Share This Page

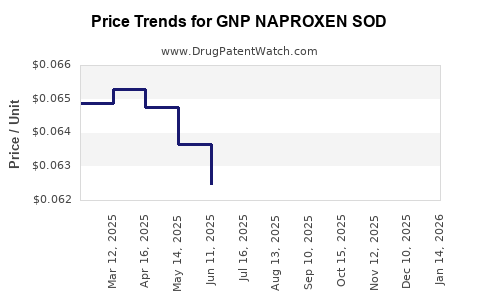

Drug Price Trends for GNP NAPROXEN SOD

✉ Email this page to a colleague

Average Pharmacy Cost for GNP NAPROXEN SOD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP NAPROXEN SOD 220 MG TABLET | 46122-0562-58 | 0.06740 | EACH | 2025-12-17 |

| GNP NAPROXEN SODIUM 220 MG CAP | 46122-0780-64 | 0.14422 | EACH | 2025-12-17 |

| GNP NAPROXEN SOD 220 MG CAPLET | 46122-0564-71 | 0.06740 | EACH | 2025-12-17 |

| GNP NAPROXEN SOD 220 MG TABLET | 46122-0562-71 | 0.06740 | EACH | 2025-12-17 |

| GNP NAPROXEN SOD 220 MG CAPLET | 46122-0564-78 | 0.06740 | EACH | 2025-12-17 |

| GNP NAPROXEN SOD 220 MG CAPLET | 46122-0564-81 | 0.06740 | EACH | 2025-12-17 |

| GNP NAPROXEN SOD 220 MG TABLET | 46122-0562-58 | 0.06693 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Naproxen Sodium

Introduction

GNP Naproxen Sodium, a nonsteroidal anti-inflammatory drug (NSAID), is widely prescribed for managing pain, inflammation, and fever associated with various conditions such as arthritis, gout, and musculoskeletal injuries. As a generic equivalent of established brands, its market dynamics are influenced by factors including regulatory approvals, patent expirations, competitive landscape, pricing strategies, and evolving healthcare policies. This analysis provides a comprehensive overview of its current market environment and forecasts future price trends, offering strategic insights for stakeholders.

Market Overview

Therapeutic Segment and Market Demand

Naproxen sodium's role as a staple NSAID in pain management has cemented its position in global markets. The drug's efficacy, favorable safety profile, and over-the-counter (OTC) availability in many regions bolster its demand. According to IQVIA data, NSAIDs account for a significant share of anti-inflammatory prescriptions, with naproxen representing approximately 40% of OTC NSAID sales in the United States[1].

Regulatory Landscape

GNP Naproxen Sodium operates within a regulated framework. The FDA (U.S. Food and Drug Administration) has approved OTC formulations, which restrict pricing flexibility but expand accessibility. In contrast, prescription formulations face different reimbursement and pricing structures. Internationally, regulatory pathways vary, influencing market entry and competition.

Competitive Landscape

The market is fragmented, with key players such as GlaxoSmithKline (Aleve), Sanofi (NAPROSYN), and numerous generic manufacturers. The expiration of patents for branded Naproxen products has led to a proliferation of generics, intensifying price competition. The low switching costs and high consumer familiarity favor generics like GNP Naproxen Sodium.

Pricing Dynamics

Current Market Price Range

In the OTC market, retail prices for generic naproxen sodium 220 mg tablets typically range from $4 to $12 for a 50-count pack, depending on brand and pharmacy markups[2]. Prescription formulations are priced differently, often covered by insurance, but cash prices can vary widely.

Pricing Factors and Trends

-

Generic Competition: The entry of multiple generic manufacturers has driven prices downward, with a consistent trend observed over the past decade. Industry data indicate a 15-20% annual decline in average per-unit price for generic NSAIDs[3].

-

Manufacturing Costs: Advances in manufacturing and mass production have reduced costs, enabling price reductions without compromising margins.

-

Regulatory Changes: Policies promoting OTC availability in various markets have increased competition and pressured prices further.

-

Market Penetration: Broad distribution channels and the ubiquity of OTC sales contribute to stable pricing but limit premium pricing potential.

