Share This Page

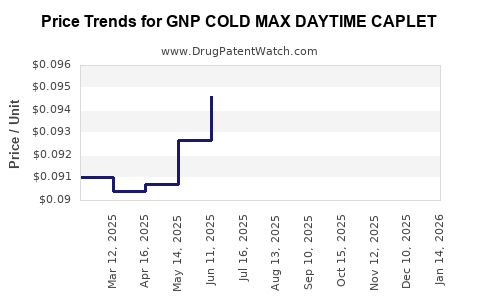

Drug Price Trends for GNP COLD MAX DAYTIME CAPLET

✉ Email this page to a colleague

Average Pharmacy Cost for GNP COLD MAX DAYTIME CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP COLD MAX DAYTIME CAPLET | 46122-0410-62 | 0.09232 | EACH | 2025-12-17 |

| GNP COLD MAX DAYTIME CAPLET | 46122-0410-62 | 0.09454 | EACH | 2025-11-19 |

| GNP COLD MAX DAYTIME CAPLET | 46122-0410-62 | 0.09637 | EACH | 2025-10-22 |

| GNP COLD MAX DAYTIME CAPLET | 46122-0410-62 | 0.09700 | EACH | 2025-09-17 |

| GNP COLD MAX DAYTIME CAPLET | 46122-0410-62 | 0.09740 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Cold Max Daytime Caplet

Introduction

GNP Cold Max Daytime Caplet is an over-the-counter (OTC) medication formulated to alleviate symptoms of common cold and flu, including nasal congestion, headache, and sore throat. As a popular product within the OTC pharmaceutical segment, understanding its market dynamics and future pricing trends is essential for stakeholders, including manufacturers, distributors, and healthcare providers. This analysis provides an in-depth assessment of the current market landscape, competitive positioning, regulatory environment, and prices, culminating in future price projections.

Market Overview

1. Industry Context

The OTC cold and flu remedies market stood at approximately USD 19.4 billion globally in 2022, with a compound annual growth rate (CAGR) of around 4.5% from 2018 to 2022 [1]. The rising prevalence of respiratory illnesses, heightened health awareness, and the increasing preference for self-medication primarily drive this segment.

2. Product Positioning

GNP Cold Max Daytime Caplet is positioned as a fast-acting, easy-to-dose medication targeting consumers who seek quick symptom relief without sleep-inducing side effects. Its active ingredients typically include acetaminophen, phenylephrine, and possibly other analgesics or decongestants, aligning with consumer preferences for multi-symptom relief.

3. Consumer Demographics

Key consumers of GNP Cold Max Daytime Caplet include working adults aged 18-49, urban population segments, and health-conscious consumers preferring OTC medications over prescription options. The product's appeal is augmented during peak cold seasons (fall and winter) and in regions with high respiratory infection rates.

Market Dynamics and Competitive Landscape

1. Key Competitors

Pivotal competitors include brands like Sudafed, DayQuil, Tylenol Cold Max, and local OTC brands. Market share distribution varies by region, with global OTC brands holding dominant positions due to strong brand recognition and distribution networks.

2. Distribution Channels

Primary channels comprise drugstores, supermarkets, online pharmacies, and direct sales to healthcare institutions. The e-pharmacy sector has experienced accelerated growth, especially amid the COVID-19 pandemic, influencing pricing strategies and product availability.

3. Regulatory Environment

Regulatory frameworks governing OTC medications differ across regions, impacting marketing, labeling, and permissible formulations. For instance, the U.S. FDA's OTC monograph system influences product formulation and marketing claims. Compliance costs and regulatory changes often impact pricing strategies.

Price Analysis

1. Current Pricing

As of Q1 2023, the average retail price of a 20-caplet pack of GNP Cold Max Daytime Caplet ranges between USD 8.50 and USD 12.00, depending on geography, retailer, and purchase channel. Discount retail chains tend to price near USD 8.50, whereas specialty pharmacies and online platforms may list at or above USD 12.00.

2. Price Components

Pricing comprises manufacturing costs, marketing, distribution, retailer margins, and regulatory compliance expenses. Manufacturer gross margins typically hover around 30-40%, with retail markup adjustments depending on channel competitiveness.

