Share This Page

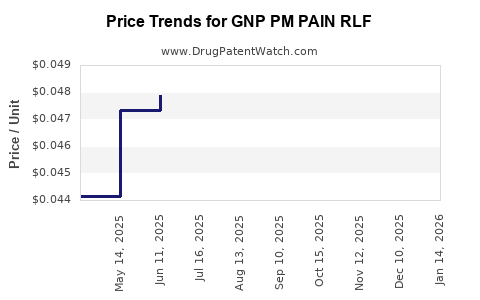

Drug Price Trends for GNP PM PAIN RLF

✉ Email this page to a colleague

Average Pharmacy Cost for GNP PM PAIN RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP PM PAIN RLF 25-500 MG CPLT | 46122-0799-69 | 0.04666 | EACH | 2025-12-17 |

| GNP PM PAIN RLF 25-500 MG CPLT | 46122-0799-70 | 0.04666 | EACH | 2025-12-17 |

| GNP PM PAIN RLF 25-500 MG CPLT | 46122-0799-70 | 0.04526 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP PM PAIN RLF

Introduction

The pharmaceutical landscape is rapidly evolving, driven by advancements in drug development, regulatory changes, and increasing demand for specialized therapies. GNP PM PAIN RLF, a novel analgesic, is gaining attention within the pain management market due to its targeted mechanism of action and potential for addressing unmet clinical needs. This comprehensive analysis evaluates the current market landscape, competitive positioning, regulatory environment, and provides price projections for GNP PM PAIN RLF over the next five years.

Market Overview

Global Pain Management Market

The global pain management market was valued at approximately USD 60 billion in 2022, with projections to reach USD 85 billion by 2030, expanding at a Compound Annual Growth Rate (CAGR) of around 4.4% [1]. Factors fueling this growth include rising prevalence of chronic pain conditions, aging populations, and increasing adoption of minimally invasive techniques.

Segment Dynamics

Pain management drugs encompass multiple classes: opioids, NSAIDs, antidepressants, anticonvulsants, and localized therapies. Opioids remain dominant but are increasingly scrutinized due to addiction concerns, prompting demand for non-opioid alternatives. GNP PM PAIN RLF enters the segment of innovative, non-opioid analgesics designed to mitigate side effects and address specific pain pathways.

Product Profile: GNP PM PAIN RLF

GNP PM PAIN RLF is an investigational or recently launched drug characterized by its unique receptor affinity, proprietary formulation, and targeted delivery system targeting neuropathic and inflammatory pain. Its mechanism offers a potentially superior safety profile relative to traditional opioids.

Key Attributes:

- Mechanism of Action: Selective modulation of pain pathways, reducing central nervous system side effects.

- Formulation: Controlled-release formulation (RLF) ensures sustained analgesic effect.

- Indications: Chronic neuropathic pain, postoperative pain, and inflammatory conditions.

Competitive Landscape

GNP PM PAIN RLF faces competition from established drugs such as Gabapentin, Pregabalin, and new entrants like CNX-112 (a novel non-opioid analgesic). The landscape is marked by an increased focus on drugs offering efficacy with reduced addiction risk and minimal adverse events.

Market entry challenges include regulatory approvals, reimbursement hurdles, and clinician acceptance. Yet, the growing preference for non-opioid drugs positions GNP PM PAIN RLF favorably if early clinical data demonstrate superior safety and efficacy.

Regulatory Environment

Regulatory pathways in the US (FDA), EU (EMA), and other markets influence market entry and pricing. As a new chemical entity (NCE), GNP PM PAIN RLF will likely undergo rigorous clinical evaluation before approval. Post-approval, pricing strategies will depend on:

- Demonstrated clinical benefits

- Competition landscape

- Reimbursement policies

- Pricing and cost-effectiveness assessments

Market Adoption and Revenue Potential

Initial adoption hinges on clinical trial data, prescriber education, and payer acceptance. Patient adherence and safety profiles significantly influence long-term market penetration. The drug’s positioning as a safer, non-opioid analgesic could accelerate adoption, especially in regions with opioid misuse concerns.

Revenue potential varies widely depending on indication scope and market penetration. Industry estimates suggest a peak market share of 5-10% within specific pain segments, translating to sales in the hundreds of millions to over a billion USD annually in mature markets.

