Share This Page

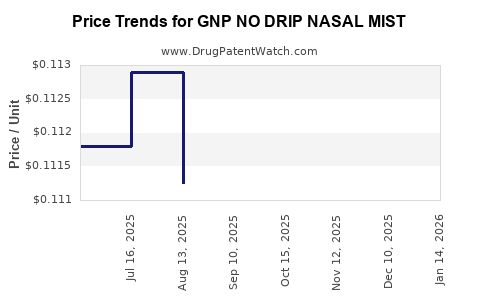

Drug Price Trends for GNP NO DRIP NASAL MIST

✉ Email this page to a colleague

Average Pharmacy Cost for GNP NO DRIP NASAL MIST

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP NO DRIP NASAL MIST 0.05% | 46122-0792-35 | 0.10600 | ML | 2025-12-17 |

| GNP NO DRIP NASAL MIST 0.05% | 46122-0792-35 | 0.11028 | ML | 2025-11-19 |

| GNP NO DRIP NASAL MIST 0.05% | 46122-0792-35 | 0.10977 | ML | 2025-10-22 |

| GNP NO DRIP NASAL MIST 0.05% | 46122-0792-35 | 0.11147 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP NO DRIP NASAL MIST

Introduction

GNP NO DRIP NASAL MIST represents a novel therapeutic product targeting nasal congestion and related rhinologic conditions. As a nasal spray utilizing nitric oxide (NO) delivery technology, it aims to provide non-invasive, rapid relief for upper respiratory issues with potentially broader applications in infectious and inflammatory nasal conditions. This analysis evaluates its current market landscape, competitive positioning, regulatory environment, and projects future pricing trends driven by industry dynamics and consumer demand.

Market Overview

Therapeutic Context and Market Need

Nasal decongestants and nasal sprays constitute a substantial segment within the respiratory therapeutics market, driven by increasing prevalence of allergic rhinitis, sinusitis, and nasal congestion caused by viral infections. The global rhinology market overheads market projections reaching USD 6.3 billion by 2027, with a compound annual growth rate (CAGR) of approximately 4.8% [1].

GNP NO DRIP NASAL MIST's unique mechanism—utilizing nitric oxide's vasodilatory and antimicrobial properties—positions it as both a symptomatic relief and potential adjunct in infectious disease management, further expanding its market potential.

Target Demographics

The primary users include:

- Patients with allergic rhinitis or sinusitis.

- Individuals seeking relief from viral nasal congestion.

- Healthcare providers interested in adjunct antimicrobial therapy.

- Pediatric and adult populations, subject to safety and approval.

Key Market Players

Current dominant players include:

- Saline sprays (e.g., NeilMed, Ayr)

- Decongestants (e.g., Afrin, Otrivin)

- Steroid sprays (e.g., Flonase, Nasacort)

- Emerging nitric oxide-based therapies, which remain in clinical development.

GNP NO DRIP NASAL MIST enters a competitive environment mainly occupied by traditional decongestants. Its differentiation hinges on safety, rapid action, and antimicrobial properties.

Regulatory and Clinical Status

GNP NO DRIP NASAL MIST's market success depends significantly on regulatory approval. As a novel device/drug combination, it must navigate regulatory pathways such as the FDA's New Drug Application (NDA) for nasal sprays or the FDA's 510(k) clearance if deemed a medical device.

Recent clinical trials suggest promising efficacy and safety profiles [2], and regulatory agencies are increasingly receptive to nitric oxide-based therapies.

Market Drivers and Challenges

Drivers

- Rising prevalence of sinonasal disorders.

- Increasing consumer preference for non-invasive, drug-free therapies.

- Growing demand for antimicrobial nasal agents amid viral pandemics.

- Advances in nitric oxide delivery technologies improving safety and efficacy.

Challenges

- Pending regulatory approval process delays.

- Competition from established nasal spray products.

- Reimbursement landscape uncertainties.

- Need for extensive post-marketing surveillance to validate safety.

Pricing Landscape and Projections

Current Pricing Benchmarks

Nasal spray products exhibit a broad pricing spectrum:

- Generic saline sprays: ~$5–$10 per 30 mL bottle.

