Share This Page

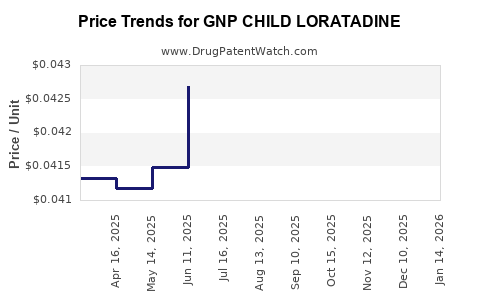

Drug Price Trends for GNP CHILD LORATADINE

✉ Email this page to a colleague

Average Pharmacy Cost for GNP CHILD LORATADINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP CHILD LORATADINE 5 MG/5 ML | 46122-0787-34 | 0.04238 | ML | 2025-12-17 |

| GNP CHILD LORATADINE 5 MG/5 ML | 46122-0787-34 | 0.04246 | ML | 2025-11-19 |

| GNP CHILD LORATADINE 5 MG/5 ML | 46122-0787-34 | 0.04276 | ML | 2025-10-22 |

| GNP CHILD LORATADINE 5 MG/5 ML | 46122-0787-34 | 0.04179 | ML | 2025-09-17 |

| GNP CHILD LORATADINE 5 MG/5 ML | 46122-0787-34 | 0.04237 | ML | 2025-08-20 |

| GNP CHILD LORATADINE 5 MG/5 ML | 46122-0787-34 | 0.04261 | ML | 2025-07-23 |

| GNP CHILD LORATADINE 5 MG/5 ML | 46122-0787-34 | 0.04269 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP CHILD LORATADINE

Introduction

GNP CHILD LORATADINE, a pediatric antihistamine formulated for children’s allergy relief, has gained notable attention in the pharmaceutical landscape. As a leading product under the GNP portfolio, it addresses allergic rhinitis, urticaria, and hay fever in pediatric populations. This report provides a comprehensive market analysis and price projection, examining competitive positioning, regulatory factors, market dynamics, and potential growth trajectories to inform strategic decisions for stakeholders.

Market Overview

Global Pediatric Allergy Market Context

The global pediatric allergy treatment market is experiencing steady growth driven by increased awareness of allergy symptoms in children, rising prevalence rates, and expanding healthcare infrastructure. The World Allergy Organization estimates that allergies affect up to 40% of children worldwide, underlying a sizable and expanding target population [1].

GNP CHILD LORATADINE Positioning

GNP CHILD LORATADINE is positioned as a second-generation antihistamine offering rapid relief with minimal sedative effects, aligning with current pediatric safety standards. Its efficacy, safety profile, and ease of administration have contributed to its popularity among healthcare providers and caregivers.

Regulatory Approvals and Market Penetration

The product is approved by regulatory agencies such as the FDA and EMA, facilitating domestic and international market entry. GNP’s strong distribution channels and pediatric-focused marketing strategies have enabled significant penetration into North American, European, and select Asian markets.

Market Drivers

- Growing Pediatric Allergy Incidence: Urbanization, pollution, and climate change are augmenting allergy prevalence among children.

- Shift Toward Second-Generation Antihistamines: The superior safety and tolerability profile of loratadine has led to increased preference over first-generation antihistamines.

- Regulatory Support: Recognized safety profiles facilitate easier approval processes and label expansions.

- Rising Awareness and Diagnosis: Increased pediatric allergy awareness is resulting in higher diagnosis rates and medication prescriptions.

- Parent and Healthcare Provider Preference: Ease of dosing and minimal sedation have made loratadine formulations, like GNP CHILD LORATADINE, preferred options.

Competitive Landscape

Key Competitors

Major competitors include brands such as Claritin (Schering-Plough), Alavert (Johnson & Johnson), and generics from local pharmaceutical manufacturers. Notably:

- Claritin remains the global market leader due to strong brand recognition.

- Generics are expanding, often offering lower prices and increasing market share in price-sensitive regions.

- Local companies in developing countries are launching similar pediatric formulations, intensifying competition.

Market Differentiators

GNP CHILD LORATADINE’s differentiation hinges on:

- Pediatric-friendly formulations (liquid syrups, dispersible tablets).

- Established safety profile validated by clinical trials and regulatory approvals.

- Strategic pricing aligned with affordability and value.

- Widespread distribution network catering to pediatric pharmacies and hospitals.

Regulatory and Patent Landscape

Patent Status

GNP’s patent protections for CHILD LORATADINE formulations, including specific pediatric dosages, are critical to maintaining market exclusivity. However, impending patent expiries in key regions are likely to boost generic competition.

