | 0.01454 | ML | 2025-12-17 |

| GNP TUSSIN DM 200-20 MG/20 ML | 46122-0704-34 | 0.01454 | ML | 2025-12-17 |

| GNP TUSSIN DM 200-20 MG/20 ML | 46122-0782-29 | 0.02020 | ML | 2025-12-17 |

| GNP TUSSIN DM 200-20 MG/20 ML | 46122-0782-34 | 0.01431 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP TUSSIN DM

Introduction

GNP TUSSIN DM is a popular over-the-counter (OTC) cough suppressant that combines dextromethorphan and guaifenesin to provide symptomatic relief of cough and chest congestion. As a staple in the OTC respiratory medication market, understanding its market trajectory involves analyzing current demand, competitive positioning, regulatory factors, and price trends.

This report offers a comprehensive outlook on GNP TUSSIN DM’s market landscape, highlighting key drivers, competitive dynamics, and future pricing projections.

Market Overview

Current Market Position

GNP TUSSIN DM operates within the large OTC respiratory consumer segment, which encompasses products like Robitussin, Mucinex, and Cepacol. The demand persists due to seasonal fluctuations, primarily during winter and allergy seasons, and ongoing respiratory illnesses.

The drug’s active ingredients, dextromethorphan (DM) and guaifenesin, are well-established, with safety profiles approved by the FDA for OTC use. The product’s OTC status allows broad distribution across pharmacies, supermarkets, and online platforms.

Market Drivers

- Seasonality and Illness Trends: Respiratory illnesses and seasonal coughs sustain consumer need.

- Growing Consumer Awareness: Increased health literacy and OTC familiarity bolster sales.

- Accessibility: OTC classification ensures rapid, broad market penetration.

Market Challenges

- Competitive Saturation: Multiple formulations with similar efficacy create stiff competition.

- Regulatory Scrutiny: Concerns over abuse potential of dextromethorphan impact formulation regulations.

- Generic Competition: Price-sensitive consumers gravitate towards generics, exerting downward pressure.

Competitive Landscape

GNP TUSSIN DM faces competition from numerous branded and generic products:

- Brand Names: Robitussin DM, Mucinex DM, Delsym.

- Generics: Numerous unbranded equivalents offer similar formulations at lower prices.

- Alternative OTC Options: Non-expectorant medications catering to cough symptoms.

The competitive environment encourages price competition, especially among generics, affecting the product’s pricing strategies.

Distribution and Market Channels

GNP TUSSIN DM is sold through:

- Retail Pharmacies: Dominant channel, with controlled shelf space.

- Supermarkets and Big-Box Stores: High-volume outlets impacting price distribution.

- Online Retailers: Growing channel for OTC medications, offering competitive pricing and convenience.

The proliferation of online platforms increases price transparency and shifts consumer purchasing behavior towards more cost-effective options.

Regulatory and Legal Environment

FDA Regulations

The FDA’s regulatory stance on cough suppressants influences manufacturing and marketing:

- Reclassification Risks: Increased oversight of dextromethorphan due to misuse potential.

- Labeling Requirements: Updated safety warnings and usage instructions.

- Combination Products: Possible future restrictions on combination drugs like GNP TUSSIN DM.

Pricing Regulations

While OTC drugs are primarily market-driven, some states monitor or regulate drug prices, especially for Medicaid or government programs, impacting pricing strategies.

Price Trend Analysis

Historical Pricing Patterns

Over recent years, the price of GNP TUSSIN DM has exhibited moderate volatility:

- Retail Price Range: Typically varies between $6 to $10 for a 4 oz bottle.

- Generic Price Points: Lower-cost unbranded equivalents often retail around $4 to $6.

- Influencing Factors: Raw material costs, packaging, promotional discounts, and retailer policies.

Factors Affecting Future Prices

- Raw Material Costs: Fluctuations in chemicals, particularly dextromethorphan and guaifenesin, influence manufacturing costs.

