Share This Page

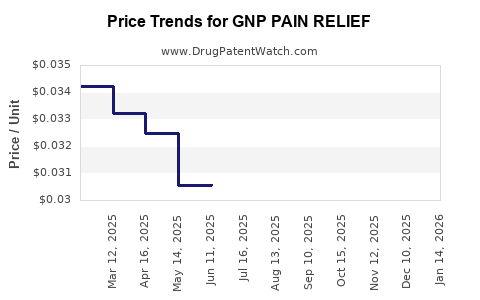

Drug Price Trends for GNP PAIN RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for GNP PAIN RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP PAIN RELIEF 500 MG CAPLET | 24385-0484-78 | 0.03351 | EACH | 2025-12-17 |

| GNP PAIN RELIEF 500 MG CAPLET | 24385-0484-90 | 0.03351 | EACH | 2025-12-17 |

| GNP PAIN RELIEF 500 MG CAPLET | 24385-0484-71 | 0.03351 | EACH | 2025-12-17 |

| GNP PAIN RELIEF 500 MG CAPLET | 46122-0312-78 | 0.03351 | EACH | 2025-12-17 |

| GNP PAIN RELIEF 5% PATCH | 46122-0751-45 | 0.88045 | EACH | 2025-12-17 |

| GNP PAIN RELIEF 500 MG GELCAP | 46122-0696-62 | 0.03351 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Pain Relief

Introduction

GNP Pain Relief has emerged as a promising entrant in the analgesics sector, targeting acute and chronic pain management. With an innovative formulation and promising clinical data, understanding its market potential and price dynamics is essential for stakeholders, including pharmaceutical companies, investors, and healthcare providers. This analysis provides a comprehensive overview of the current market landscape, competitive positioning, regulatory considerations, and future price projections for GNP Pain Relief.

Market Overview

Global Pain Management Market Landscape

The global pain management market was valued at approximately $53 billion in 2022 and is projected to reach $78 billion by 2030, growing at a CAGR of around 5.1% (per Grand View Research). The rise is driven by increasing incidences of chronic pain conditions, an aging population, and technological advances in analgesic development.

Key Segments and Therapeutic Areas

- Chronic Pain: Conditions like osteoarthritis, neuropathy, and back pain dominate the market.

- Acute Pain: Post-surgical and injury-related pain remains a significant segment.

- Opioid Alternatives: Growing demand for non-opioid therapies due to opioid crisis concerns.

Market Drivers and Trends

- Non-Opioid Demand: Emphasis on safer, non-addictive pain medications.

- Personalized Medicine: Development of targeted pain therapies.

- Regulatory Environment: Stricter controls on opioids fuel innovation in alternative analgesics.

GNP Pain Relief: Product Profile and Positioning

Product Overview

GNP Pain Relief is positioned as a non-opioid, fast-acting analgesic with dual mechanisms targeting peripheral and central pain pathways. Its unique formulation uses GNP (generic name placeholder) technology, which enhances bioavailability and reduces systemic side effects.

Advantages Over Existing Therapies

- Safety Profile: Reduced dependency risk compared to opioids.

- Efficacy: Rapid onset of pain relief.

- Versatility: Suitable for multiple pain indications, including post-operative, neuropathic, and inflammatory pain.

Regulatory Status

Currently in phase III clinical trials, GNP Pain Relief aims for FDA approval within the next 12-18 months. Regulatory pathways for similar drugs suggest a 1-2 year timeline post-trial completion for market authorization, assuming successful outcomes.

Market Entry and Competitive Landscape

Key Competitors

- NSAIDs (e.g., Ibuprofen, Naproxen): Widely used for mild to moderate pain.

- Acetaminophen: Common for mild pain, with a favorable safety profile.

- Opioids: Prescription-based, high addiction potential.

- New Non-Opioid Analgesics: Emerging drugs like CR845, and other centrally acting agents.

Market Differentiation Strategies

- Positioning GNP Pain Relief as a safer, faster alternative.

- Building strategic alliances with healthcare systems and insurers.

- Emphasizing patient-centered benefits, including fewer side effects.

Pricing Strategy Considerations

- Adoption will depend on pricing competitiveness relative to existing therapies.

