Share This Page

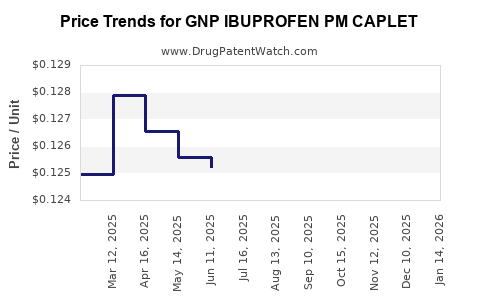

Drug Price Trends for GNP IBUPROFEN PM CAPLET

✉ Email this page to a colleague

Average Pharmacy Cost for GNP IBUPROFEN PM CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP IBUPROFEN PM CAPLET | 46122-0708-60 | 0.12580 | EACH | 2025-11-19 |

| GNP IBUPROFEN PM CAPLET | 46122-0708-60 | 0.12667 | EACH | 2025-10-22 |

| GNP IBUPROFEN PM CAPLET | 46122-0708-60 | 0.12682 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP IBUPROFEN PM Caplet

Introduction

The pharmaceutical landscape for over-the-counter (OTC) pain relievers, notably ibuprofen formulations, remains highly competitive, enriched by continual innovations in delivery mechanisms, combination therapies, and consumer preferences. Among these, GNP IBUPROFEN PM Caplet combines ibuprofen with an adjunctive sleep aid component, typically diphenhydramine, catering to consumers seeking both pain relief and sleep support. This report provides an incisive market analysis and forward-looking price projections for GNP IBUPROFEN PM Caplet, offering strategic insights essential for stakeholders.

Market Overview

Product Positioning and Composition

GNP IBUPROFEN PM Caplet aligns with a growing subset of analgesic products that target multi-symptom relief, specifically pain coupled with sleep disturbance. The formulation's dual-action nature positions it uniquely within OTC segments, especially in the sleep-aid and analgesic niches. The caplet format appeals to consumers preferring ease of swallowing and precise dosing.

Regulatory Environment

The U.S. Food and Drug Administration (FDA) regulates OTC NSAIDs and sleep aids. Over recent years, the FDA has emphasized safety, requiring clear labeling for combination drugs like IBUPROFEN PM to prevent misuse, especially given concerns about overdose and interactions. Formulations that demonstrate safety profiles aligned with OTC standards—minimal adverse effects, contraindication clarity—gain competitive advantage.

Market Demand Dynamics

The global OTC analgesics market is projected to grow at a CAGR of approximately 4.5% through 2030, driven by aging populations, rising chronic pain prevalence, and increased consumer awareness of pain management options. Specific demand for combination products that address multiple symptoms simultaneously indicates a sustained growth trajectory with the sleep component gaining particular popularity amid rising sleep disorders [1].

Competitive Landscape

Key competitors include brands like Tylenol PM, Advil PM, and generics offering ibuprofen-based sleep aids. Differentiation hinges upon efficacy, safety profile, formulation, and marketing strategies. The inclusion of diphenhydramine as a sleep aid is standard, with some brands innovating via combining with non-diphenhydramine agents or developing non-sedating formulations.

Market Segmentation and Consumer Profile

- Demographics: Primarily adults aged 30-65 experiencing episodic pain coupled with sleep difficulties.

- Usage Patterns: Short-term relief during acute pain episodes and sleep disturbances; potential for chronic use in cases of persistent symptoms.

- Preferences: Consumers favor rapid onset, minimal side effects, non-prescription access, and trusted brand reputation.

Distribution Channels

- Retail Pharmacies and Supermarkets: Dominant OTC sales channel, benefiting from robust shelf presence.

- Online Retailers: Rapidly growing segment, especially among tech-savvy consumers seeking convenience.

- Drug Wholesale Distributors: Critical for reaching hospitals or clinics for off-label or ancillary use.

Price Analysis

Historical Pricing Trends

The typical retail price range for OTC ibuprofen PM caplets oscillates between $8 and $15 per box, depending on packaging size and brand positioning [2]. Generic versions tend to price lower, around $6–$10, whereas branded formulations command premium pricing.