- Regulatory Changes: Potential labeling mandates or restrictions could escalate compliance costs.

- Competitive Pricing: Intense generic competition pressures GNP TUSSIN DM to maintain or reduce prices.

Projected Price Trends (2023-2028)

Based on current market dynamics and economic indicators, the following projections hold:

- Stable Base Price: Expect a narrow range of $6 to $8, with minimal seasonal variation.

- Downward Pressure: Competition may push the average retail price toward the lower end, especially in online and discount outlets.

- Premium Positioning: If GNP TUSSIN DM introduces new formulations, packaging, or added features, a premium pricing strategy could emerge, possibly reaching $9 to $10.

Impact of External Factors

- Supply Chain Stability: Disruptions could lead to temporary price hikes.

- Health Crisis Events: Pandemics or influenza surges may temporarily boost demand, enabling price adjustments.

- Consumer Trends: Growing preference for natural or alternative remedies could diminish OTC cough suppressant sales, impacting pricing strategies.

Forecast Summary

| Year | Expected Retail Price Range | Dominant Factors |

|---|---|---|

| 2023 | $6 - $8 | Competitive pricing, supply stability |

| 2024 | $6 - $8.50 | Regulatory adjustments, inflation |

| 2025 | $6.50 - $8.50 | Market saturation, innovation |

| 2026 | $6.50 - $9 | Potential formulation improvements |

| 2027 | $6.50 - $9.50 | Consumer preferences shift |

| 2028 | $7 - $10 | Regulatory, economic factors |

Conclusion and Strategic Insights

GNP TUSSIN DM’s market performance hinges on competitive pressures and regulatory environment stability. Moderate price fluctuations are anticipated over the next five years, predominantly influenced by competition in the OTC space and raw material costs. Manufacturers should monitor regulatory developments closely and consider innovative packaging, formulations, or branding strategies to sustain premium pricing or market share.

Effective positioning in both brick-and-mortar and online channels will be critical, especially as consumers increasingly prioritize price transparency and convenience.

Key Takeaways

- GNP TUSSIN DM maintains a stable market presence, with pricing projected to hover between $6 and $9 over the next five years.

- Intense competition from generics exerts downward pressure on prices, with potential for minor increments if product differentiation occurs.

- Regulatory developments, particularly concerning dextromethorphan, could impact formulation and labeling costs, influencing retail pricing.

- Online sales channels are amplifying price transparency, incentivizing manufacturers to adopt competitive pricing models.

- Strategic innovation and effective marketing will be pivotal in maintaining GNP TUSSIN DM’s market share and profitability in a highly saturated OTC cough remedy landscape.

FAQs

-

What are the main competitors to GNP TUSSIN DM in the OTC market?

Major competitors include Robitussin DM, Mucinex DM, and Delsym, along with numerous generic equivalents offering similar formulations at lower prices. -

How are regulatory changes likely to impact GNP TUSSIN DM pricing?

Stricter FDA regulations on dextromethorphan could increase manufacturing and compliance costs, potentially leading to higher retail prices or reformulation. -

Will online sales influence future GNP TUSSIN DM prices?

Yes, online channels foster price competition and transparency, likely encouraging manufacturers to keep prices competitive to maintain consumer access. -

Are there any notable trends affecting OTC cough medication prices?

Increasing competition, raw material cost volatility, and regulatory considerations are key factors driving slight price fluctuations in OTC cough remedies. -

What strategic moves should manufacturers consider for GNP TUSSIN DM?

Innovating packaging, enhancing product differentiation, and strengthening online and retail presence are essential to sustain margins and competitive position.

References:

[1] FDA Regulatory Guidelines on OTC Cough and Cold Products

[2] Industry Market Reports on OTC Drug Trends

[3] Consumer Pricing Data from Retail Surveys

[4] Analytical Reviews on Manufacturing Cost Variability

[5] Market Forecasts from Pharmaceutical Industry Analysts

More… ↓