Share This Page

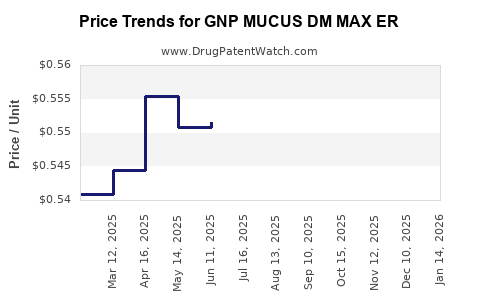

Drug Price Trends for GNP MUCUS DM MAX ER

✉ Email this page to a colleague

Average Pharmacy Cost for GNP MUCUS DM MAX ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP MUCUS DM MAX ER 1200-60 MG | 46122-0637-03 | 0.53895 | EACH | 2025-12-17 |

| GNP MUCUS DM MAX ER 1200-60 MG | 46122-0637-74 | 0.53895 | EACH | 2025-12-17 |

| GNP MUCUS DM MAX ER 1200-60 MG | 46122-0637-03 | 0.54629 | EACH | 2025-11-19 |

| GNP MUCUS DM MAX ER 1200-60 MG | 46122-0637-74 | 0.54629 | EACH | 2025-11-19 |

| GNP MUCUS DM MAX ER 1200-60 MG | 46122-0637-74 | 0.54136 | EACH | 2025-10-22 |

| GNP MUCUS DM MAX ER 1200-60 MG | 46122-0637-03 | 0.54136 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP MUCUS DM MAX ER

Introduction

GNP MUCUS DM MAX ER is a prescription medication indicated for the symptomatic relief of cough and mucus production associated with respiratory infections and chronic respiratory illnesses. As a combination product that contains expectorants and cough suppressants, its market positioning hinges on demand for respiratory health management, especially within the pulmonology and primary care sectors. This analysis explores current market dynamics, competitive landscape, regulatory factors, and future price trajectories to inform stakeholders' strategic decisions.

Market Overview

Global Respiratory Therapeutics Market

The global respiratory therapeutics market, valued at approximately USD 35 billion in 2022, is projected to grow at a CAGR of 4.5% through 2030, driven by rising prevalence of respiratory diseases such as COPD, asthma, and acute respiratory infections (ARI) [1]. The aging population, increased pollution exposure, and expanding access to healthcare services underpin this growth.

Segment Specifics: Cough and Cold Remedies

Within this spectrum, OTC and prescription cough and cold remedies constitute a significant share. These include expectorants and antitussives, with GNP MUCUS DM MAX ER positioned as a branded, extended-release formulation targeting chronic or severe cough episodes. Its demand peaks seasonally, notably during winter months, and regionally varies based on healthcare infrastructure and pathogen prevalence.

Market Drivers

- Rising respiratory disease burden: COPD and asthma remain leading causes of morbidity, fueling demand for symptomatic relief.

- Aging populations: Increased susceptibility among the elderly elevates prescription rates.

- Enhanced formulary access: Integration into hospital and outpatient formularies increases prescription volume.

- COVID-19 pandemic effects: Heightened focus on respiratory health management potentially broadens therapeutic use.

Market Constraints

- Generic competition: Multiple OTC and generic alternatives exert downward pressure on prices.

- Regulatory challenges: Stringent approval and manufacturing standards influence market entry and pricing.

- Consumer preferences: Growing inclination towards natural remedies may affect demand.

Competitive Landscape

Key Market Players

- Reckitt Benckiser (Robitussin DM): Dominates OTC segment with extensive brand recognition.

- Purdue Pharma (Syrup formulations): Holds significant prescription market share.

- Teva, Mylan, and Sun Pharma: Supply generic versions, impacting pricing and market share.

- Emerging local manufacturers: Offer regional formulations with competitive pricing.

Product Differentiators

GNP MUCUS DM MAX ER distinguishes itself with:

- Extended-release formulation: Promotes compliance, reduces dosing frequency.

- Combination therapy: Addresses multiple symptoms simultaneously.

- Patent protection: Limited generic competition pending patent expiry, providing pricing leverage.

Regulatory Environment

Regulatory agencies such as the FDA in the US and EMA in Europe maintain rigorous standards for safety, efficacy, and manufacturing. Approval pathways for combination products like GNP MUCUS DM MAX ER involve demonstrating bioequivalence for generics and compliance with labeling requirements. Patent protections and orphan drug designations influence market exclusivity periods, affecting pricing strategies.