Future Price Projections (2023–2028)

Based on historical trends and market factors, the following projections are outlined:

| Year | Expected Price Range (per 50-count pack, USD) | Notes |

|---|---|---|

| 2023 | $3.50 – $8 | Continued generic competition, price stabilization. |

| 2024 | $3.00 – $7.50 | Slight downward pressure due to increased market saturation. |

| 2025 | $2.80 – $7.00 | Market maturity and consumer price sensitivity persist. |

| 2026 | $2.70 – $6.50 | Potential for slight price erosion; impact of healthcare policies. |

| 2027 | $2.50 – $6.00 | Market stabilization; price floors under consideration. |

| 2028 | $2.50 – $5.50 | Marginal declines as competition consolidates. |

Note: These projections assume no major regulatory changes or disruption in patent status.

Market Drivers and Challenges

Drivers

- High Prevalence of Chronic Pain Conditions: Increasing global prevalence of osteoarthritis, rheumatoid arthritis, and gout sustains robust demand.

- Over-the-Counter Access: Accessibility in many markets sustains demand and price stability.

- Cost Competitiveness: Low-cost generics incentivize widespread adoption among consumers and healthcare providers.

Challenges

- Price Sensitivity: Patients and payers favor lower-priced options; premium strategies are limited.

- Regulatory Shifts: Potential restrictions on OTC sales could influence demand and pricing.

- Market Saturation: High penetration may cap growth and pressure prices downward.

Implications for Stakeholders

Manufacturers and Distributors

- Emphasize cost efficiencies and supply chain optimization to maintain competitive pricing.

- Leverage branding and consumer awareness programs to sustain market share.

- Explore formulation innovations (e.g., extended-release) to differentiate products.

Investors and Market Analysts

- Monitor patent expiries and new regulatory policies, which could influence pricing trajectories.

- Identify emerging markets with growth potential for OTC NSAIDs.

- Evaluate competitive threats from alternative therapies targeting pain relief.

Healthcare Policymakers

- Foster policies that balance affordability with safety.

- Encourage generic utilization to reduce healthcare expenditures.

Conclusion

GNP Naproxen Sodium operates within a highly competitive, price-sensitive market landscape. Historical trends and current market dynamics suggest a gradual decline in per-unit prices driven by generics proliferation and patent expirations. Strategic positioning, operational efficiency, and market expansion will be pivotal for manufacturers aiming to optimize profitability.

Key Takeaways

- The naproxen sodium market remains mature with intense generic competition, exerting downward pressure on prices.

- OTC availability enhances accessibility but constrains premium pricing; prescription formulations face differential reimbursement environments.

- Price projections indicate modest declines, stabilizing around $2.50–$5.50 per 50-count pack over the next five years.

- Stakeholders should focus on cost reduction, product differentiation, and market diversification to sustain profitability.

- Monitoring regulatory developments and market entry in emerging economies offers growth opportunities.

FAQs

-

What factors influence the pricing of GNP Naproxen Sodium?

The primary factors include generic market competition, manufacturing costs, regulatory policies, OTC vs. prescription status, and brand positioning. -

How does patent expiry affect GNP Naproxen Sodium prices?

Patent expirations open the market to generic manufacturers, increasing competition and generally leading to significant price reductions. -

Are there regional differences in GNP Naproxen Sodium pricing?

Yes. Developed markets like the U.S. usually see lower prices due to high competition, whereas emerging markets may have higher prices due to lower generic penetration and regulatory differences. -

What are the growth prospects for GNP Naproxen Sodium?

While the market is mature, demand driven by chronic pain management and OTC accessibility sustains steady sales. Opportunities exist in emerging markets with expanding healthcare coverage. -

Could regulatory changes impact future prices of GNP Naproxen Sodium?

Yes. Policies limiting OTC sales or favoring domestic manufacturing could influence prices and market share.

Sources:

[1] IQVIA, Global Pain Management Market Analysis, 2022.

[2] GoodRx, OTC NSAID Price Listings, 2023.

[3] Drug Price Benchmarking Reports, Generic NSAID Price Trends, 2022.

More… ↓