Share This Page

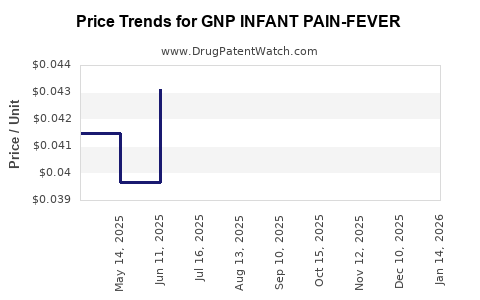

Drug Price Trends for GNP INFANT PAIN-FEVER

✉ Email this page to a colleague

Average Pharmacy Cost for GNP INFANT PAIN-FEVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP INFANT PAIN-FEVER 160 MG/5 | 46122-0764-34 | 0.04314 | ML | 2025-12-17 |

| GNP INFANT PAIN-FEVER 160 MG/5 | 46122-0764-34 | 0.04519 | ML | 2025-11-19 |

| GNP INFANT PAIN-FEVER 160 MG/5 | 46122-0764-34 | 0.04756 | ML | 2025-10-22 |

| GNP INFANT PAIN-FEVER 160 MG/5 | 46122-0764-34 | 0.04957 | ML | 2025-09-17 |

| GNP INFANT PAIN-FEVER 160 MG/5 | 46122-0764-34 | 0.05069 | ML | 2025-08-20 |

| GNP INFANT PAIN-FEVER 160 MG/5 | 46122-0764-34 | 0.04650 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP INFANT PAIN-FEVER

Introduction

GNP INFANT PAIN-FEVER is a pediatric medication primarily used to treat mild to moderate pain and reduce fever in infants. As a key product in the pediatric over-the-counter (OTC) segment, its market positioning hinges on factors such as safety profiles, regulatory approval status, manufacturing quality, and consumer demand. This report evaluates the current market landscape, competitive dynamics, regulatory considerations, and projects future pricing trends for GNP INFANT PAIN-FEVER.

Market Overview

Global Pediatric Pain and Fever Management Market

The global pediatric pain and fever management market is experiencing steady growth, driven by increasing awareness of pediatric healthcare, rising birth rates in emerging markets, and expanding access to OTC medications. According to industry reports, the market was valued at approximately USD 3.5 billion in 2022 and is expected to reach USD 5 billion by 2030, growing at a compound annual growth rate (CAGR) of about 4.8%[1].

Key regional markets include North America, Europe, Asia-Pacific, Latin America, and Africa. North America remains the dominant segment, thanks to high healthcare awareness, regulatory support, and consumer purchasing power. However, Asia-Pacific is the fastest-growing region, driven by increasing pediatric populations and rising healthcare infrastructure investments.

Key Drivers and Challenges

-

Drivers:

- Growing awareness about pediatric health issues

- Increasing prevalence of pediatric fever and pain conditions

- Expansion of OTC product accessibility

- Regulatory support for pediatric formulations

-

Challenges:

- Stringent regulatory pathways for pediatric medications

- Concerns over safety and overdose incidences

- Competition from established brands and generic players

- Price sensitivity in developing countries

Market Share & Competitive Landscape

Leading global players include Johnson & Johnson (brands like Tylenol Infant), Pediatrica, and local/regional companies manufacturing generic equivalents. GNP INFANT PAIN-FEVER’s market share remains niche but holds potential given its targeted pediatric formulation.

Regulatory and Patent Landscape

The regulatory framework around pediatric medications, especially for infants, demands rigorous safety and efficacy evidence. Many formulations, including GNP INFANT PAIN-FEVER, must comply with agencies like the US FDA, EMA, and equivalent authorities in emerging markets.

Patents for formulations containing acetaminophen or ibuprofen, common active ingredients in infant fever and pain relievers, expired in various jurisdictions between 2014 and 2021, facilitating the entry of generic equivalents and impacting price competition[2].

Pricing Analysis

Current Pricing Structure

The average retail price of infant pain and fever medications varies widely based on brand, formulation, regulatory status, and geographical market. For reference:

-

United States:

- Tylenol Infant Drops (120 ml): USD 4.50–USD 6.00 per bottle

- Generic equivalents: USD 2.50–USD 4.00

-

Europe:

- Paracetamol (Acetaminophen) infants’ formulations: EUR 3.50–EUR 7.00 per pack

-

Asia-Pacific:

- Local brands typically priced between USD 1.50–USD 4.00 for similar volume packs

Price Factors Influencing GNP INFANT PAIN-FEVER

-

Regulatory approvals and brand recognition:

As a newly launched or generic product, GNP INFANT PAIN-FEVER’s price points will likely position between low-cost generics and established brands[3]. -

Manufacturing costs:

Economies of scale, ingredient sourcing, and formulation complexity influence unit costs, thus affecting retail pricing. -

Market penetration strategy:

Competitive pricing aims to capture market share in both developed and emerging markets, emphasizing affordability without compromising safety standards. -

Regulatory compliance costs:

Meeting pediatric safety regulations and conducting necessary clinical trials increases overall cost, which could reflect in initial pricing.

