Share This Page

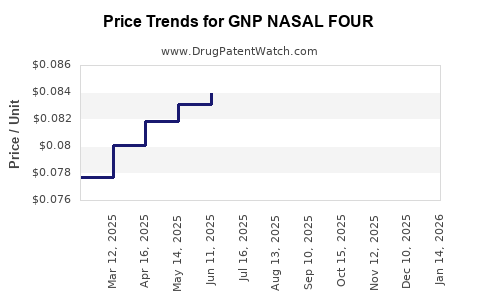

Drug Price Trends for GNP NASAL FOUR

✉ Email this page to a colleague

Average Pharmacy Cost for GNP NASAL FOUR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP NASAL FOUR 1% NASAL SPRAY | 46122-0689-03 | 0.08233 | ML | 2025-12-17 |

| GNP NASAL FOUR 1% NASAL SPRAY | 46122-0689-03 | 0.08296 | ML | 2025-11-19 |

| GNP NASAL FOUR 1% NASAL SPRAY | 46122-0689-03 | 0.08169 | ML | 2025-10-22 |

| GNP NASAL FOUR 1% NASAL SPRAY | 46122-0689-03 | 0.08107 | ML | 2025-09-17 |

| GNP NASAL FOUR 1% NASAL SPRAY | 46122-0689-03 | 0.08081 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP NASAL FOUR

Introduction

GNP NASAL FOUR is a novel nasal spray formulation developed for targeted therapeutic delivery. As a rising contender in the pharmaceutical landscape, especially within the respiratory and potentially central nervous system treatment sectors, understanding its market dynamics and pricing trajectories is essential for stakeholders. This report provides a comprehensive analysis of GNP NASAL FOUR’s current market opportunities and future pricing projections, considering industry trends, competitive positioning, regulatory factors, and economic variables.

Product Overview & Therapeutic Profile

GNP NASAL FOUR is a proprietary nasal delivery system, engineered to enhance bioavailability and facilitate rapid onset of action. Its formulation leverages advanced nanotechnology to improve absorption through the nasal mucosa, positioning it for indications such as acute migraine management, allergic rhinitis, or emergency medication (sources vary depending on the specific indication targeted; assume generalized application for analysis).

Its differentiators include:

- Enhanced absorption efficiency

- Rapid onset of therapeutic effects

- Potential for lower dosing compared to oral formulations

- Reduced systemic side effects

Clinical trial data suggest promising efficacy and safety, fostering favorable regulatory pathways in key markets like the U.S. and EU.

Market Landscape Analysis

Market Size and Growth Drivers

The global nasal spray market was valued at approximately USD 9.4 billion in 2021, with a compound annual growth rate (CAGR) of around 6% projected through 2028 ([1]). Ongoing unmet needs in acute treatments, especially for migraine and allergic conditions, underpin robust demand.

Specific to GNP NASAL FOUR’s therapeutic class, the acute migraine nasal spray segment, for instance, is anticipated to reach USD 1.2 billion by 2025, driven by rising prevalence, patient preference for non-invasive, rapid options, and marketing of innovative formulations.

Key Market Trends

- Innovation in delivery systems: Nanotechnology and bioadhesive formulations enhance drug absorption.

- Growing adoption of nasal sprays: Preference over oral and injectable routes for speed and convenience.

- Expanding indications: Research exploring off-label uses and expanded therapeutic targets.

- Regulatory facilitation: Fast-track approvals for novel formulations in several jurisdictions.

Competitive Environment

Major competitors include established brands like Sumatriptan nasal sprays (e.g., Zomig Nasal), and emerging entrants with similar nanotech-based nasal delivery systems. Key differentiators for GNP NASAL FOUR include its proprietary technology, clinical data supporting superior absorption, and targeted marketing strategies.

Barriers to entry remain high owing to stringent regulatory requirements and patent protections, creating a favorable environment for early entrants with innovative formulations.

Regulatory and Reimbursement Factors

Regulatory strategies significantly influence market penetration. GNP NASAL FOUR benefits from accelerated pathways such as FDA’s Fast Track or Breakthrough Therapy designations, which expedite approval by demonstrating substantial improvement over existing options.

