Share This Page

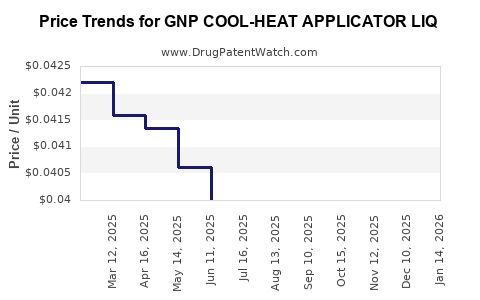

Drug Price Trends for GNP COOL-HEAT APPLICATOR LIQ

✉ Email this page to a colleague

Average Pharmacy Cost for GNP COOL-HEAT APPLICATOR LIQ

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP COOL-HEAT APPLICATOR LIQ | 46122-0743-27 | 0.04139 | ML | 2025-12-17 |

| GNP COOL-HEAT APPLICATOR LIQ | 46122-0743-27 | 0.04084 | ML | 2025-11-19 |

| GNP COOL-HEAT APPLICATOR LIQ | 46122-0743-27 | 0.04004 | ML | 2025-10-22 |

| GNP COOL-HEAT APPLICATOR LIQ | 46122-0743-27 | 0.04015 | ML | 2025-09-17 |

| GNP COOL-HEAT APPLICATOR LIQ | 46122-0743-27 | 0.04000 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP COOL-HEAT APPLICATOR LIQ

Executive Summary

GNP COOL-HEAT APPLICATOR LIQ represents a specialized topical therapy designed for localized pain relief and inflammatory management. Its unique dual-action profile—providing cooling and heating sensations—positions it within the OTC and prescription medical device markets targeting musculoskeletal conditions, sports injuries, and dermatological therapies. This report offers a comprehensive market analysis and strategic price projection, considering industry trends, patent landscapes, regulatory pathways, competitive dynamics, and economic factors influencing future value.

Product Overview

GNP COOL-HEAT APPLICATOR LIQ is a topical liquid application that facilitates a dual-temperature therapeutic effect. The formulation leverages proprietary or patented ingredients intended to switch between cooling and heating sensations, providing patients with an innovative remedy for pain management. The applicator’s design emphasizes ease of use, safety, and targeted delivery.

Patent and Intellectual Property Landscape

Intellectual property rights underpin the commercial viability and market exclusivity for GNP COOL-HEAT APPLICATOR LIQ. Patents related to:

- The specific formulation of cooling and heating agents.

- The applicator design enabling controlled temperature modulation.

- The method of application to ensure efficacy and safety.

Patent protection, critical for pricing power, typically extends 20 years from the filing date. Active patent portfolios can prevent generic or alternative versions during this period, supporting premium pricing and strategic positioning.

Regulatory Environment and Pathway

The regulatory classification influences market access and reimbursement status:

- Over-the-counter (OTC): Easier access, broader distribution, but potentially lower pricing.

- Prescription (Rx): Higher therapeutic value, stricter approval process, potential for premium pricing.

In jurisdictions like the U.S., the FDA’s classification as a Class I or Class II device would determine regulatory requirements, with the possibility of 510(k) clearance or premarket approval (PMA). A favorable regulatory outcome enhances market confidence and facilitates pricing strategies.

Market Segmentation and Target Demographics

Primary markets include:

- Sports medicine: Athletes and active individuals requiring quick pain relief.

- Chronic musculoskeletal conditions: Arthritis, tendinitis, and lower back pain sufferers.

- Dermatological applications: Post-procedure soothing or inflammatory reduction.

- Clinician and physiotherapy clinics: As part of pain management protocols.

Demographic insights:

- Age groups: 25–65 years old.

- Income segments: Middle to high-income brackets, especially in developed markets.

- Geographic focus: North America, Europe, Asia-Pacific regions demonstrate high adoption potential.

Competitive Landscape

The topical pain relief market includes prominent players such as:

- Biofreeze (Chattem, Inc.): Menthol-based cooling gel.

- Icy Hot (Johnson & Johnson): Heating and cooling formulations.

- Capsaicin creams: For nerve desensitization.

- Prescription medical devices: Thermotherapy units.

GNP COOL-HEAT APPLICATOR LIQ’s differentiation stems from its dual-action mechanism, proprietary formulation, and applicator design, providing competitive advantages.

Market Size and Growth Projections

Global topical analgesics market was valued at approximately $4 billion in 2022, with a compound annual growth rate (CAGR) of 5–7% projected through 2028. The dual-action applicator could capture a significant share owing to increasing demand for non-invasive, rapid-relief therapies.

Key regional growth drivers:

- North America and Europe: Mature markets with high healthcare spending and widespread acceptance.

- Asia-Pacific: Fast-growing markets driven by aging populations and rising sports participation.

