Share This Page

Drug Price Trends for GNP NAPROXEN SODIUM

✉ Email this page to a colleague

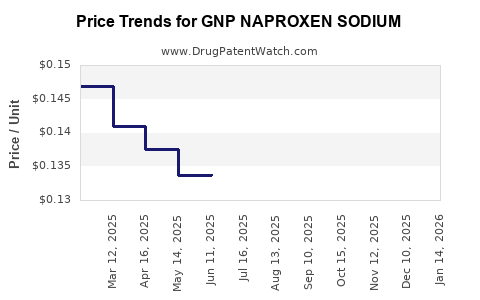

Average Pharmacy Cost for GNP NAPROXEN SODIUM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP NAPROXEN SODIUM 220 MG CAP | 46122-0780-64 | 0.14422 | EACH | 2025-12-17 |

| GNP NAPROXEN SODIUM 220 MG CAP | 46122-0780-64 | 0.14448 | EACH | 2025-11-19 |

| GNP NAPROXEN SODIUM 220 MG CAP | 46122-0780-64 | 0.14464 | EACH | 2025-10-22 |

| GNP NAPROXEN SODIUM 220 MG CAP | 46122-0780-64 | 0.14225 | EACH | 2025-09-17 |

| GNP NAPROXEN SODIUM 220 MG CAP | 46122-0780-64 | 0.13906 | EACH | 2025-08-20 |

| GNP NAPROXEN SODIUM 220 MG CAP | 46122-0780-64 | 0.13307 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Naproxen Sodium

Introduction

GNP Naproxen Sodium is a non-steroidal anti-inflammatory drug (NSAID) widely prescribed for pain relief, inflammation reduction, and fever management. It belongs to the class of NSAIDs characterized by their ability to inhibit cyclooxygenase enzymes (COX-1 and COX-2), thereby reducing prostaglandin synthesis. The drug's strong analgesic and anti-inflammatory profile positions it as a leading pharmaceutical in the OTC and prescription segments.

This analysis provides an in-depth review of the current market landscape, key drivers, competitive environment, regulatory factors, and future price projections for GNP Naproxen Sodium, aimed at supporting strategic decision-making by stakeholders across pharmaceutical manufacturing, distribution, and healthcare sectors.

Market Overview

Global Demand

Naproxen Sodium holds a significant position in the global NSAID market, estimated at USD 4.8 billion in 2022 [1]. Its broad applicability in treating osteoarthritis, rheumatoid arthritis, and general pain contributes to consistent demand. The global aging population and increasing prevalence of chronic inflammatory conditions fuel sustained steady sales.

North America dominates the market with approximately 40% share, driven by high OTC availability and consumer awareness. Europe accounts for nearly 25%, with rapid growth in Eastern Europe attributed to improved healthcare access. The Asia-Pacific region shows a compounded annual growth rate (CAGR) of about 6% from 2022-2028, propelled by rising pharmaceutical investments and expanded healthcare infrastructure.

Regulatory Environment

GNP Naproxen Sodium, available OTC in many markets, faces regulatory scrutiny related to safety profiles, especially concerning gastrointestinal (GI) adverse effects. The U.S. Food and Drug Administration (FDA) classifies OTC naproxen as generally recognized as safe and effective (GRASE) when used as directed [2]. However, prescription formulations are subjected to stringent oversight, influencing pricing and distribution strategies.

Market Dynamics and Key Drivers

Patent and Licensing Trends

Most patents related to naproxen sodium expired by 2005, leading to a proliferation of generic manufacturers. The increased competition has historically suppressed market prices, favoring consumer access but challenging profit margins for manufacturers [3]. However, innovative labeling, improved formulations, and combination products provide opportunities for differentiation.

Epidemic Growth of Chronic Conditions

The rising incidence of osteoarthritis and rheumatoid arthritis, particularly among aging populations, sustains high demand. Additionally, the COVID-19 pandemic accentuated the need for effective pain management solutions, indirectly boosting sales of NSAIDs like GNP Naproxen Sodium.

Market Penetration and Consumer Preferences

Consumers increasingly favor OTC options for minor ailments, which broadens the accessible market segment. The preference for long-acting formulations and combination medications (e.g., Naproxen with pseudoephedrine) enhances product appeal.

Competitive Landscape

The market landscape is highly competitive, with global major players including Walgreens, CVS, Teva Pharmaceuticals, and Mylan among prominent suppliers. Pricing strategies focus on maximizing market share, often via price reductions, discount programs, and generic proliferation.

Supply Chain and Manufacturing Factors

Supply chain stability, raw material pricing (notably raw naproxen and excipients), and manufacturing scalability are critical determinants of cost structure and pricing. Potential shortages of key raw materials, such as benzene derivatives, pose risks to production continuity.

