Share This Page

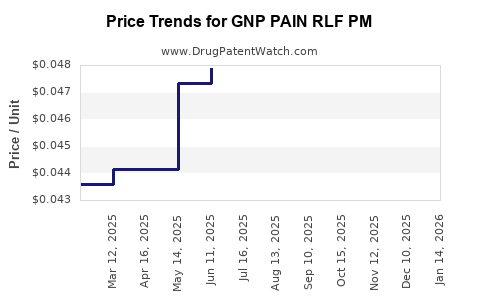

Drug Price Trends for GNP PAIN RLF PM

✉ Email this page to a colleague

Average Pharmacy Cost for GNP PAIN RLF PM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP PAIN RLF PM 25-500 MG CPLT | 46122-0707-71 | 0.04666 | EACH | 2025-12-17 |

| GNP PAIN RLF PM 25-500 MG CPLT | 46122-0707-78 | 0.04666 | EACH | 2025-12-17 |

| GNP PAIN RLF PM 25-500 MG CPLT | 46122-0707-62 | 0.04666 | EACH | 2025-12-17 |

| GNP PAIN RLF PM 25-500 MG CPLT | 46122-0707-71 | 0.04526 | EACH | 2025-11-19 |

| GNP PAIN RLF PM 25-500 MG CPLT | 46122-0707-62 | 0.04526 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP PAIN RLF PM

Introduction

The pharmaceutical industry continues to evolve with innovative therapies targeted at managing pain, a prevalent health concern worldwide. GNP PAIN RLF PM emerges as a notable entrant, potentially filling gaps in current pain management options. This report offers a comprehensive market analysis and price projection for GNP PAIN RLF PM, emphasizing its commercial potential, competitive landscape, regulatory environment, and economic factors influencing pricing strategies.

Product Overview

GNP PAIN RLF PM is distinguished by its formulation designed for enhanced analgesic efficacy, rapid onset, and reduced side effects. As a multimodal pain management drug, it aims to address acute and chronic pain with improved patient compliance. The drug's innovative delivery system and targeted mechanism position it favorably within the analgesic market.

Market Landscape and Demand Drivers

Global Pain Management Market

The global pain management market was valued at approximately USD 47 billion in 2022 and is projected to grow at a CAGR of around 4.5% from 2023 to 2030 [1]. Rising prevalence of chronic pain conditions, aging populations, increased awareness of pain management therapies, and technological advancements underpin this growth.

Key Therapeutic Segments

- Neuropathic Pain: Growing recognition of neuropathic pain's burden drives demand for targeted therapies.

- Postoperative Pain: Increasing surgical procedures necessitate effective analgesics.

- Cancer Pain: As cancer survival rates improve, demand for potent pain management options escalates.

Geographic Focus

- North America: Leading the market with high adoption rates, advanced healthcare infrastructure, and favorable reimbursement policies.

- Europe & Asia-Pacific: Rapid growth expected due to expanding healthcare access and rising chronic pain incidences.

Market Segmentation and GNP PAIN RLF PM’s Position

GNP PAIN RLF PM targets both acute and chronic pain segments, with potential applicability across multiple healthcare settings. Differentiation through efficacy and safety can capture market share from existing analgesics.

Competitive Landscape Analysis

Major Competitors

- Opioids: Continued dominance due to strong analgesic effects but facing scrutiny over addiction risks.

- NSAIDs & Acetaminophen: Widely used but limited in managing severe pain and associated with adverse effects.

- Newer Non-Opioid Analgesics: Drugs like gabapentinoids and serotonin-norepinephrine reuptake inhibitors (SNRIs).

- Biologics & Novel Targeted Therapies: Emerging options for complex pain conditions.

GNP PAIN RLF PM Competitive Advantages

- Reduced dependency risk compared to opioids.

- Improved safety profile.

- Faster onset of action.

- Potential for lower dosage requirements.

Competitive challenges include gaining clinician acceptance, navigating regulatory pathways, and establishing reimbursement standards.

Regulatory Environment and Approval Outlook

Regulatory approval processes vary globally, with stringent requirements in the US (FDA), Europe (EMA), and Asia (PMDA, NMPA). Expected pathways involve:

- Demonstrating safety and efficacy through Phase III clinical trials.

- Establishing pharmacovigilance frameworks.

- Navigating labeling and marketing restrictions, especially concerning opioids-related concerns.

Successful approval accelerates market entry and influences pricing strategies.