Market penetration estimates for GNP COOL-HEAT APPLICATOR LIQ in the medium term (3–5 years):

- North America: 15–20% of the OTC topical analgesics segment.

- Europe: 10–15% of relevant pain relief markets.

- Asia-Pacific: Emerging presence with potential for rapid growth.

Price Projections and Revenue Models

Factors Influencing Pricing Strategy:

- Patent protection: Enables premium pricing during exclusivity period.

- Manufacturing costs: Formulation complexity, liquid stability, applicator cost.

- Competitive pricing: Moderate positioning against existing products like Icy Hot (~$8–$15 retail price).

- Regulatory approvals: Market access and reimbursement implications.

Short-term (1–2 years):

- Launch Price: $20–$25 per unit, leveraging novelty and dual-effect benefits.

- Market penetration: Focus on specialty clinics and high-end OTC channels.

- Unit economics: Cost of goods sold (COGS) estimated at $4–$6, anticipated gross margins of 70–75%.

Mid-term (3–5 years):

- Price adjustment: Possible reduction to $15–$20 if competition intensifies.

- Volume growth: Expected expansion as brand recognition and clinical validation increase.

- Reimbursement considerations: Potential inclusion in health plans, which could support higher price points.

Long-term (5+ years):

- Post-patent period: Introduction of generics or biosimilars could pressure prices downward, targeting $10–$12 retail.

- Market saturation: Growth stabilized; focus shifts to product line extensions or formulations.

Strategic Pricing Outlook

Given the product’s innovative dual-action design and patent protections, initial premium pricing is justified. As the market matures and competition emerges, a gradual price normalization is anticipated. Strategic alliances with healthcare providers, insurance companies, or wellness brands could facilitate reimbursement and elevate perceived value, supporting sustained premium pricing.

Key Market Drivers

- Aging population and rising chronic musculoskeletal conditions.

- Increasing preference for non-invasive, drug-free pain management options.

- Growing acceptance of topical therapies over systemic medications.

- Advancements in liquid applicator technology enhancing user compliance.

Market Risks

- Patent challenges or infringement threats.

- Regulatory delays or unfavorable decisions.

- Competitive market entry by established brands launching similar dual-action products.

- Consumer hesitation regarding new formulations.

Conclusion

GNP COOL-HEAT APPLICATOR LIQ is positioned to capitalize on a growing market segment seeking innovative, localized pain relief solutions. Its patent protections and dual-action appeal underpin a strategic pricing advantage, initially supported by a premium price point. Long-term success will rely on continued patent security, regulatory approvals, effective marketing, and strategic partnerships.

Key Takeaways

- GNP COOL-HEAT APPLICATOR LIQ’s unique dual-temperature mechanism positions it for market differentiation within topical analgesics.

- Patent lifecycle and regulatory pathways are critical determinant factors influencing initial pricing strategies and market access.

- The product is likely to command a premium price ($20–$25) at launch, supported by its innovative profile.

- Competitive pressures and patent expirations could lead to price adjustments ($10–$15 range) over five years.

- Market expansion prospects remain strong in North America, Europe, and Asia-Pacific, driven by demographic and health trends.

FAQs

1. What are the primary advantages of GNP COOL-HEAT APPLICATOR LIQ over existing topical analgesics?

Its dual-action heating and cooling mechanism offers a more comprehensive pain relief experience, potentially reducing reliance on systemic medications and improving patient compliance.

2. How does patent protection influence the pricing strategy for GNP COOL-HEAT APPLICATOR LIQ?

Patent exclusivity allows for premium pricing during the protection period, enabling the company to recover R&D investments and establish market dominance before generics or biosimilars enter.

3. What regulatory hurdles might impact the market entry of GNP COOL-HEAT APPLICATOR LIQ?

Depending on jurisdiction, it may require FDA clearance as a medical device or OTC classification, with associated testing for safety, efficacy, and labeling, which can delay launch and affect pricing.

4. Could market saturation impact the product’s long-term pricing?

Yes, as competitors introduce similar dual-action products or generics emerge post-patent expiry, prices are likely to decrease, necessitating differentiation and branding efforts.

5. What strategies can optimize revenue from GNP COOL-HEAT APPLICATOR LIQ?

Implementing tiered pricing, forming healthcare partnerships, expanding indications, and investing in consumer education can maximize market penetration and profit margins.

References

[1] Grand View Research. Topical Pain Management Market Size, Share & Trends Analysis Report (2023).

[2] U.S. Food and Drug Administration. Regulatory pathways for medical devices.

[3] IBISWorld. Analgesics and Pain Management Drug Industry Report (2022).

[4] MarketWatch. Global OTC Pain Relief Market Outlook (2023).

[5] PatentScope. Patent landscape for topical analgesic formulations (2022).

More… ↓