3. Price Trends and Drivers

Historical data indicates a gradual price increase, averaging 2% annually over the last five years, primarily driven by raw material costs and inflation. Competitive pressures and increased online retailing exert downward price pressures in some markets, balancing higher input costs.

Future Price Projections

1. Short-Term (Next 1-2 Years)

Given current inflationary pressures and raw material costs—particularly for active ingredients like acetaminophen—prices are projected to increase modestly, approximately 1-3% annually. Supply chain disruptions may impose temporary price inflation, especially in regions heavily reliant on imported ingredients [2].

2. Medium to Long-Term (3-5 Years)

As the global OTC market sustains steady growth, price escalation could align with inflation rates (~2%), assuming no significant regulatory changes or supply disruptions. Increased adoption of online distribution channels may exert further downward pressure; however, premium formulations or combo products could command higher prices.

3. Impact of Innovation and Regulations

Development of new formulations with improved efficacy or reduced side-effects could lead to premium pricing. Conversely, stricter regulations or increased generic competition may compress prices, affecting profit margins and market share strategies.

Market Opportunities and Risks

Opportunities:

- Expansion into emerging markets with increasing healthcare awareness.

- Diversification into combination formulations for broader symptom coverage.

- Enhancement of online direct-to-consumer sales channels.

Risks:

- Regulatory changes restricting certain active ingredients.

- Price erosion due to intensified competition and generics.

- Supply chain vulnerabilities impacting raw material costs.

Concluding Remarks

GNP Cold Max Daytime Caplet occupies a strong position within a resilient OTC segment. Its future pricing trajectory is expected to follow a moderate upward trend, influenced by inflationary pressures, but constrained by competitive dynamics and regulatory developments. Stakeholders should focus on optimizing supply chains, leveraging digital channels, and maintaining compliance to sustain optimal margins.

Key Takeaways

- The global OTC cold remedies market demonstrates steady growth, with GNP Cold Max Daytime Caplet positioned favorably due to consumer demand for convenient, multi-symptom relief products.

- Current retail prices average USD 8.50-12.00 per pack; pricing is influenced by regional factors, distribution channels, and competitive pressures.

- Price projections indicate a modest CAGR of 1-3% over the next two years, driven by raw material costs and inflation.

- Opportunities include expanding into emerging markets and harnessing online sales, while risks involve regulatory shifts and pricing pressures from generic competition.

- Strategic focus should be on supply chain efficiency, innovation, and compliance to maintain competitiveness and profitability.

FAQs

1. What are the key active ingredients in GNP Cold Max Daytime Caplet?

Typically, the active ingredients include acetaminophen for pain and fever relief, phenylephrine as a nasal decongestant, and possibly other ingredients like chlorpheniramine or caffeine for additional symptom relief, depending on formulation.

2. How does GNP Cold Max Daytime Caplet compare price-wise to competitors?

It offers a mid-range price point, generally comparable to similar OTC remedies like DayQuil or Tylenol Cold Max, with slight variations based on regional pricing strategies and retailer discounts.

3. What factors significantly influence the future pricing of OTC cold remedies?

Raw material costs, regulatory changes, competitive dynamics, inflation, and innovations in formulation are primary determinants of future OTC product prices.

4. Is online retailing affecting the pricing strategies for GNP Cold Max Daytime Caplet?

Yes. Online channels often offer lower prices due to reduced distribution costs, intensifying price competition and leading to slight decreases in retail pricing or promotional discounts.

5. Are there regulatory concerns that could impact the market or pricing of GNP Cold Max Daytime Caplet?

Regulatory authorities may introduce restrictions on certain ingredients or labeling requirements, potentially affecting formulation costs and permissible marketing claims, which can influence pricing strategies.

Sources

[1] MarketWatch, “Over-The-Counter (OTC) Drugs Market Size, Share & Trends Analysis,” 2023.

[2] IBISWorld, “Global Supply Chain Dynamics in OTC Pharmaceuticals,” 2022.

More… ↓