Share This Page

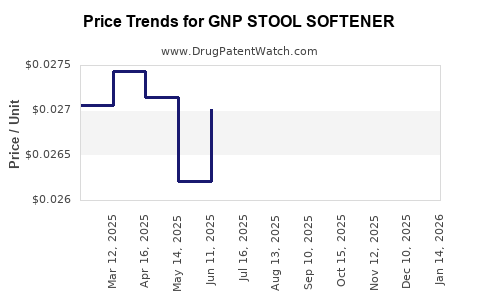

Drug Price Trends for GNP STOOL SOFTENER

✉ Email this page to a colleague

Average Pharmacy Cost for GNP STOOL SOFTENER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP STOOL SOFTENER 100 MG SFGL | 46122-0692-78 | 0.02885 | EACH | 2025-12-17 |

| GNP STOOL SOFTENER 250 MG SFGL | 46122-0693-78 | 0.04929 | EACH | 2025-12-17 |

| GNP STOOL SOFTENER-STIM LAX TB | 46122-0669-78 | 0.03270 | EACH | 2025-12-17 |

| GNP STOOL SOFTENER 100 MG SFGL | 46122-0692-85 | 0.02885 | EACH | 2025-12-17 |

| GNP STOOL SOFTENER 100 MG SFGL | 46122-0692-72 | 0.02885 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Stool Softener

Introduction

GNP Stool Softener is an over-the-counter (OTC) medication used primarily to relieve constipation by softening stools, facilitating easier bowel movements. As with many established gastrointestinal therapies, GNP Stool Softener occupies a significant niche within the global laxative market. This analysis explores current market dynamics, competitive positioning, regulatory landscape, and future price projections for GNP Stool Softener, providing actionable insights for stakeholders.

Market Overview

The global laxative market, including stool softeners, anticipates steady growth driven by increasing prevalence of gastrointestinal disorders, aging populations, and rising awareness of OTC therapies. The market size was estimated at USD 4.8 billion in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of approximately 4.5% from 2023 to 2030 [1].

Key Drivers:

- Aging Population: Older adults experience higher constipation prevalence, expanding demand for stool softeners like GNP.

- Chronic Conditions: Conditions such as irritable bowel syndrome (IBS), opioid-induced constipation, and dietary factors augment usage.

- OTC Accessibility: Growing preference for self-medication enhances OTC product sales, including GNP.

Market Segments:

- Brand vs. Generic: Generic stool softeners constitute approximately 70% of sales, with GNP competing in this space.

- Distribution Channels: Pharmacies, supermarkets, online platforms, and healthcare providers.

Competitive Landscape

GNP Stool Softener operates in a competitive environment with numerous stakeholders, including:

- Major Pharmaceutical Companies: Johnson & Johnson, Bayer, and Reynolds Consumer Healthcare.

- Generic Manufacturers: Comprising smaller firms with lower pricing strategies targeting price-sensitive consumers.

The market is characterized by tight price competition, regulatory constraints, and high demand for safety and efficacy. Brand loyalty remains modest, with consumers often prioritizing price and convenience.

Regulatory Environment Impact

Regulatory agencies, like the FDA (U.S.) and EMA (Europe), enforce strict guidelines on labeling, safety, and manufacturing standards for OTC laxatives. Compliance ensures market access but may influence cost structures and, consequently, retail pricing [2].

Recent regulatory trends include:

- Enhanced safety labeling: Leading to increased formulation transparency.

- New guidelines on active ingredients: Affecting product formulation and approval timelines.

These factors influence production costs and, by extension, product pricing strategies.

Pricing Analysis

Current Pricing Dynamics:

- Wholesale Price: Generic GNP Stool Softener typically retails between USD 3.50 - USD 7.00 per bottle (contains 100-200 tablets or capsules).

- Retail Price: Consumer prices vary based on location, distribution channel, and formulation size but generally range from USD 4.00 - USD 8.00 retail.

Factors Affecting Price Points:

- Manufacturing Costs: Economies of scale and ingredient sourcing impact pricing.