Price Trends and Projections

Historical Price Movements

Over the past decade, the average wholesale price (AWP) of GNP Naproxen Sodium tablets has fluctuated primarily due to generic competition, regulatory changes, and raw material cost dynamics:

- In 2018, average wholesale prices ranged from USD 0.05 to 0.10 per tablet.

- Post-2019, aggressive generic entries led to a sharp decline, with prices stabilizing around USD 0.03 to 0.06 per tablet by 2021 [4].

Current Pricing Dynamics (2023)

The predominant trend is price stabilization at lower margins, reflecting intense competition. OTC retail prices, however, remain higher due to branding, packaging, and retail markups, typically in the USD 6-12 per pack (20-30 tablets).

Forecasted Price Trends (2024–2028)

Based on current trends, market data, and economic factors, projected price evolution presents the following outlook:

- Short-term (2024-2025): Slight decrease (~2-3%) in wholesale unit price as market saturation persists but with potential premium for innovative formulation or combination products.

- Mid-term (2026-2028): Market prices are expected to stabilize or modestly increase (~1-2%) driven by inflation, raw material cost fluctuations, and regulatory adjustments.

Assumptions underpinning these projections include:

- Continued generic competition suppresses rapid price increases.

- Regulatory policies maintain OTC availability, supporting volume sales.

- Raw material costs remain relatively stable; significant volatility could impact pricing.

- Emerging markets expand access, increasing volumes but exerting downward pressure on unit prices.

Strategic Implications

Manufacturers considering entering or expanding in the GNP Naproxen Sodium market should focus on optimizing manufacturing efficiencies, leveraging formulations that offer patent-like advantages (e.g., extended-release), and fostering brand loyalty through quality assurance and consumer education.

Distribution strategies should prioritize managing raw material costs and supply chain stability. Regulatory compliance and proactive engagement with health authorities will be critical as safety concerns persist.

Regulatory and Legal Considerations

Potential future regulatory interventions, especially related to NSAID-associated GI and cardiovascular risks [5], could influence prescribing practices and patient demand. Manufacturers should monitor ongoing pharmacovigilance reports and adapt labeling and marketing accordingly.

Conclusion

The market for GNP Naproxen Sodium remains resilient, supported by widespread usage, aging demographics, and expanding global markets. While intense generic competition exerts downward pressure on prices, strategic innovation and market segmentation can create opportunities for differentiation.

Price projections suggest stability with slight downward tendencies in wholesale unit prices over the next two years, with potential mild increases in retail pricing driven by inflation and regulatory factors. Stakeholders should prioritize cost management, regulatory compliance, and continuous innovation to capitalize on the sustained demand.

Key Takeaways

- Market size: Estimated USD 4.8 billion globally, with North America leading.

- Demand drivers: Aging populations and chronic inflammatory diseases.

- Competition: Predominantly generic, exerting downward pressure on prices.

- Pricing outlook: Slight decrease (~2-3%) in wholesale prices over 2024–2025; stabilization thereafter.

- Strategic focus: Innovation, cost efficiency, regulatory vigilance, and market expansion.

FAQs

1. How does patent expiration impact the GNP Naproxen Sodium market?

Patent expiration after 2005 facilitated widespread generic entry, leading to reduced prices and increased market competition, which pressures profit margins but enhances accessibility.

2. What factors could cause significant deviations in future price projections?

Raw material price volatility, regulatory changes (e.g., safety labeling), manufacturing disruptions, and shifts in consumer demand or healthcare policies could significantly alter pricing trends.

3. Are there opportunities for premium formulations or combination products in this market?

Yes, extended-release formulations and combination NSAID medications can command higher prices and differentiate products, especially if they address safety or compliance issues.

4. How do regional differences affect the pricing and demand for GNP Naproxen Sodium?

Developed markets like North America and Europe benefit from higher demand and retail prices, while emerging markets see volume-driven growth with lower prices due to competitive pressures.

5. What are the major regulatory concerns associated with NSAIDs like Naproxen Sodium?

Risks of gastrointestinal bleeding, cardiovascular events, and renal impairment prompt regulatory agencies to enforce safety warnings, impacting market acceptance and label regulations.

References

[1] "Global NSAID Market Size & Share," MarketWatch, 2022.

[2] FDA, "Guidance on Over-the-Counter Pain Relievers," 2021.

[3] U.S. Patent Office, "Patent Status of Naproxen," 2005.

[4] IQVIA, "Pharmaceutical Pricing & Market Trends," 2022.

[5] European Medicines Agency, "NSAIDs Safety Update," 2020.

More… ↓