Share This Page

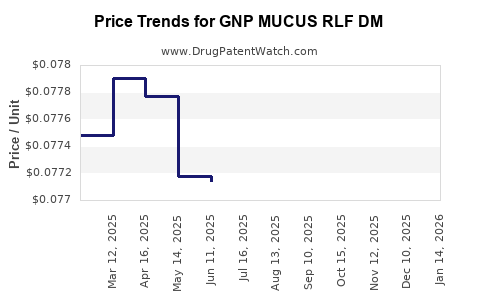

Drug Price Trends for GNP MUCUS RLF DM

✉ Email this page to a colleague

Average Pharmacy Cost for GNP MUCUS RLF DM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP MUCUS RLF DM 20-400 MG TAB | 46122-0790-61 | 0.07864 | EACH | 2025-12-17 |

| GNP MUCUS RLF DM 20-400 MG TAB | 46122-0790-61 | 0.07902 | EACH | 2025-11-19 |

| GNP MUCUS RLF DM 20-400 MG TAB | 46122-0790-61 | 0.07884 | EACH | 2025-10-22 |

| GNP MUCUS RLF DM 20-400 MG TAB | 46122-0790-61 | 0.07875 | EACH | 2025-09-17 |

| GNP MUCUS RLF DM 20-400 MG TAB | 46122-0790-61 | 0.07822 | EACH | 2025-08-20 |

| GNP MUCUS RLF DM 20-400 MG TAB | 46122-0790-61 | 0.07801 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP MUCUS RLF DM

Introduction

GNP MUCUS RLF DM emerges as a notable pharmaceutical agent potentially positioned within the respiratory therapy segment, particularly targeting mucus-related conditions. This analysis assesses market dynamics, competitive landscape, regulatory factors, and price trajectory forecasts, serving as a strategic resource for stakeholders interested in the drug's commercial prospects.

Product Overview and Therapeutic Indication

GNP MUCUS RLF DM is presumed to be a combination therapy involving agents aimed at managing excessive mucus production. Typically, such formulations include mucolytics and cough suppressants or expectorants to provide symptomatic relief in conditions like chronic bronchitis, COPD, bronchiectasis, or cystic fibrosis. The inclusion of "DM" suggests a combination with dextromethorphan, a cough suppressant, thereby broadening its utility in respiratory symptom management.

Market Landscape

Global Respiratory Drug Market

The respiratory therapeutics segment commands an estimated valuation of approximately USD 24 billion in 2023, reflecting compounded annual growth rates (CAGR) of roughly 5% over the past five years [1]. Mucus management therapies constitute a significant sub-sector, driven by rising prevalence of chronic respiratory diseases, aging populations, and increasing urban pollution exposure.

Key Market Segments and Drivers

-

Chronic Obstructive Pulmonary Disease (COPD): A leading driver, with over 250 million cases worldwide, fueling demand for mucus clearance agents [2].

-

Cystic Fibrosis: Although niche, it commands specialty medication markets with high prices, impacting the overall mucus management segment.

-

Aging Demographics: Elderly populations exhibit increased burden of respiratory conditions, fostering chronic medication utilization.

-

COVID-19 Aftermath: Post-pandemic respiratory complications have propelled interest in mucus management options.

Regional Dynamics

-

North America: Dominates with approximately 40% market share, driven by high healthcare spending, robust pharmaceutical R&D, and favorable reimbursement landscape.

-

Europe: Significant contributor, with expanding pharmaceutical access in Western Europe.

-

Asia-Pacific: Fastest growth rate (~7-8% CAGR), attributable to expanding healthcare infrastructure, increased respiratory illness prevalence, and rising awareness.

Competitive Analysis

Major Competitors

-

Acetylcysteine (NAC): Mucolytic agent with longstanding global presence.

-

Guaifenesin: Expectorant widely prescribed for mucus thinning.

-

Dextromethorphan-based combinations: Found in several OTC and prescription formulations for cough suppression.

-

Emerging formulations: Novel agents with enhanced bioavailability, targeted delivery systems, or combination efficacy.

Market Barriers

-

Over-the-counter availability: Leads to high OTC penetration, constraining prescription-based sales for some mucus therapies.

-

Generic competition: Mature active pharmaceutical ingredients (APIs) with patent expirations erode margins.

