Share This Page

Drug Price Trends for GNP IBUPROFEN

✉ Email this page to a colleague

Average Pharmacy Cost for GNP IBUPROFEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP IBUPROFEN 200 MG MINI SFGL | 46122-0593-60 | 0.08038 | EACH | 2025-12-17 |

| GNP IBUPROFEN 200 MG SOFTGEL | 46122-0580-55 | 0.08038 | EACH | 2025-12-17 |

| GNP IBUPROFEN 200 MG MINI SFGL | 46122-0593-41 | 0.08038 | EACH | 2025-12-17 |

| GNP IBUPROFEN 200 MG SOFTGEL | 46122-0580-58 | 0.08038 | EACH | 2025-12-17 |

| GNP IBUPROFEN 100 MG CHEW TAB | 46122-0617-62 | 0.14450 | EACH | 2025-12-17 |

| GNP IBUPROFEN PM CAPLET | 46122-0708-60 | 0.12572 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Ibuprofen

Introduction

Ibuprofen, a widely used non-steroidal anti-inflammatory drug (NSAID), has established robust market presence globally due to its efficacy in managing pain, inflammation, and fever. GNP Ibuprofen, a specific formulation or brand variant, holds a notable segment within this expansive landscape. This analysis explores the current market dynamics, competitive landscape, regulatory environment, and future price projections for GNP Ibuprofen, providing valuable insights for stakeholders aiming to navigate this competitive sector.

Market Overview

Global Market Size and Growth Trends

The global ibuprofen market was valued at approximately USD 7.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.3% from 2023 to 2030 [1]. The rising prevalence of chronic and acute pain conditions, coupled with increasing awareness of OTC (over-the-counter) analgesics, fuels sustained demand.

Asia-Pacific, North America, and Europe constitute the predominant markets. North America leads owing to high consumption rates, advanced healthcare infrastructure, and widespread OTC availability. However, emerging economies in Asia-Pacific are rapidly expanding due to increasing health awareness and urbanization.

Key Market Drivers

- Aging Population: Increased elderly population experiencing chronic pain boosts demand.

- Over-the-Counter Accessibility: Regulatory relaxations expand OTC sales channels.

- Pharmaceutical Innovation: Development of extended-release formulations and combination therapies widens market options.

- Consumer Health Trends: Growing preference for self-medication and OTC products.

Competitive Landscape

Major Market Players

Key players include Johnson & Johnson (Motrin, Advil), Bayer AG, Pfizer, and Teva Pharma, with regional manufacturers increasingly penetrating local markets. Brand differentiation, pricing strategies, and regulatory approvals dictate market shares.

GNP Ibuprofen Positioning

GNP (Generic Naming Product) Ibuprofen, like many generic formulations, benefits from lower cost structures and broad market accessibility. Its market competitiveness hinges on price, quality, supply chain reliability, and regulatory compliance.

Regulatory Environment

Regulations governing OTC and prescription status vary globally. In the United States, the FDA classifies ibuprofen as a OTC drug, which influences pricing strategies through regulatory approvals, labeling requirements, and safety monitoring.

In emerging markets, regulatory leniency can facilitate rapid product entry but may raise concerns regarding quality assurance, impacting pricing and market penetration.

Pricing Dynamics

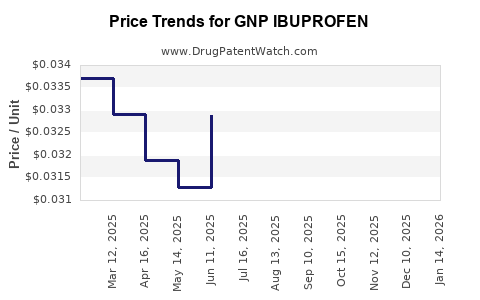

Current Pricing Trends

GNP Ibuprofen typically prices lower than branded counterparts, driven by generic market competition. The average retail price per 200 mg tablet ranges from USD 0.02 to USD 0.05, depending on regional pricing policies and distribution channels [2].

Factors Influencing Price

- Regulatory Approval & Compliance: Stricter standards increase manufacturing costs, potentially raising prices.

- Manufacturing Costs: Raw material prices, economies of scale, and technological efficiencies impact unit costs.

