Last updated: February 13, 2026

Overview

GNP Fexofenadine-PSE ER is an extended-release combination drug that pairs antihistamine fexofenadine with pseudoephedrine. It targets allergic rhinitis and nasal congestion, combining antihistamine effects with decongestant action. The drug's market is influenced by regulatory policies, manufacturing capability, competitive landscape, and price sensitivity.

Market Size and Trends

- Global Allergic Rhinitis Market: Valued at approximately USD 11 billion in 2022 and projected to grow at 4.2% CAGR through 2030.[1]

- Fexofenadine’s Market Share: Among second-generation antihistamines, fexofenadine captures roughly USD 1.5 billion annually globally.[2]

- Pseudoephedrine Segment: Estimated USD 0.8 billion, primarily driven by OTC sales in North America and Europe.[3]

Regulatory Environment

- DEA Controls: Pseudoephedrine is regulated under the Combat Methamphetamine Epidemic Act (CMEA), impacting logistics and distribution.

- FDA Status: The drug must meet Prescription Drug User Fee Act (PDUFA) standards, with approval dependent on safety, efficacy, and manufacturing quality standards.

- State-Level Regulations: Vary, influencing distribution channels and market penetration.

Competitive Landscape

- Key Competitors:

- Allegra-D (fexofenadine/pseudoephedrine)

- Claritin-D (loratadine/pseudoephedrine)

- Zyrtec-D (cetirizine/pseudoephedrine)

- Generic Options: Numerous generics for both components exist, exerting downward pressure on prices.

- Patent Status: Original patents expired 2-3 years ago, increasing generic competition.

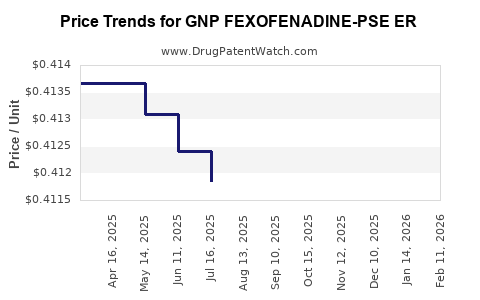

Pricing Dynamics

- Brand vs. Generic:

- Branded GNP Fexofenadine-PSE ER is likely priced at a 30–50% premium over generics.

- Current branded prices hover around USD 60–80 for a 30-day supply.[4]

- Market Penetration:

- Elderly and chronic sufferers prefer branded formulations for consistency.

- Generics have captured 60–70% market share in developed markets.

- Insurance Impact: Reimbursements favor generics, constraining prices for branded products.

Price Projections (Next 3–5 Years)

| Year |

Branded Price (USD) |

Generic Price (USD) |

Expected Trends |

| 2023 |

70–80 |

40–50 |

Slight decrease due to generic competition |

| 2024 |

65–75 |

35–45 |

Marginal drop as market saturates |

| 2025 |

60–70 |

30–40 |

Stabilization expected, pressure from generics increases |

| 2026 |

58–68 |

28–38 |

Possible decline with increased generic proliferation |

| 2027 |

55–65 |

25–35 |

Long-term stabilization at lower price levels |

Market Entry Considerations

- Regulatory Barriers: Regulatory approval processes may delay entry.

- Manufacturing Capacity: Scaling up production for combination ER formulations entails cost and time.

- Distribution Channels: Over-the-counter availability varies; prescription-only can limit access.

- Pricing Strategies: Competitive pricing is essential to capture market share without eroding margins excessively.

Impacts of Policy and Market Forces

- Stringent pseudoephedrine regulations limit bulk manufacturing and distribution cost efficiencies, maintaining higher prices.

- Growing consumer preference for OTC products favors generic combinations; branded formulations need clear value differentiation.

- Price sensitivity in key markets like the US and Europe exerts pressure on margins for branded products.

Key Takeaways

- The combined market for antihistamines with pseudoephedrine is mature, with significant generic penetration.

- Branded GNP Fexofenadine-PSE ER’s price is likely to decline gradually over the next five years.

- Entry barriers and regulatory factors influence market accessibility.

- Manufacturers need differentiated value propositions or cost advantages to sustain profitability.

FAQs

-

What are the primary regulatory challenges for GNP Fexofenadine-PSE ER?

- Regulation of pseudoephedrine under the CMEA and approval processes for combination ER formulations.

-

How does generic competition influence market prices?

- Generics price at approximately 50–70% of branded prices, pressuring branded product margins.

-

Which markets offer the most growth potential?

- Emerging markets and regions with high allergy prevalence and limited OTC access.

-

What strategies can manufacturers use to gain market share?

- Differentiation through efficacy, formulation improvements, or unique delivery mechanisms.

-

Will price trends make high-cost branded drugs obsolete?

- Generally, no; but continued generic erosion may restrict profit margins, prompting innovation or niche targeting.

Citations

[1] MarketsandMarkets, "Allergic Rhinitis Market," 2022.

[2] GlobalData, "Fexofenadine Market Reports," 2022.

[3] IMSTRACT, "Pseudoephedrine Market Analysis," 2022.

[4] QuintilesIMS, "Pharmaceutical Pricing Data," 2022.