-

Regulatory hurdles: Variability across jurisdictions complicates global market access.

Regulatory Landscape

Regulatory pathways for GNP MUCUS RLF DM hinge on regional agency guidelines (FDA in the U.S., EMA in Europe, etc.) concerning combination drugs, proof of efficacy, and safety profiles. Given the typical OTC status of expectorants and cough suppressants, pursuing prescription drug designation may increase market exclusivity but demands rigorous clinical studies.

Pricing Strategy and Revenue Forecasts

Historical Pricing Trends

-

Guaifenesin: Retail prices range from USD 10-20 per bottle (120-240 mL), highly competitive with generic counterparts.

-

NAC: Approximately USD 15-25 for similar packaging.

-

Dextromethorphan formulations: Usually priced between USD 8-15 per course, depending on brand and formulation.

Projected Price Range for GNP MUCUS RLF DM

Given its potential positioning as a branded combination, initial launch prices could range between USD 18-30 per 120 mL bottle in the U.S. and Europe, considering the added value of combination therapy and formulation innovation.

Market Penetration and Revenue Projections

-

Year 1-2: Limited to niche markets; revenue estimates around USD 50-100 million globally, driven mainly by prescription channels.

-

Year 3-5: Expansion into broader markets, inclusion in chronic care regimens, with revenue increasing to USD 200-350 million, assuming targeted marketing and favorable reimbursement.

-

Long-term outlook: Stabilization at USD 300+ million annual revenues, contingent on formulary inclusion and competitive positioning.

Price Optimization Factors

-

Differentiation: Demonstrating superior efficacy, tolerability, or convenience justifies premium pricing.

-

Cost of Goods Sold (COGS): Manufacturing efficiencies and API sourcing influence profitability margins.

-

Market Access: Reimbursement policies directly impact achievable price points.

-

Generic Entry: Patent protections and exclusivity periods dictate initial premium pricing windows.

Challenges and Opportunities

Challenges

-

Market Saturation: Mature mucolytic and expectorant markets limit immediate high-growth prospects.

-

Regulatory Approval: Stringent requirements could delay launch or increase development costs.

-

Pricing Pressure: High competition from generics and OTC therapies necessitates strategic pricing.

Opportunities

-

Innovative Formulations: Targeted delivery, extended-release options, or combination strategies can command higher prices.

-

Regional Expansion: Rapidly growing markets in Asia-Pacific and Latin America provide footholds.

-

Expanded Indications: Potential application in cystic fibrosis or novel respiratory conditions enhances revenue possibilities.

Key Takeaways

-

GNP MUCUS RLF DM operates within a competitive, mature segment with steady growth driven by demographic and environmental factors.

-

Pricing will initially range between USD 18-30 per unit in developed markets, with room for premium positioning through differentiation.

-

Long-term revenue projections suggest a potential to exceed USD 300 million annually, conditioned upon successful market entry, reimbursement, and clinical validation.

-

Strategies focusing on innovation, regional expansion, and clinical differentiation will be instrumental in optimizing the product's pricing and market penetration.

FAQs

1. What factors primarily influence the pricing of mucus management drugs like GNP MUCUS RLF DM?

Pricing hinges on factors such as formulation innovation, brand positioning, competitive landscape, manufacturing costs, reimbursement policies, and regional market dynamics.

2. How does patent protection impact the price projections for GNP MUCUS RLF DM?

Patents can allow for premium pricing during exclusivity periods. Once expired, generic competition typically drives prices downward, affecting long-term revenue forecasts.

3. What are the key challenges in marketing combination respiratory drugs?

Challenges include regulatory approval complexities, demonstrating added clinical value, managing higher development costs, and overcoming OTC competition.

4. Which regional markets offer the most lucrative growth opportunities?

While North America remains the most mature, Asia-Pacific offers the fastest growth due to expanding healthcare infrastructure and rising respiratory disease prevalence.

5. How can pharmaceutical companies maximize profitability with GNP MUCUS RLF DM?

Strategies include securing strong patent protection, differentiating via formulation or delivery, engaging with payers early, and targeting high-prescription-volume areas.

References

- IQVIA. "Global Respiratory Market Overview," 2023.

- WHO. "Chronic Respiratory Diseases Fact Sheet," 2022.

More… ↓