- Regulatory Compliance: Costs of meeting safety standards influence retail prices.

- Market Competition: Aggressive pricing by generics tends to keep prices low.

- Brand Positioning: GNP’s positioning as a reputable or value-formulated product influences its pricing strategy.

Pricing Trends:

Over the past five years, prices have remained relatively stable due to high competition and a mature market. Minor price fluctuations reflect inflation, ingredient costs, and distribution expenses.

Future Price Projections (2023-2030)

Based on current market dynamics, cost trends, and regulatory factors, the following projections are outlined:

| Year | Estimated Wholesale Price | Estimated Retail Price | Key Drivers |

|---|---|---|---|

| 2023 | USD 3.75 - USD 7.50 | USD 4.50 - USD 8.50 | Inflation, raw material costs, regulation updates |

| 2024 | USD 3.80 - USD 7.65 | USD 4.55 - USD 8.75 | Competitive pricing pressures, supply chain stability |

| 2025 | USD 3.85 - USD 7.80 | USD 4.60 - USD 9.00 | Increased demand, potential formulation updates |

| 2026 | USD 3.90 - USD 8.00 | USD 4.75 - USD 9.25 | Regulatory shifts, raw material costs stabilization |

| 2027-2030 | Slight incremental increases (2-3% annually) | Stabilized or gradual increase | Market maturation, inflation, possible formulation innovations |

This conservative projection reflects minimal but continuous price adjustments, embracing market competitiveness and inflationary pressures.

Market Risks and Opportunities

Risks:

- Regulatory delays or stricter standards may increase manufacturing costs.

- Pricing pressures from generics could compress margins.

- Market saturation in mature markets could restrict price growth.

Opportunities:

- Emerging markets present room for price premium positioning due to increasing health awareness.

- Product innovation, such as enhanced formulations (e.g., added probiotics), can command higher prices.

- Digital marketing and online sales broaden accessibility and enable differentiated pricing strategies.

Conclusion

GNP Stool Softener remains a competitive product within a mature, high-volume OTC market. Pricing stability is expected through 2030, with minor incremental increases driven by regulatory compliance, raw material costs, and market demand. Stakeholders should focus on strategic positioning, continued regulatory adherence, and exploring emerging markets for potential growth and premium pricing.

Key Takeaways

- The global laxative market, including stool softeners like GNP, is projected to grow at around 4.5% CAGR, driven primarily by aging populations and OTC consumer preference.

- Current retail prices for GNP Stool Softener typically range from USD 4.00 to USD 8.00 per unit, with competitive pressures maintaining stable pricing.

- Future price increases are expected to be modest (~2-3% annually) due to market saturation and aggressive generics competition.

- Regulatory compliance costs and formulation innovations may influence pricing, offering opportunities for premium positioning.

- Emerging markets and product diversification remain strategic avenues for revenue growth and improved pricing margins.

FAQs

1. What factors most influence the pricing of GNP Stool Softener?

Pricing is primarily affected by manufacturing costs, regulatory compliance expenses, market competition, distribution channels, and consumer demand.

2. How does regulatory environment impact GNP Stool Softener prices?

Regulations increase compliance costs, which can elevate manufacturing expenses and influence retail pricing, especially if new safety or formulation standards are introduced.

3. Are generic versions of GNP Stool Softener more affordable?

Yes. Generics typically undercut brand-name products like GNP, leading to lower consumer prices due to decreased R&D costs and competitive pricing strategies.

4. What emerging markets could present growth opportunities for GNP Stool Softener?

Regions such as Southeast Asia, Latin America, and Africa present expanding healthcare access and rising consumer health awareness, allowing for premium pricing strategies.

5. How might technological innovations affect future pricing?

Product enhancements, such as formulations with added functional benefits, can justify higher prices. Additionally, online sales facilitate direct-to-consumer pricing flexibility and promotional strategies.

References

[1] Market Research Future, “Global Laxatives Market Trends and Forecast,” 2022.

[2] U.S. Food and Drug Administration (FDA), “Over-the-Counter (OTC) Drug Regulation,” 2023.

More… ↓