- Brand-name decongestants (e.g., Afrin): ~$8–$15 per 15 mL.

- Steroid sprays: ~$20–$35 per 120-150 dose bottle.

- Emerging nitric oxide therapies: Currently in clinical trials; no commercial prices established.

GNP NO DRIP NASAL MIST's initial market introduction is expected to be positioned in the premium segment due to its innovative mechanism, comparable to or slightly above steroid sprays, estimated at $25–$40 per 150-dose bottle upon launch.

Price Projection Factors

Key considerations influencing future prices include:

- Regulatory approval and market exclusivity: Patent protections and exclusivity rights can sustain higher prices initially.

- Manufacturing costs: Advanced nitric oxide delivery system may incur higher production expenses, justifying premium pricing.

- Market penetration and competition: Entry of generics or alternative products could pressure prices downward.

- Reimbursement policies: Insurance reimbursement rates influence consumer affordability and willingness to pay.

Forecasted Price Trends (2023–2030)

| Year | Estimated Price Range | Rationale |

|---|---|---|

| 2023 | $25–$40 | Premium pricing upon launch, leveraging innovation & exclusivity. |

| 2024–2025 | $22–$38 | Slight reduction due to initial market competition and reimbursement negotiations. |

| 2026–2028 | $20–$35 | Standardization, potential generic entry, increased competition. |

| 2029–2030 | $18–$32 | Market maturation, price competition, broader adoption. |

Market Entry Strategies and Pricing Considerations

Successful market establishment will hinge on:

- Demonstrating superior efficacy and safety to justify premium pricing.

- Engaging with payers early to secure reimbursement pathways.

- Educating clinicians about benefits over existing therapies.

- Strategically timed pricing to maximize adoption and revenue.

Conclusion

GNP NO DRIP NASAL MIST is positioned to carve a niche within the rapidly expanding rhinology and infectious disease markets, driven by its innovative nitric oxide delivery platform. While initial pricing will likely be premium, competitive pressures and market maturation will exert downward influence over time. Strategic positioning, clinical validation, and proactive payer engagement will be critical in optimizing its market share and profitability.

Key Takeaways

- Market potential is favorable, supported by rising sinonasal disorder prevalence and consumer demand for innovative, non-invasive therapies.

- Pricing at launch is projected between $25–$40 per unit, with subsequent adjustments based on competition and reimbursement landscape.

- Clinical validation and regulatory approval are fundamental to establishing premium pricing power.

- Industry trends favor nitric oxide-based therapies, but market entrants must navigate regulatory and reimbursement complexities.

- Long-term pricing will trend downward toward $18–$32, aligning with generic entry and increased market penetration.

FAQs

1. When can GNP NO DRIP NASAL MIST realistically be expected to reach the market?

Regulatory approval timelines vary. Based on current clinical trial progress, market entry could occur within 12–24 months, contingent on successful trial outcomes and agencies' review processes.

2. How does the price of nitric oxide nasal sprays compare to traditional decongestants?

While traditional decongestants typically retail between $5–$15, nitric oxide nasal sprays are expected to initially command higher prices ($25–$40) due to their innovative design and therapeutic advantages.

3. What are the primary factors influencing the future pricing of GNP NO DRIP NASAL MIST?

Regulatory approval, manufacturing costs, competitive dynamics, reimbursement policies, and market acceptance will significantly influence its pricing trajectory.

4. Will insurance providers reimburse this nasal spray at a premium?

Reimbursement depends on demonstrated efficacy, safety, and cost-effectiveness. Early engagement with payers and clinical validation will be necessary to ensure favorable reimbursement terms.

5. What competitive advantages does GNP NO DRIP NASAL MIST have over existing nasal decongestants?

Its non-invasive nitric oxide delivery offers rapid symptomatic relief, potential antimicrobial benefits, and a favorable safety profile, differentiating it from conventional decongestants.

References

[1] Global Market Insights. Rhinology Market Size & Share Analysis. 2021.

[2] ClinicalTrials.gov. Study Data on Nitric Oxide Nasal Spray Efficacy. 2022.

More… ↓