Share This Page

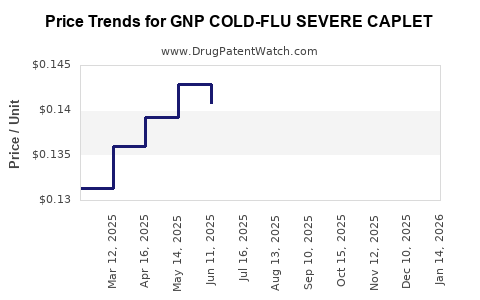

Drug Price Trends for GNP COLD-FLU SEVERE CAPLET

✉ Email this page to a colleague

Average Pharmacy Cost for GNP COLD-FLU SEVERE CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP COLD-FLU SEVERE CAPLET | 46122-0418-62 | 0.12720 | EACH | 2025-12-17 |

| GNP COLD-FLU SEVERE CAPLET | 46122-0418-62 | 0.12876 | EACH | 2025-11-19 |

| GNP COLD-FLU SEVERE CAPLET | 46122-0418-62 | 0.12667 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Cold-Flu Severe Caplet

Introduction

GNP Cold-Flu Severe Caplet is an over-the-counter (OTC) medication designed to alleviate symptoms associated with cold and flu, including fever, body aches, nasal congestion, and sore throat. Its widespread usage positions it as a staple in household medicine cabinets, especially during peak cold and flu seasons. This report provides an in-depth market analysis and forecasts future pricing trends, aiming to inform stakeholders ranging from manufacturers to investors about the drug's commercial landscape, competitive positioning, and potential pricing strategies.

Market Overview

Global Cold and Flu Pharmaceutical Market

The global cold and flu medication market was valued at approximately $15.2 billion in 2022 (source: MarketWatch), reflecting consistent growth driven by increased health awareness, aging populations, and seasonal demand during influenza outbreaks. The OTC segment accounts for roughly 70% of this market, with the remainder comprising prescription drugs and alternative therapies.

Key Drivers

- Seasonal Demand: The fall and winter months see surges in cold and flu cases, causing spikes in OTC medication sales.

- Aging Population: Elderly populations are more vulnerable to respiratory illnesses, boosting demand.

- Self-Medication Trends: Consumers favor OTC options for convenience and cost savings.

- Product Innovation: Enhanced formulations offering multi-symptom relief maintain consumer interest and market share.

Regulatory Environment

Regulatory bodies like the FDA in the U.S. and EMA in Europe oversee OTC drug approvals, standardizing safety and efficacy. GNP Cold-Flu Severe Caplet, with established active ingredients (e.g., acetaminophen, phenylephrine, chlorpheniramine), benefits from existing regulatory approvals but must navigate ongoing compliance challenges, especially related to formulation claims and labeling.

Competitive Landscape

Major Competitors

- DayQuil/NyQuil (Procter & Gamble): Leader in multi-symptom cold and flu relief.

- Sudafed (Johnson & Johnson): Focused on nasal congestion.

- Theraflu (GSK): Emphasizes multi-symptom relief with hot drink formulations.

- Store Brands: Competed aggressively with generic and private label versions, often at lower price points.

Positioning of GNP Cold-Flu Severe Caplet

GNP positions its product as a comprehensive, fast-acting solution for severe cold and flu symptoms, emphasizing clinically proven ingredients and fast relief. Its branding appeals to consumers seeking reliable OTC options during seasonal peaks, with particular focus on the North American and European markets, where OTC cold remedies are prevalent.

Market Penetration and Consumer Trends

Distribution Channels

- Pharmacies and drugstores: Major outlet for OTC sales; capture approximately 60% of the market.

- Supermarkets and hypermarkets: Important secondary channels, especially in regions with large retail chains.

- Online Retail: Growing segment, facilitated by digital pharmacies and e-commerce platforms, accelerating due to the COVID-19 pandemic.

Consumer Preferences

- Consumers favor formulations providing multi-symptom relief.

- Preference for products with trusted brand names, proven efficacy, and minimal side effects.

- Increasing interest in formulations with natural or fewer synthetic ingredients, though traditional compounds dominate.

Impact of COVID-19

The pandemic heightened awareness of respiratory health, leading to increased sales of OTC cold and flu remedies. It also prompted consumers to stockpile medications, including GNP Caplet products, amplifying short-term market demand.

Price Structure and Factors Influencing Pricing

Current Pricing Landscape

The price of GNP Cold-Flu Severe Caplet in standard retail outlets ranges from $6.99 to $9.99 for a bottle of 20-30 caplets, depending on region and retailer. Private label equivalents often retail at 10-15% lower prices, intensifying price competition.