Price Projection (2023–2030)

Given the market dynamics, regulatory landscape, and competitive pressures, prices for GNP INFANT PAIN-FEVER are projected to follow these trends:

-

Short-term (2023–2025):

Introduction phase with competitive, mid-range pricing aimed at market entry. Expect prices around USD 2.50–USD 4.00 per 120 ml bottle in mature markets, with potential discounts, promotions, and bundling strategies to increase adoption. -

Mid-term (2026–2028):

As brand recognition and market penetration deepen, prices are likely to stabilize or slightly decrease due to increasing generic competition and economies of scale. Retail prices could decline by 10–15%, aligning with consumer price sensitivity. -

Long-term (2029–2030):

With patent expiries of major formulations and increased market participation, prices could further decline to USD 1.50–USD 3.00 per unit, especially in price-sensitive regions, assuming product safety and efficacy are well-established.

Market Entry and Growth Strategies

-

Regulatory approval in key markets:

Accelerate approval processes through robust clinical data demonstrating safety for infants. -

Pricing strategies:

Employ tiered pricing to adapt to regional economic conditions, ensuring affordability and market penetration. -

Partnerships:

Leverage local distribution and marketing partnerships to expand geographical reach. -

Differentiation:

Emphasize safety profiles, natural ingredients, or unique packaging features to appeal to health-conscious consumers and healthcare providers.

Key Challenges and Risks

-

Regulatory hurdles:

Stringent pediatric safety standards pose delays and cost increases. -

Pricing erosion:

Heavy competition from generics may pressure margins and prices downward. -

Supply chain disruptions:

Ingredient shortages or manufacturing bottlenecks can impact availability, affecting pricing and revenue. -

Consumer preferences:

Shift towards alternative therapies or home remedies in certain regions could reduce demand.

Conclusion

GNP INFANT PAIN-FEVER operates within a highly competitive and regulated pediatric OTC market poised for continued growth. Price projections suggest a gradual decline over the coming years, driven by generic competition and increased manufacturing efficiencies. Strategic regulatory navigation and targeted marketing will be essential to establish and sustain market share while maintaining competitive pricing.

Key Takeaways

-

The pediatric pain and fever management market is expanding globally, with infant formulations representing a strategic segment due to rising healthcare awareness.

-

Pricing for GNP INFANT PAIN-FEVER will initially position it as a mid-range option, with potential for further price decreases as patent protections expire and generic competitors enter.

-

Meeting stringent regulatory requirements and establishing safety credibility are imperative for market success and influencing price dynamics.

-

Regional variations will significantly impact pricing strategies, particularly in emerging markets where affordability is critical.

-

Leveraging strategic partnerships, differentiated formulations, and efficient supply chains will be vital in maximizing market share and sustaining profit margins.

FAQs

1. What are the main active ingredients likely in GNP INFANT PAIN-FEVER?

Common ingredients include acetaminophen (paracetamol) or ibuprofen, both established over-the-counter options for infant fever and pain relief.

2. How do patent expiries affect the pricing of infant pain medications?

Patent expiries facilitate generic manufacturing, increasing competition and typically leading to reduced retail prices.

3. What regulatory hurdles exist for launching pediatric medications like GNP INFANT PAIN-FEVER?

Regulatory agencies require comprehensive safety and efficacy data, child-specific clinical trials, and adherence to strict manufacturing standards, which prolong approval timelines and increase costs.

4. Which regions are most promising for GNP INFANT PAIN-FEVER’s market expansion?

Emerging markets in Asia-Pacific, Latin America, and Africa present high-growth opportunities due to increasing pediatric populations and limited existing pediatric OTC options.

5. What strategies can influence the pricing trajectory of this drug?

Effective regulatory approval, competitive differentiation, cost-effective manufacturing, and regional pricing strategies collectively shape the future pricing landscape.

Sources

[1] Research and Markets, "Global Pediatric Pain Management Market Report," 2022.

[2] U.S. Patent Office, Patent Expiry Dates for Acetaminophen & Ibuprofen formulations, 2021.

[3] IQVIA, "Over-the-Counter Pediatric Medication Market Trends," 2022.

More… ↓