Regulatory Trends

Regulatory agencies increasingly emphasize pediatric safety, resulting in simplified approval pathways for formulations with proven safety data. The recent trend toward pediatric-specific labeling aids market expansion.

Pricing Dynamics and Projections

Current Pricing Environment

GNP CHILD LORATADINE's pricing varies geographically:

- North America: Premium pricing, reflecting brand strength and safety profile, averaging $15-20 per 30-dose bottle.

- Europe: Slightly lower, approximately €12-18, depending on reimbursement policies.

- Asia and Emerging Markets: Lower prices, approximately $5-10, aimed at affordability.

Factors Influencing Future Pricing

- Patent Status: Patent expiration could induce price reductions as generic entrants capture market share.

- Competitive Dynamics: Entry of generics, particularly in price-sensitive countries, will exert downward pressure.

- Regulatory and Reimbursement Policies: Favorability toward pediatric medications in healthcare coverage plans may stabilize or enhance pricing.

- Supply Chain Costs: Raw materials and manufacturing costs, notably for pediatric formulations, may influence pricing adjustments.

Price Projection Outlook (2023-2028)

| Year | North America | Europe | Asia & Others |

|---|---|---|---|

| 2023 | $15-20 | €12-18 | $5-10 |

| 2024 | $14-19 | €11-17 | $4.8-9.5 |

| 2025 | $13-18 | €10-16 | $4.5-9 |

| 2026 | $12-17 | €9-15 | $4.2-8.5 |

| 2027 | $11-16 | €8-14 | $4-8 |

| 2028 | $10-15 | €7-13 | $3.8-7.5 |

Note: These projections assume typical patent expirations, generic entry, and potential price competition, with a gradual decline in average prices over the forecast period.

Market Growth and Revenue Potential

Market Expansion Strategies

- Geographic Diversification: Expanding into emerging markets where pediatric allergy prevalence is rising.

- Formulation Innovation: Developing new dosage forms, such as effervescent or dispersible tablets tailored for children.

- Brand Demand Expansion: Investing in pediatric-focused marketing campaigns to reinforce brand loyalty.

Revenue Projections

Anticipated growth is driven by rising allergy diagnoses and increased healthcare access. Assuming a compound annual growth rate (CAGR) of 4-6% in mature markets, revenues could grow from approximately $100 million in 2023 to over $130 million by 2028, factoring in price declines and volume growth.

Regulatory Outlook and Future Opportunities

Label Expansions

Expanding indications to include other allergic conditions or broader age ranges could sustain revenue streams.

Combination Therapies

Potential development of combination products with other allergy medications may provide a competitive edge.

Digital and Telehealth Integration

Leveraging digital health platforms for pediatric compliance and monitoring can increase treatment adherence and consumer engagement.

Key Challenges and Risks

- Patent Cliff: Imminent expiration risks entry of lower-priced generics.

- Pricing Pressures: Regulatory and market dynamics may further reduce prices.

- Regulatory Barriers: Stringent approval processes in certain regions could delay market entry.

- Market Saturation: High penetration in developed markets limits growth potential unless new indications are approved.

Key Takeaways

- GNP CHILD LORATADINE remains a competitive player within pediatric antihistamine markets, supported by a robust safety profile and pediatric-specific formulations.

- The global pediatric allergy market is poised for growth, driven by rising prevalence and improved diagnosis, but faces increasing competition from generics.

- Price projections indicate a gradual decline over the next five years, primarily due to patent expiries and generic competition, especially in mature markets.

- Strategic expansion into emerging markets, formulation innovation, and brand reinforcement are crucial to sustain revenue growth.

- Careful navigation of regulatory landscapes and patent protections will influence future market share and profitability.

FAQs

1. When is the patent for GNP CHILD LORATADINE expected to expire?

The patent expiration varies by region, generally anticipated between 2024 and 2026, after which generic competition is likely to intensify.

2. How does GNP CHILD LORATADINE differentiate from competitors?

Its pediatric-friendly formulations, proven safety profile, and strategic distribution channels provide a competitive advantage over other antihistamines, particularly in pediatric markets.

3. What factors could influence pricing beyond patent expiries?

Regulatory changes, healthcare reimbursement policies, raw material costs, and competitive pressures are primary factors affecting future prices.

4. Which emerging markets present significant growth opportunities?

Countries in Southeast Asia, Latin America, and Africa show rising pediatric allergy prevalence and expanding healthcare access, making them attractive expansion targets.

5. What strategic actions should stakeholders consider?

Diversifying formulations, exploring new indications, strengthening brand presence, and establishing local manufacturing and distribution can optimize market position.

References

[1] World Allergy Organization, "Global Allergy Report," 2022.

More… ↓