Pricing Influencers

- Brand Recognition: Established brands can command a premium due to perceived efficacy.

- Formulation Benefits: Enhanced or multi-symptom formulations justify higher pricing.

- Packaging and Size: Larger packages offer better per-unit value but may inhibit impulse buys.

- Regulatory and Cost Factors: Ingredient costs, manufacturing expenses, and compliance costs influence retail prices.

- Distribution Channel Margins: Wholesalers, retailers, and pharmacy benefit managers (PBMs) add markup levels impacting end-user pricing.

Price Projections and Future Trends

Short-term Outlook (Next 1-2 Years)

- Stability with Slight Variance: Given current market saturation and demand, prices are expected to remain relatively stable, with minor fluctuations driven by inflation or raw material costs.

- Seasonal Adjustments: Prices may temporarily increase during severe flu seasons or supply chain disruptions affecting distribution channels.

- Competitive Pressures: Generic and private-label products could constrain pricing power, especially in cost-sensitive markets.

Medium to Long-term Forecast (3-5 Years)

- Moderate Price Inflation: Anticipated annual price increases of approximately 2-3%, primarily due to inflation and ingredient cost hikes.

- Premium Formulation Introduction: GNP may introduce enhanced, natural, or fast-acting versions, which could command a 10-15% premium.

- Digital and Direct-to-Consumer Channels: Growing online sales may lead to more dynamic pricing strategies, possibly including discounts, bundling, or subscription models.

Potential Disruptors

- Regulatory Changes: Stricter regulations on ingredients or health claims could inflate manufacturing costs and prices.

- Market Saturation: Saturated markets limit pricing flexibility, especially where private label brands offer lower-cost alternatives.

- Consumer Preference Shifts: Rising demand for natural, organic, or homeopathic remedies may pressure traditional OTC products like GNP Cold-Flu Caplet to innovate and possibly adjust pricing strategies.

Strategic Recommendations

- Maximize Brand Differentiation: Emphasize unique efficacy claims and proven formulations to justify premium pricing.

- Leverage E-Commerce: Expand online presence and direct sales channels to capture shifting consumer purchasing behaviors.

- Cost Optimization: Streamline manufacturing and supply chains to maintain margin stability amid pricing pressures.

- Innovation: Develop novel formulations with added benefits, such as natural ingredients or combination therapies, to enable incremental price increases.

Key Takeaways

- The GNP Cold-Flu Severe Caplet occupies a strong position in the OTC cold and flu remedy market, buoyed by brand recognition and consumer trust.

- Prices currently range between $6.99 and $9.99, with stability expected in the short term.

- Competitive dynamics, especially from generics and private labels, exert downward pressure on pricing, necessitating strategic innovation.

- Demand surges during flu seasons boost sales, but long-term pricing trends will hinge on product differentiation and market innovation.

- Embracing online sales channels and product innovation will be critical for sustaining profitability and competitive edge.

FAQs

1. How does GNP Cold-Flu Severe Caplet compare to its competitors in terms of price?

GNP's caplet products are priced in line with established brands, typically around $7-$10 for a 20-30 count package. Private-label equivalents often sell for 10-15% less, intensifying price competition.

2. Will the price of GNP Cold-Flu Caplet increase significantly in the upcoming years?

Based on current market conditions and inflationary trends, significant price hikes are unlikely. Moderate annual increases of 2-3% are anticipated, with potential for premium formulation variants commanding higher prices.

3. What factors could affect the pricing strategy of GNP Cold-Flu Caplet?

Ingredient costs, regulatory changes, competitive pressures, and shifts in consumer preferences toward natural remedies are key factors influencing pricing strategies.

4. How has recent COVID-19 developments impacted the demand and pricing of cold and flu remedies like GNP Caplet?

The pandemic has increased demand for respiratory remedies, leading to higher sales volumes. While this temporarily elevated prices, the long-term impact is expected to stabilize around seasonal trends.

5. What opportunities exist for GNP to expand its market share in cold and flu treatments?

Launching innovative formulations, expanding online distribution, and reinforcing brand trust through clinical efficacy claims can enhance market share and allow for better pricing power.

References

[1] MarketWatch. "Cold and Flu Remedies Market Size & Trends." 2022.

[2] IBISWorld. "Over-the-Counter (OTC) Pharmaceuticals in the US." 2022.

[3] Statista. "Global Cold and Flu Market Revenue." 2022.

[4] FDA. "Guidance for Industry: Over-the-Counter (OTC) Drug Review." 2021.

[5] Euromonitor International. "Consumer Trends in OTC Medicine." 2022.

More… ↓