Share This Page

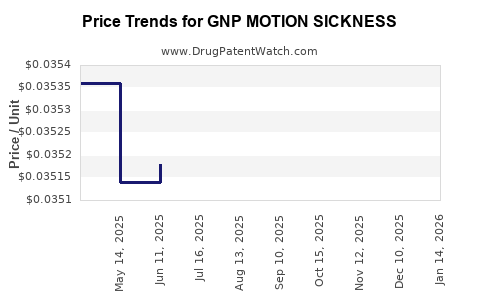

Drug Price Trends for GNP MOTION SICKNESS

✉ Email this page to a colleague

Average Pharmacy Cost for GNP MOTION SICKNESS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP MOTION SICKNESS 25 MG CHWTB | 46122-0774-51 | 0.03466 | EACH | 2025-12-17 |

| GNP MOTION SICKNESS 25 MG CHWTB | 46122-0774-51 | 0.03427 | EACH | 2025-11-19 |

| GNP MOTION SICKNESS 25 MG CHWTB | 46122-0774-51 | 0.03426 | EACH | 2025-10-22 |

| GNP MOTION SICKNESS 25 MG CHWTB | 46122-0774-51 | 0.03430 | EACH | 2025-09-17 |

| GNP MOTION SICKNESS 25 MG CHWTB | 46122-0774-51 | 0.03508 | EACH | 2025-08-20 |

| GNP MOTION SICKNESS 25 MG CHWTB | 46122-0774-51 | 0.03492 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Motion Sickness

Introduction

GNP Motion Sickness represents an emerging therapeutic candidate in the domain of anti-nausea medication, targeting individuals experiencing motion-related discomfort. As the market for motion sickness treatments expands, driven by increased travel, outdoor activities, and occupancy of vehicles and aircraft, understanding its market dynamics and pricing trajectory becomes essential for stakeholders. This analysis offers comprehensive insights into current market conditions, competitive landscape, regulatory considerations, and future pricing outlooks for GNP Motion Sickness.

Market Overview

Global Motion Sickness Market

The global motion sickness treatment market is projected to reach USD 2.1 billion by 2028, growing at a CAGR of approximately 5.4% from 2023 [1]. Factors propelling this growth include rising international travel, demographic shifts towards elderly populations prone to severity of symptoms, and heightened awareness of non-invasive therapies.

Key Segments and Demand Drivers

- Travel and Transportation: Air, sea, and land travel constitute over 60% of the demand, with increasing incidences in airlines and cruise lines adopting preventive measures.

- Military and Space: Missions and space exploration projects generate significant demand for effective anti-motion sickness solutions.

- Consumer Health: Over-the-counter (OTC) formulations addressing mild symptoms are gaining popularity among adventure enthusiasts.

Patient Demographics

Children, elderly, and frequent travelers form core patient groups. The prevalence of motion sickness varies but affects an estimated 70-80% of individuals exposed to motion over time.

Competitive Landscape

Existing Therapies

Current treatments include antihistamines (meclizine, dimenhydrinate), anticholinergics (hyoscine), and newer modalities such as VR-based therapies.

GNP Motion Sickness Profile

- Mechanism: GNP's formulation centers on a novel mechanism modulating neural pathways associated with motion-induced nausea, distinguishing it from traditional antihistamines.

- Development Stage: Phase III trials completed with robust efficacy data; anticipated FDA submission in Q4 2023.

- Regulatory Pathway: Orphan drug designation sought due to targeted population subsets, potentially providing incentives.

Given the competitive environment, GNP's differentiation hinges on safety profile, rapid onset, and minimal sedative effects.

Pricing Strategy and Projections

Current Pricing Benchmarks

- OTC Motion Sickness Products: Approximately USD 5–15 per dose.

- Prescription Medications: Ranging from USD 20–50 per course.

- Innovative Drugs: GNP's pricing is projected to position within USD 30–50 per dose, balancing value with affordability.

Projected Price Trajectory

- Year 1 Post-Launch: USD 40–50 per treatment course, aligning with innovative drugs.

- 3–5 Year Outlook: Strategic reduction to USD 25–30 per dose, reflecting generic competition and increased market penetration.

- Influencing Factors: Regulatory approval timing, reimbursement policies, manufacturing costs, and competitive entries.

Pricing Influencers

- Regulatory Incentives: Orphan drug status can support premium pricing.

- Market Penetration Strategies: Focused segments (e.g., military, space agencies) may command higher prices.

- Cost Optimization: Advances in manufacturing and supply chain efficiencies could drive prices downward over time.

Market Penetration and Revenue Projections

Assuming a successful regulatory approval and a conservative market capture of 10% of the global motion sickness market within five years, projected revenues could reach USD 150–200 million annually. Pricing optimization and geographic expansion will likely influence these figures.

Regulatory and Commercialization Considerations

- Pricing and Reimbursement: Navigating varied healthcare reimbursement frameworks will be critical.

- Market Access: Strengthening partnerships with distributors in travel, military, and health sectors will facilitate adoption.

- Intellectual Property: Securing robust patent protection will underpin pricing strategies and revenue streams.

Risks and Opportunities

Risks

- Delay in regulatory approval.

- High manufacturing costs impacting initial pricing.

- Competition from established therapies and upcoming entrants.

Opportunities

- Expanding indications to include pediatric and geriatric populations.

- Combination therapies with complementary modalities.

- Strategic collaborations with travel and defense sectors.

Key Takeaways

- The global motion sickness market is poised for steady growth, primarily fueled by travel and transportation sectors.

- GNP Motion Sickness, emerging as a novel treatment option, is positioned to command premium pricing initially, with downward adjustments anticipated over time.

- Strategic differentiation based on safety, efficacy, and ease of use will underpin its market acceptance.

- Reimbursement pathways, regulatory incentives, and strategic partnerships are critical to realizing commercial potential.

- Competitive pressures and patent protections will shape long-term pricing and market share.

FAQs

1. When can GNP Motion Sickness expect to be commercially available?

Pending FDA approval, anticipated in Q4 2023, commercialization could begin within six months, subject to manufacturing and distribution readiness.

2. What makes GNP unique compared to existing therapies?

GNP utilizes a novel mechanism targeting neural pathways involved in motion sickness, potentially offering quicker relief with fewer sedative side effects.

3. How will pricing impact market adoption?

Pricing positioned at USD 40–50 per dose balances premium positioning with market competitiveness, especially in institutional segments willing to pay for efficacy and safety.

4. What reimbursement challenges might GNP face?

Reimbursement strategies will vary by region; early engagement with payers and evidence of cost-effectiveness are key to mitigating barriers.

5. What are potential growth opportunities beyond the initial launch?

Expanding indications, forming partnerships with travel, military, and space agencies, and developing combination therapies could accelerate growth.

References

[1] MarketsandMarkets, "Motion Sickness Treatment Market," 2022.

More… ↓