- Market Competition: Increased competition drives prices downward; monopolistic scenarios may stabilize prices temporarily.

- Distribution & Supply Chain: Logistics efficiency influences retail pricing, especially in remote markets.

Impact of Patent Expiry

Patent expiration for brand-specific formulations typically results in a significant price drop (~30-50%), fostering generic market entry and intensifying price competition.

Future Price Projections

Short-term Outlook (2023-2025)

Projected stabilization in GNP Ibuprofen prices, with slight declines of 2-3% annually in mature markets, driven by intensified generic competition and sourcing efficiencies.

Medium to Long-term Outlook (2026-2030)

- Price Compression: Expectations of further price reductions (up to 10%) in competitive markets as manufacturing costs decline and supply chains optimize.

- Premium Pricing in Emerging Markets: Regulatory complexities or quality assurance concerns could support higher price points, albeit with limited margins.

- Impact of Formulation Innovations: Introduction of new formulations (e.g., topical or extended-release) may command premium pricing but constitute a small market segment.

Pricing Strategies and Market Entry

Stakeholders should consider localized pricing strategies based on regulatory landscapes, competitor pricing, and consumer purchasing power. Strategic positioning as a cost-effective generic can maximize market penetration, especially in price-sensitive regions.

Challenges and Opportunities

- Regulatory Challenges: Navigating diverse approval processes necessitates significant compliance investments.

- Quality Assurance: Maintaining GMP standards sustains consumer trust and price stability.

- Market Saturation: High generic competition requires innovative marketing and distribution tactics.

- Expanding Access in Emerging Markets: Growing health awareness offers opportunities to expand market share, justifying potential investment in localized manufacturing.

Conclusion

GNP Ibuprofen resides in a highly competitive, mature global market characterized by downward pricing pressures due to generic competition. While current prices remain relatively stable in developed markets, the ongoing patent expiries, regulatory changes, and supply chain enhancements will increasingly influence future pricing structures. Stakeholders must adapt to regional regulatory environments and pursue cost efficiencies to maintain profitability and market relevance.

Key Takeaways

- The global ibuprofen market is poised for steady growth, with generics like GNP Ibuprofen playing a central role in expanding access and driving affordability.

- Competitive pricing, driven by patent expiries and increased market entrants, continues to exert downward pressure on prices.

- Strategic focus on regulatory compliance and quality assurance sustains competitiveness and supports pricing stability.

- Opportunities exist in emerging markets, provided manufacturers localize production and optimize supply chains.

- Future price declines of up to 10% are anticipated over the next five years, emphasizing the importance of cost management and innovative formulations.

FAQs

1. How does patent expiration affect GNP Ibuprofen pricing?

Patent expiration enables generic manufacturers to enter the market, significantly increasing supply and intensifying price competition. As a result, prices typically decrease by 30-50%, making the drug more affordable but reducing profit margins for branded versions.

2. What are the regulatory considerations for GNP Ibuprofen in different regions?

Regulatory environments vary, with agencies like the FDA in the U.S. and EMA in Europe requiring rigorous safety and efficacy data. In emerging markets, approval processes may be less stringent but pose challenges related to quality assurance. Compliance influences market access, pricing, and formulation options.

3. How does regional market competition impact GNP Ibuprofen prices?

Intense competition from multiple generic manufacturers drives prices downward, especially in mature markets. Market saturation can lead to price wars, emphasizing the need for differentiation through quality, distribution, or marketing strategies.

4. What are the prospects for innovative formulations of GNP Ibuprofen?

Innovations such as topical gels, patches, or extended-release tablets could command premium pricing. However, their market share remains limited, and development costs are high, requiring careful assessment of market demand.

5. What strategies can stakeholders adopt to maintain profitability amid price pressures?

Stakeholders should focus on cost efficiencies, enhancing supply chain resilience, ensuring regulatory compliance, and exploring markets with less price competition. Diversification into new formulations and strengthening brand trust can also sustain margins.

Sources:

[1] Market Research Future, "Ibuprofen Market Size and Forecast," 2022.

[2] IQVIA, "Pharmaceutical Pricing Trends," 2022.

More… ↓