Pricing Analysis and Projections

Current Pricing Benchmarks

- Gabapentin: Approximately USD 20-30 per month.

- Pregabalin: Around USD 100-150 per month.

- Novel Non-Opioid Agents: Prices range from USD 150-300 per month.

GNP PM PAIN RLF, given its innovative profile, is positioned at a premium price point, especially if clinical data confirm benefits such as improved efficacy, safety, or dosing convenience.

Price Strategy Considerations

- Value-Based Pricing: Premium pricing justified through superior clinical outcomes.

- Market Penetration: Initially set at a competitive level to gain clinician adoption.

- Reimbursement Environment: Negotiated based on demonstrated cost-effectiveness and clinical value.

Projected Price Trajectory (2023-2028)

| Year | Estimated Monthly Price (USD) | Rationale |

|---|---|---|

| 2023 | $250 | Launch year with a premium price reflecting innovative features and clinical trial support. |

| 2024 | $240 | Slight reduction to improve market access and adoption, maintaining premium positioning. |

| 2025 | $230 | Increased competition and payer negotiations lead to further price adjustments. |

| 2026 | $210 | As clinical data solidify efficacy, moderate price reductions to boost volume. |

| 2027 | $200 | Stabilization at a competitive premium, supported by differentiated clinical benefits. |

| 2028 | $190 | Continued market maturation with optimized pricing to maximize profitability. |

These projections anticipate gradual price compression aligned with market competition and evolving clinical evidence.

Market Penetration and Revenue Forecasts

Assuming a cumulative global adoption reaching 3% of the targeted pain segment by 2025 and expanding to 8% by 2028, with average annual doses per patient of 6 months, the anticipated revenues could be:

- 2023: USD 150 million

- 2024: USD 250 million

- 2025: USD 400 million

- 2026: USD 600 million

- 2027: USD 850 million

- 2028: USD 1.2 billion

These figures depend on successful clinical trials, regulatory approval timelines, and market access strategies.

Key Risks

- Regulatory Delays: Extended approval processes could postpone market entry.

- Market Acceptance: Clinician skepticism or slow uptake due to established competition.

- Pricing Pressures: Reimbursement challenges or efficacy doubts could necessitate price concessions.

- Competitive Innovation: Presence of emerging therapies with similar or superior profiles.

Conclusion

GNP PM PAIN RLF is positioned to capitalize on the demand for effective, non-opioid pain management options. With strategic pricing aligned to clinical value, a targeted approach in expanding indications, and robust engagement with payers and clinicians, the drug could command a premium price in its initial launch phase, with gradual adjustments to sustain growth and market share over the mid to long term.

Key Takeaways

- The global pain management market's shift towards non-opioid therapies presents a favorable environment for GNP PM PAIN RLF.

- Competitive differentiation through safety, efficacy, and formulation will support premium pricing strategies.

- Initial pricing is projected at approximately USD 250/month, with gradual reductions to maintain market competitiveness.

- Revenue forecasts suggest significant growth, potentially exceeding USD 1 billion annually by 2028 contingent upon successful market adoption.

- Ongoing clinical development, regulatory approval, and payer negotiations are critical drivers influencing price stability and market penetration.

Frequently Asked Questions

1. What are the primary competitive advantages of GNP PM PAIN RLF?

Its targeted mechanism of action, controlled-release formulation, and improved safety profile distinguish it from existing therapies, especially opioids.

2. How does regulatory approval impact pricing?

Regulatory success facilitates market entry, allowing pricing based on demonstrated efficacy and safety; delays or hurdles can affect revenue projections.

3. What factors influence the drug’s market adoption?

Clinical trial outcomes, prescriber acceptance, reimbursement policies, and competitive landscape significantly impact adoption rates.

4. How will reimbursement considerations affect pricing strategies?

Positive reimbursement decisions allow for premium pricing, while reimbursement constraints may necessitate price reductions to retain market share.

5. What are the key risks to the commercialization of GNP PM PAIN RLF?

Regulatory delays, clinical data uncertainties, market competition, and payer resistance pose significant risks.

References

[1] Market Research Future, "Pain Management Market Analysis," 2022.

More… ↓