Pricing Analysis

Current Pricing Landscape

- Brand-name formulations: Retail prices for GNP MUCUS DM MAX ER range from USD 20 to USD 35 per box (30-60 tablets), depending on region.

- Generic equivalents: Prices fluctuate between USD 10 and USD 20, exerting pressure on the brand price.

- Insurance and reimbursement: Coverage varies; co-payments influence patient accessibility and demand elasticity.

Factors Influencing Pricing

- Market penetration levels: Higher penetration in institutional settings can stabilize pricing.

- Manufacturing costs: Extended-release formulations involve sophisticated technology, elevating costs.

- Patent status: Active patents enable premium pricing; expirations increase price competition through generics.

- Regulatory costs: Approval and compliance expenses impact initial and ongoing pricing strategies.

Projected Price Trends (2023-2030)

Given current patent protections and market dynamics:

- Short to Mid-term (2023-2025): Prices are anticipated to stabilize or decline marginally (2-3%) due to intensified generic competition.

- Post-patent expiry (post-2025)**: Sharp decrease in brand pricing (~15-25%) is expected as generics enter the market.

- Long-term (2026-2030): Market consolidation and value-based pricing models may lead to tiered pricing, with branded prices maintaining a premium for innovative delivery systems.

Future Market Opportunities and Risks

Opportunities

- Formulation innovations: New extended-release technologies could justify premium pricing.

- Expanding indications: Use in pediatric or geriatric populations can broaden market scope.

- Regional expansion: Emerging markets with rising healthcare access present growth avenues.

- Digital health integration: Monitoring adherence could augment drug value propositions.

Risks

- Price erosion from generics: Entry of more affordable counterparts threatens profit margins.

- Regulatory delays or hurdles: Could postpone market entry for new formulations or indications.

- Competitor innovation: Alternative therapies, including natural or non-pharmacologic options, could reduce demand.

- Market saturation: High penetration levels may cap growth potential in mature markets.

Strategic Recommendations

- Patent management: Protect current formulations to sustain premium pricing.

- R&D investment: Develop next-generation formulations or combination therapies for differentiation.

- Regional pricing strategies: Tailor prices aligning with local healthcare reimbursement landscapes.

- Cost optimization: Streamline manufacturing to preserve margins amidst pricing pressures.

- Market education and positioning: Highlight efficacy and convenience of GNP MUCUS DM MAX ER to justify higher prices.

Key Takeaways

- The respiratory therapeutics market remains robust, with demand driven by demographic trends and disease prevalence.

- GNP MUCUS DM MAX ER occupies a niche with competitive advantages in extended-release technology but faces pricing pressures from generics.

- Immediate pricing prospects suggest stability, with significant reductions following patent expiration.

- Future growth hinges on innovation, regional expansion, and strategic patent portfolio management.

- Stakeholders should prioritize differentiation and operational efficiencies to optimize profitability amid evolving market conditions.

Frequently Asked Questions

1. How does GNP MUCUS DM MAX ER compare to generic alternatives in pricing and effectiveness?

Branded versions typically command higher prices (~USD 20-35), reflecting formulation technology and brand recognition, while generics are priced lower (~USD 10-20). Effectiveness remains comparable when bioequivalence criteria are met, but patient adherence may favor extended-release formulations for convenience.

2. When are the patent protections for GNP MUCUS DM MAX ER expected to expire?

Patent expirations are anticipated around 2025-2026, after which generic manufacturers can introduce competing products, exerting downward pressure on prices.

3. What regional factors influence the pricing of GNP MUCUS DM MAX ER?

Pricing varies with healthcare infrastructure, reimbursement policies, and market competition. Developed regions with insurance coverage allow premium pricing, while emerging markets favor affordability, leading to lower prices.

4. How might regulatory developments impact the market prospects of GNP MUCUS DM MAX ER?

Delayed approvals or new safety requirements could hinder market entry or expansion. Conversely, favorable regulatory pathways for new indications or formulations can enhance profitability.

5. What strategies can manufacturers adopt to extend the market life of GNP MUCUS DM MAX ER?

Investing in formulation innovations, securing additional patents, exploring new indications, and regional market penetration are effective strategies to mitigate generic competition and sustain prices.

Sources

[1] Global Respiratory Therapeutics Market Report, MarketResearch.com, 2022.

More… ↓