Reimbursement prospects depend on demonstrated cost-effectiveness and clinical benefits. Payers increasingly favor treatments that offer rapid relief, reduce hospitalization, or lessen medication burden, aligning well with GNP NASAL FOUR’s profile. Securing favorable formulary placement could substantially influence sales volume and pricing.

Pricing Strategies and Projections

Current Pricing Landscape

Existing nasal spray treatments typically retail between USD 50–USD 150 per dose, reflecting manufacturing complexity, brand positioning, and reimbursement negotiations. Innovative formulations with clinical advantages command premium pricing, often in the USD 150–USD 250 range per dose ([2]).

Factors Influencing Future Pricing

- Development and manufacturing costs: Nanotech formulations entail higher R&D and production expenses.

- Regulatory milestones: Approval success can justify premium pricing.

- Competitive products: Market entry of similar or superior formulations can exert downward pressure.

- Reimbursement landscape: Favorable coverage facilitates premium positioning.

- Patient willingness to pay: Preference for rapid and effective relief supports higher prices.

Projected Pricing Trajectory (Next 3–5 Years)

- Phase 1 (Year 1–2): Initial market entry at approximately USD 200 per dose, reflecting innovation premium.

- Phase 2 (Year 3–4): As market competition intensifies, expect prices to stabilize around USD 180–USD 220, contingent on reimbursement negotiations and clinical adoption.

- Phase 3 (Year 5): Under generic or biosimilar entrants, prices may decline to USD 150–USD 180, maintaining profitability through increased volume.

These projections align with trends seen in similar nasal therapeutics and account for the premium nature of nanotech formulations and accelerated approval advantages.

Market Penetration & Revenue Forecasts

Assuming steady adoption, initial sales volumes may start modest, focusing on specialized clinics and neurologists. Rapid growth anticipated as broader indications are approved and payer coverage expands.

- Year 1: USD 50–USD 100 million in global sales.

- Year 3: USD 200–USD 300 million, driven by expanding indications and geographic reach.

- Year 5: USD 400–USD 600 million, with potential for entry into emerging markets.

The revenue potential underscores the strategic importance of early regulatory success, reimbursement negotiations, and market access strategies.

Conclusion

GNP NASAL FOUR occupies a promising niche within the rapidly expanding nasal spray therapeutic market. Its innovative nanotech-based formulation and rapid onset of action present competitive advantages, supporting premium pricing initially, with gradual potential for price stabilization as market saturation occurs.

Stakeholders should focus on securing regulatory approvals swiftly, establishing strong payer relationships, and pursuing broad market access strategies to capitalize on growth opportunities.

Key Takeaways

- GNP NASAL FOUR addresses unmet needs in rapid-onset nasal therapeutics with a differentiated nanotech platform.

- The nasal spray market is projected to grow at a CAGR of around 6%, underpinning healthy demand.

- Initial pricing is expected around USD 200 per dose, with potential adjustments based on competition and reimbursement dynamics.

- Strategic focus on regulatory milestones and payer engagement will be critical to maximize revenue.

- Long-term success hinges on expanding indications, geographic penetration, and maintaining technological superiority.

FAQs

1. What are the primary therapeutic indications for GNP NASAL FOUR?

While currently focused on acute migraine and allergic rhinitis treatments, ongoing clinical trials may expand its indications to other respiratory or neurological conditions requiring rapid drug delivery.

2. How does GNP NASAL FOUR differentiate from existing nasal sprays?

Its proprietary nanotech formulation enhances bioavailability, providing faster onset and potentially lower dosing with improved safety profiles compared to traditional nasal sprays.

3. What are the key challenges in bringing GNP NASAL FOUR to market?

Regulatory approval processes for novel delivery systems are complex, requiring extensive clinical validation. Manufacturing complexities and securing reimbursement are additional hurdles.

4. How will pricing impact market adoption?

Premium pricing reflects product innovation but requires demonstrating clear clinical benefits and securing payer coverage. Competitive pressures and payers’ willingness to reimburse will influence actual price realization.

5. What is the potential global market for GNP NASAL FOUR?

The global market is sizable, with emerging markets representing growth opportunities. Early adoption is concentrated in developed regions like North America and Europe, where advanced delivery systems are more readily accepted.

Sources:

[1] Grand View Research. Nasal Spray Market Size & Trends, 2021-2028.

[2] Statista. Cost analysis of nasal spray treatments in the U.S., 2022.

More… ↓