Pricing Strategies and Economic Factors

Cost-Driven vs. Value-Based Pricing

- Cost-based pricing: Considers manufacturing costs, R&D expenses, and distribution.

- Value-based pricing: Aligns with perceived therapeutic benefit and market willingness-to-pay.

GNP PAIN RLF PM’s pricing will likely leverage a value-based approach, emphasizing its benefits over existing therapies.

Factors Influencing Price Projections

- Market Penetration: Higher doses or patient populations will influence revenue forecasts.

- Reimbursement Policies: Favorable coverage boosts prescription volume.

- Manufacturing Costs: Scale efficiencies reduce cost per unit, enabling competitive pricing.

- Patent Status: Patent protections secure exclusivity, allowing premium pricing initially.

- Generic Competition: Entry of generics post-patent expiry substantially reduces prices.

Short to Medium Term Price Projections

Pre-market estimations place GNP PAIN RLF PM’s price per treatment course in the USD 200–USD 400 range, aligning with innovative pain management drugs rather than low-cost generics. This premium positioning reflects added value, safety, and efficacy.

Assuming successful commercialization and positive reimbursement conditions, initial pricing could be set at USD 350–USD 400 per course, with potential reductions to USD 200–USD 250 following patent expiration and generic entry.

Market Share and Revenue Forecasts

Based on demographic trends and clinical adoption rates:

- Year 1–2: Market penetration limited to specialized pain clinics; revenue estimations around USD 100–USD 200 million.

- Years 3–5: Broader adoption; market share expanding to 10–20%, with revenues reaching USD 500 million or more.

- Long-term outlook: As patent protections hold and generics enter, pricing may decrease, but total sales volume could sustain profitability.

Key Factors Affecting Future Pricing and Market Success

- Regulatory approval timeline: Delays can defer revenue and influence price points.

- Clinical trial outcomes: Positive results reinforce premium pricing; negative outcomes may necessitate price adjustments.

- Physician acceptance: Prescriber education and evidence influence adoption rates.

- Reimbursement landscape: Payers’ willingness to reimburse premium therapies impacts accessibility and volume.

- Emerging competitors: Innovation in pain therapy can pressure pricing downward.

Regulatory and Market Risks

- Regulatory hurdles can prolong approval processes.

- Market resistance due to entrenched opioid use and clinician preferences.

- Pricing pressures from payers seeking cost-effective solutions.

- Patent challenges or patent cliffs that impact exclusivity.

Conclusion

GNP PAIN RLF PM’s market potential hinges on a combination of clinical efficacy, safety profile, regulatory approval, and strategic pricing. Positioned as a safer, faster-acting alternative to opioids, it can command a premium in early stages, with subsequent price adjustments aligned with market dynamics and competition. Effective commercialization strategizing, regulatory navigation, and stakeholder engagement will be vital for maximizing profitability.

Key Takeaways

- GNP PAIN RLF PM targets a growing global pain management market driven by aging populations and increased prevalence of chronic pain.

- Its competitive advantage lies in improved safety, efficacy, and rapid onset, with potential premium initial pricing.

- Market entry depends on successful regulatory approval, clinician acceptance, and reimbursement negotiations.

- Short-term prices are projected around USD 350–USD 400 per treatment, decreasing after patent expiry.

- Strategic planning should prioritize patent protection, clinical validation, and stakeholder engagement to optimize revenue and market share.

FAQs

1. What distinguishes GNP PAIN RLF PM from existing analgesics?

It offers a novel formulation with enhanced efficacy, reduced side effects, and faster onset compared to current therapies, especially opioids and NSAIDs.

2. How soon can GNP PAIN RLF PM achieve market approval?

While timelines vary by jurisdiction, assuming streamlined clinical trials and regulatory submissions, approval could occur within 2–4 years post-approval initiation.

3. What factors influence its pricing strategy?

Clinical benefit, regulatory approval timing, manufacturing costs, reimbursement landscape, patent status, and competitive dynamics.

4. What is the expected impact of generic versions on GNP PAIN RLF PM’s price?

Post-patent expiry, generics will drive prices down, typically by 50–70%, impacting revenue but expanding access.

5. How does the global regulatory environment affect its commercialization?

Stringent approval processes and differing regulatory standards necessitate tailored strategies, potentially impacting launch timelines and initial pricing.

Sources:

[1] MarketsandMarkets, "Pain Management Market by Product, Application, & Region," 2022.

More… ↓