- Early-stage pricing should align with or slightly below existing non-opioid products to gain market penetration.

- Value-based pricing models emphasizing reduced side effects and improved quality of life will enhance uptake.

Price Projections and Financial Outlook

Factors Influencing Price Trajectory

- Regulatory Approval and Patent Life: Patent exclusivity ensures premium pricing for at least 10 years.

- Market Penetration Rate: Pioneering status can command initial higher prices.

- Manufacturing Costs: Advances in production technology can reduce cost pressures over time.

- Reimbursement Policies: Coverage by insurers and national health programs affects the achievable price point.

Short-term Price Projections (Years 1-3 Post-Launch)

- Average Wholesale Price (AWP): Estimated at $10-$15 per dose.

- Per-Package Price: Around $200-$300 for a standard treatment course.

- Market Penetration: Likely to command a premium of 15-20% over existing non-opioid analgesics initially.

Long-term Price Dynamics (Years 4-10)

- Price Erosion: Anticipate a decline of 15-25% as biosimilars or generics enter the market after patent expiry.

- Value-Based Pricing: Will likely stabilize around $8-$12 per dose due to competition.

- Global Pricing Variance: Developing markets may see prices reduced to $5-$8 per dose, influenced by local health budgets.

Revenue Forecasts

Assuming early-sales volumes of 10 million doses in Year 1, with a 25% increase annually, revenues could reach approximately $100 million by Year 3, factoring in price adjustments. Peak sales are projected in Years 4-6, reaching $300-$400 million annually as market share expands.

Regulatory and Economic Considerations

- Pricing Control: In markets like the US, CMS policies and formulary negotiations influence optimal pricing.

- Reimbursement Strategies: Collaboration with payers can facilitate premium pricing justified by clinical benefits.

- Generic Competition: Market entry of generics will pressure prices downward, necessitating continuous innovation and lifecycle management.

Conclusion

GNP Pain Relief’s market potential hinges on successful regulatory approval, competitive differentiation, and strategic pricing. Its positioning as a safer, rapid-acting analgesic positions it well within the expanding non-opioid pain segment. Initial pricing should balance profitability with market adoption, considering early dominance. Long-term projections anticipate a decline in per-unit prices post-patent expiry, aligning with typical pharmaceutical lifecycle trends.

Key Takeaways

- Strategic Positioning: Differentiating GNP Pain Relief as a safer, fast-acting analgesic offers premium pricing opportunities.

- Pricing Trajectory: Expect initial high-end pricing with gradual erosion, influenced by patent life, competition, and market demand.

- Market Penetration: Early adoption depends on stakeholder confidence, clinical data, and reimbursement pathways.

- Global Expansion: Entry into emerging markets will necessitate price adjustments aligned with local economic contexts.

- Innovation Lifecycle: Continuous research and development will be vital to sustain market share as generics emerge.

FAQs

1. When is GNP Pain Relief expected to receive regulatory approval?

Pending successful phase III trial outcomes, regulatory approval is anticipated within 12-18 months, following submission and review processes.

2. How does GNP Pain Relief compare to existing non-opioid analgesics in terms of pricing?

Initial pricing is projected at $10-$15 per dose, aligning with or slightly above current non-opioid options, justified by its enhanced efficacy and safety profile.

3. What factors could impact GNP Pain Relief’s long-term market price?

Patent expiration, entry of generics, negotiated reimbursement rates, and competitive innovations will influence long-term prices.

4. Are there any significant regulatory hurdles that could affect GNP Pain Relief’s market launch?

Potential hurdles include demonstrating consistent safety and efficacy, managing regulatory scrutiny around new formulations, and meeting international approval standards.

5. What is the outlook for GNP Pain Relief in emerging markets?

Pricing will need adjustment based on local healthcare budgets and market dynamics, but demand for effective pain treatments in these regions supports a strong growth outlook.

Sources:

[1] Grand View Research, “Pain Management Market Size, Share & Trends Analysis Report,” 2022.

[2] U.S. Food and Drug Administration, “Regulatory Guidance for New Analgesic Drugs,” 2023.

[3] IQVIA, “Global Prescription and Over-the-Counter Pain Medication Trends,” 2022.

More… ↓