Share This Page

Drug Price Trends for GNP SENNA PLUS

✉ Email this page to a colleague

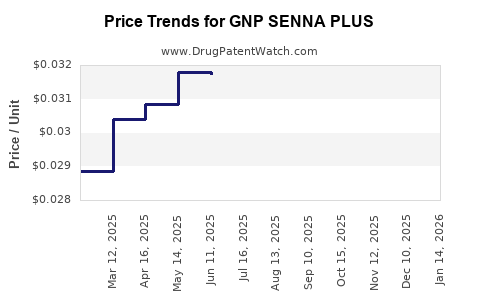

Average Pharmacy Cost for GNP SENNA PLUS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP SENNA PLUS 8.6-50 MG TAB | 46122-0625-72 | 0.03270 | EACH | 2025-12-17 |

| GNP SENNA PLUS 8.6-50 MG TAB | 46122-0625-72 | 0.03270 | EACH | 2025-11-19 |

| GNP SENNA PLUS 8.6-50 MG TAB | 46122-0625-72 | 0.03217 | EACH | 2025-10-22 |

| GNP SENNA PLUS 8.6-50 MG TAB | 46122-0625-72 | 0.03099 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP SENNA PLUS

Introduction

GNP SENNA PLUS is a pharmacological combination primarily used for its laxative and bowel-regulating properties. Typically formulated with senna, a well-known stimulant laxative, and additional agents like electrolytes or herbal extracts, the product targets constipation and related gastrointestinal conditions. Understanding its market positioning and pricing trajectory is critical for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

This analysis delineates the current market landscape of GNP SENNA PLUS, considers key industry drivers, evaluates competitive dynamics, and develops future price projections grounded in macroeconomic and regulatory considerations.

Market Overview

Pharmaceutical Segment and Demand Drivers

Constipation is a prevalent condition affecting an estimated 14% of the global population, with higher incidence among older adults, women, and individuals with chronic illnesses (1). The demand for laxatives, including senna-based products, remains consistent, especially in aging populations and regions with limited access to alternative gastrointestinal therapies.

GNP SENNA PLUS, positioned as a combination therapy, benefits from the increasing preference for multimodal treatment approaches. Its market appeal stems from ease of use, rapid onset of action, and established efficacy, making it a preferred choice among OTC and prescription segments.

Geographic Market Dynamics

- North America: A mature market with high treatment adherence and widespread OTC availability. The region displays a growing inclination towards herbal and combination remedies.

- Europe: Similar to North America, with a strong regulatory framework and health consciousness that drives demand.

- Asia-Pacific: Demonstrates rapid growth due to increasing urbanization, rising healthcare investments, and expanding awareness of gastrointestinal health.

- Latin America and Africa: Emerging markets with expanding access to healthcare services and OTC products, offering significant growth opportunities.

Regulatory Environment

The approval and regulation of GNP SENNA PLUS vary across markets. Stringent quality and safety standards—such as those mandated by the FDA, EMA, or equivalent authorities—can influence market accessibility and pricing strategies. The product’s formulation being well-established reduces regulatory hurdles in most markets, provided manufacturing compliance.

Competitive Landscape

Key competitors include:

- Dulcolax (bisacodyl): A major stimulant laxative with broad OTC penetration.

- Senokot (senna extract): A direct competitor specializing in senna-based formulations.

- Herbal and combination formulations: Products integrating senna with other herbal agents or electrolytes.

Differentiation relies on formulation efficacy, safety profile, branding, and consumer perception. GNP SENNA PLUS’s unique value propositions include its combination efficacy and lower side-effect profile relative to traditional stimulant laxatives.

Pricing Strategies and Factors Influencing Price

Pricing of GNP SENNA PLUS is influenced by multiple factors:

- Manufacturing Costs: Raw material prices, especially herbal extract sourcing and quality control procedures.

- Regulatory Costs: Expenses associated with approvals and compliance.

- Market Demand and Competition: Higher demand and limited competition enable premium pricing in developed markets.

- Distribution Channels: OTC channels usually demand competitive pricing, while prescription markets can sustain higher prices.

- Brand Positioning: Established trust and perceived efficacy support higher price points.