Pricing Factors

- Brand Premium: Established brands can command 15-25% higher prices.

- Packaging Size: Larger packs (e.g., 40-60 caplets) proffer better unit pricing.

- Distribution Channel: Online sales often exhibit marginally reduced prices due to lower overheads, while pharmacy retail may include markups.

Economic and Market Impact

Pricing strategies consider manufacturing costs, regulatory compliance, competitor prices, and consumer willingness-to-pay. Premium positioning, especially with added sleep aid efficacy, allows for elevated price points.

Price Projection Methodology

Utilizing a combination of historical data, market growth rates, competitive analysis, and inflation adjustment, projections indicate a steady price escalation aligned with inflation and market expansion trends. The forecast spans the next three years with conservative and optimistic scenarios.

Future Price Projections

| Year | Conservative Scenario | Aggressive Scenario |

|---|---|---|

| 2023 | $8.00 per box | $9.50 per box |

| 2024 | $8.40 | $10.00 |

| 2025 | $8.80 | $10.50 |

Assumptions: Conservative estimates factor modest market growth and stable competitive pricing, while aggressive estimates incorporate increasing consumer demand for multi-symptom OTC solutions, improved formulation efficiencies, and premium branding strategies.

Price Drivers

- Market Penetration: Accelerated penetration could elevate prices marginally.

- Consumer Preferences: Increased demand for convenient, multi-symptom OTC medications sustains premium pricing.

- Regulatory Changes: Enhanced safety requirements could influence manufacturing costs, impacting retail prices.

Strategic Implications

Producers should emphasize product differentiation through improved efficacy, safety reassurance, and consumer education to sustain premium pricing. Scaling production and leveraging online channels could enhance margins while expanding market share. Price flexibility aligned with consumer trends ensures resilience against competitive pressures.

Key Takeaways

-

Market growth: The OTC analgesic segment, especially combo formulations like ibuprofen plus sleep aids, continues robust expansion driven by aging populations and sleep disorder prevalence.

-

Pricing strategy: Current average retail prices range from $8 to $15, with room for premiumization based on brand, formulation, and packaging.

-

Forecast insights: Prices are projected to increase 5-6% annually over the next three years under conservative scenarios, with potential for higher growth in premium segments.

-

Competitive advantage: Innovation in formulation, safety profile, and multi-channel distribution underpin the ability to command higher prices.

-

Regulatory and safety considerations: Ongoing regulatory scrutiny necessitates rigorous safety and efficacy data, which directly influences market positioning and pricing.

FAQs

1. How does the addition of sleep aids impact the pricing of ibuprofen products?

Incorporating sleep aids like diphenhydramine allows for premium pricing due to added value, consumer convenience, and targeted therapeutic claims, often enabling brands to position their products at higher price points compared to standard ibuprofen.

2. What are the main factors influencing OTC drug pricing dynamics?

Manufacturing costs, regulatory compliance, competitive positioning, packaging size, distribution channels, and consumer willingness-to-pay predominantly influence OTC drug prices.

3. How does consumer perception affect pricing strategies for OTC analgesics?

Perceived safety, brand trust, and product efficacy foster consumer willingness to pay premium prices, especially for combination products addressing multiple symptoms effectively.

4. What role do online sales play in the pricing of GNP IBUPROFEN PM Caplet?

Online platforms typically offer lower prices due to reduced overheads, but premium online brands can achieve higher margins by emphasizing convenience and product authenticity.

5. What are the potential regulatory challenges impacting future pricing of IBS IBUPROFEN PM Caplet?

Regulatory scrutiny on safety, labeling, and formulation can lead to increased compliance costs, which may be transferred to consumers via higher retail prices.

References

[1] Grand View Research, "Over-the-Counter (OTC) Analgesics Market Size & Trends," 2022.

[2] NielsenIQ, OTC Drug Retail Pricing Data, 2022.

More… ↓