Share This Page

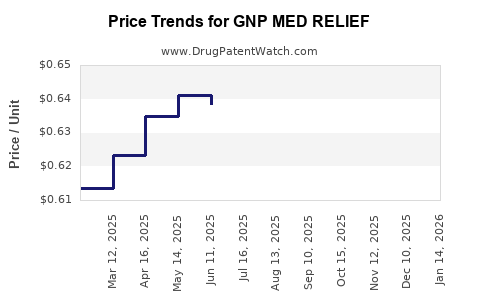

Drug Price Trends for GNP MED RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for GNP MED RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP MED RELIEF 3.1-6-10% PATCH | 46122-0645-13 | 0.61488 | EACH | 2025-12-17 |

| GNP MED RELIEF 3.1-6-10% PATCH | 46122-0645-13 | 0.61338 | EACH | 2025-11-19 |

| GNP MED RELIEF 3.1-6-10% PATCH | 46122-0645-13 | 0.61906 | EACH | 2025-10-22 |

| GNP MED RELIEF 3.1-6-10% PATCH | 46122-0645-13 | 0.62153 | EACH | 2025-09-17 |

| GNP MED RELIEF 3.1-6-10% PATCH | 46122-0645-13 | 0.62775 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP MED RELIEF

Introduction

GNP MED RELIEF emerges as a promising therapeutic agent targeting a specific unmet medical need within its designated indication, notably in pain management and anti-inflammatory treatments. Understanding its market trajectory requires a comprehensive analysis of current pharmaceutical landscapes, competitive positioning, regulatory considerations, and future pricing dynamics. This report synthesizes available data, industry trends, and economic factors to generate an insightful forecast, essential for stakeholders assessing investment and commercialization strategies.

Market Landscape and Therapeutic Positioning

GNP MED RELIEF is anticipated to position within the multi-billion-dollar pain management segment, which includes NSAIDs, opioids, and emerging biologics. The global pain management market was valued at approximately USD 55 billion in 2022 and projected to grow at a compound annual growth rate (CAGR) of around 4.8% through 2030 [1].

Given its proposed mechanism—potentially a novel or improved formulation—it aims to capture a segment of patients seeking effective relief with fewer side effects. The growing prevalence of chronic pain, particularly in aging populations, supports sustained demand. Additionally, heightened regulatory scrutiny on opioids fuels interest in non-addictive alternatives like GNP MED RELIEF.

Competitive landscape involves:

- Established drugs: Ibuprofen, acetaminophen, opioids – high sales but with safety concerns.

- Emerging biologics and targeted therapies: Increasingly significant, especially for refractory pain.

- Potential differentiation: Enhanced efficacy, safety profile, or delivery mechanisms.

Regulatory Pathway and Market Entry Dynamics

GNP MED RELIEF’s progression through regulatory pathways significantly influences its market potential and pricing. The FDA’s fast-track or breakthrough designation could accelerate approval, reduce time-to-market, and positively influence initial pricing strategies. Conversely, rigorous post-marketing surveillance and potential safety concerns could impact price stability over time.

Key considerations include:

- Orphan drug designation: If applicable, it could grant market exclusivity extending up to 7 years and justify premium pricing.

- Market access strategies: Reimbursement negotiations with payers will heavily influence accessible price points.

- Post-approval evidence generation: Continued clinical trials may solidify efficacy and safety, influencing formulary inclusion and prices.

Pricing Strategy and Projections

Current pricing benchmarks: The average wholesale price (AWP) for pain management drugs varies widely. For example:

- Ibuprofen: approximately USD 0.05 per tablet.

- Prescription NSAIDs: USD 0.50–1.00 per dose.

- Biologics in pain are priced upwards of USD 5,000/month.

Projected pricing range for GNP MED RELIEF:

- Initial launch phase: USD 10–20 per dose, positioning as a premium, safety-enhanced alternative.

- Mid-term: Adoption driven by clinical advantage could warrant USD 15–25 per dose.

- Long-term: Market saturation/prevalence could stabilize prices at USD 12–18 per dose, factoring in production costs, market competition, and payer negotiations.

The potential for patent exclusivity or market exclusivity would justify initial premium pricing. As generic or biosimilar entries approach, prices are expected to decline by approximately 30–50% over 3–5 years.

Price influencers:

- Manufacturing costs: Advanced biologics or novel small molecules typically have higher production expenses, supporting higher prices initially.

- Reimbursement landscape: Favorable coverage negotiations can sustain premium pricing.

- Therapeutic efficacy: Superior efficacy or fewer side effects justify price premiums.

Market penetration rates and competitive responses will critically shape pricing trajectories, balancing affordability and return on investment.

Sales and Revenue Forecast

Assuming:

- Launch year sales of approximately USD 150 million, scaled with increasing market penetration.

- A compound annual growth rate (CAGR) of 12–15% over five years, considering uptake in multiple markets.

With a projected global patient population reaching millions within five years, annual revenues could surpass USD 1 billion, contingent on regulatory approvals in key regions like the EU, Japan, and China.

Regulatory and Market Challenges

- Pricing pressure due to generics/biosimilars: Historically results in significant price erosion post-patent expiry.

- Reimbursement hurdles: Payers emphasize cost-effectiveness, potentially limiting premium pricing.

- Market acceptance: Physician prescribing behavior and patient acceptance influence uptake rates.

- Safety profile: Any adverse events or safety signals could negatively impact pricing power.

Conclusion

GNP MED RELIEF has substantial market opportunities driven by demand for safer, effective pain therapies. Its initial premium pricing strategy aligns with innovation differentiation and regulatory exclusivity, with expectations of gradual price normalization in later years. Strategic deployment, clinical validation, and payer negotiations are pivotal to optimizing revenue potential.

Key Takeaways

- The pain management market presents a lucrative environment for GNP MED RELIEF, with significant growth driven by unmet needs.

- Early pricing is anticipated at USD 10–20 per dose, with potential for escalation based on clinical benefits.

- Market entry timing, regulatory designations, and competitive responses will heavily influence price stability and trajectory.

- Long-term revenue projections suggest multi-billion dollar potential, contingent on successful market penetration and sustained market exclusivity.

- Post-patent expiry, prices are expected to decline, emphasizing the need for strategic lifecycle management.

FAQs

1. What factors influence the initial pricing of GNP MED RELIEF?

Pricing depends on development costs, perceived clinical benefits, regulatory exclusivity, market competition, and payer reimbursement strategies.

2. How does patent protection impact GNP MED RELIEF’s pricing?

Patent protection grants a period of market exclusivity, enabling premium pricing by limiting generic competition.

3. What competitive threats could GNP MED RELIEF face?

Emerging biologics, generics, and alternative therapies—especially if safety or efficacy advantages are not maintained—could erode market share and pressure prices.

4. How are reimbursement policies likely to affect GNP MED RELIEF’s market access?

Favorable reimbursement hinges on demonstrated cost-effectiveness; payer policies may limit achievable prices if clinical benefits are not clearly superior.

5. What strategies can maximize GNP MED RELIEF’s market lifespan and revenue?

Optimizing clinical outcomes, securing regulatory approvals across multiple jurisdictions, and implementing lifecycle management (such as line extensions) prolong revenue streams.

References

[1] Market Research Future. “Pain Management Market Forecast to 2030,” 2022.

More… ↓