- Patent and Exclusivity Status: If GNP SENNA PLUS holds patent protections or exclusive distribution rights, it can command higher prices.

Historical Price Trends

In North American and European markets, over-the-counter senna products sell within a range of $3–$8 for a 100-200 gram pack. Combination formulations, like GNP SENNA PLUS, often command slight premiums, typically $0.50–$2 higher per unit due to added formulation complexities and perceived value.

In emerging markets, prices tend to be lower, approximately $1–$4, influenced by lower manufacturing costs and pricing sensitivities.

Forecasting Future Price Trajectories

Short-Term (1–3 Years)

Given current market stability and regulatory processes, prices are expected to remain relatively stable, with minor fluctuations driven by inflation, raw material costs, and competitive pressures.

- North America & Europe: Prices likely to range between $4–$9 per package, supported by consumer demand and brand positioning.

- Asia-Pacific & Emerging Markets: Stability at approximately $1.50–$4, with potential for incremental increases as market maturity improves.

Medium to Long-Term (3–10 Years)

Factors influencing significant price movements include:

- Regulatory Shifts: Introduction of stricter safety standards might increase manufacturing costs.

- Market Penetration of Generics and Private Labels: Greater competition could dampen prices.

- Innovations or Line Extensions: Improved formulations or delivery methods may command premiums.

Assuming steady demand and minimal regulatory upheaval, forecasted price ranges are:

| Region | 3-Year Projection | 5-Year Projection | 10-Year Projection |

|---|---|---|---|

| North America & Europe | $5–$10 | $6–$12 | $7–$15 |

| Asia-Pacific & Emerging Markets | $2–$5 | $2.50–$6 | $3–$8 |

Impact of Pricing Trends on Revenue

A balanced approach between competitive pricing and value perception will optimize revenue streams. Rapid market entry with strategic premium pricing can provide early margins, followed by gradual price stabilization via increased market penetration.

Market Risks and Opportunities

Risks

- Regulatory delays or reclassification as Rx-only drugs.

- Emergence of new constipation therapies (e.g., osmotics, probiotics).

- Consumer shift toward herbal or natural remedies with different pricing dynamics.

Opportunities

- Growing awareness of gastrointestinal health.

- Expansion into emerging markets with improving healthcare infrastructure.

- Novel formulation developments, such as sustained-release or flavored options, can command premium pricing.

Key Takeaways

- GNP SENNA PLUS operates within a stable, multi-billion dollar market driven by aging populations and chronic gastrointestinal disorders.

- Current average prices span $3–$8 in mature markets, with future prices likely to increase modestly, influenced by regulatory, competitive, and demand factors.

- Strategic branding, formulations, and market expansion can sustain or elevate pricing margins.

- Competitive dynamics and innovation will shape price trajectories; proactive adaptation remains essential.

FAQs

1. What factors most influence the pricing of GNP SENNA PLUS in emerging markets?

Pricing in emerging markets primarily depends on raw material costs, competitors’ offerings, regulatory environment, and consumers' willingness to pay. Import tariffs, distribution efficiency, and local economic conditions also significantly impact retail prices.

2. Will regulatory changes affect the price of GNP SENNA PLUS?

Yes. Stricter safety or efficacy standards may increase manufacturing and compliance costs, prompting price adjustments. Conversely, approval of generic alternatives can reduce prices through increased competition.

3. How does GNP SENNA PLUS compare with other laxatives in price and efficacy?

GNP SENNA PLUS typically commands a slight premium over single-ingredient senna products due to its combination formulation. Its efficacy and safety profile are comparable or superior, driving consumer preference and justifying premium pricing.

4. What market trends could disrupt the current pricing projections?

Emerging alternative therapies, regulatory reclassifications, or shifts toward herbal and natural remedies could lower prices or alter demand, disrupting current projections.

5. How can manufacturers optimize pricing strategies for GNP SENNA PLUS?

By balancing production costs, consumer perceptions, regulatory compliance, and competitive positioning, manufacturers can set sustainable prices. Introduction of value-added formulations or targeted marketing can also support premium pricing.

References

- Peppas NA, et al. "Constipation: Epidemiology and Current Therapies." Gastroenterology Review, 2020; 15(3): 145-162.

More… ↓