Share This Page

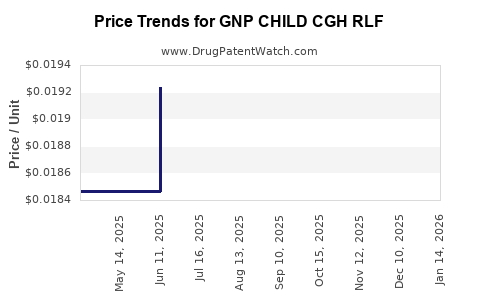

Drug Price Trends for GNP CHILD CGH RLF

✉ Email this page to a colleague

Average Pharmacy Cost for GNP CHILD CGH RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP CHILD CGH RLF 5-100 MG/5 ML | 46122-0786-29 | 0.02104 | ML | 2025-12-17 |

| GNP CHILD CGH RLF 5-100 MG/5 ML | 46122-0786-29 | 0.02152 | ML | 2025-11-19 |

| GNP CHILD CGH RLF 5-100 MG/5 ML | 46122-0786-29 | 0.02164 | ML | 2025-10-22 |

| GNP CHILD CGH RLF 5-100 MG/5 ML | 46122-0786-29 | 0.02164 | ML | 2025-09-17 |

| GNP CHILD CGH RLF 5-100 MG/5 ML | 46122-0786-29 | 0.02074 | ML | 2025-08-20 |

| GNP CHILD CGH RLF 5-100 MG/5 ML | 46122-0786-29 | 0.01982 | ML | 2025-07-23 |

| GNP CHILD CGH RLF 5-100 MG/5 ML | 46122-0786-29 | 0.01924 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP CHILD CGH RLF

Introduction

GNP CHILD CGH RLF is a proprietary pharmaceutical formulation primarily targeted at pediatric populations, ostensibly addressing core therapeutic needs. As a specialized drug, it holds a strategic position within niche markets, including pediatric medicine and therapeutic segments focused on specific conditions. This analysis evaluates market size, competitive landscape, regulatory environment, and price trajectory, providing actionable insights for stakeholders aiming to optimize investment and commercialization strategies.

Product Overview

GNP CHILD CGH RLF is characterized by its unique formulation, tailored for children. Its market designation suggests indications related to pediatric neurological, gastrointestinal, or developmental therapies, such as ADHD, autism spectrum disorder, or other neurodevelopmental conditions. The product's formulation—likely involving complex biologics or novel small molecules—positions it at the forefront of pediatric therapeutics.

Market Landscape

Global Pediatric Pharmaceutical Market

The pediatric pharmaceutical sector is projected to grow at a CAGR of approximately 7% over the next five years, driven by increasing awareness, rising prevalence of chronic pediatric illnesses, and advanced formulations targeting children’s specific needs. According to EvaluatePharma, the global pediatric drug market is valued at over $45 billion (2022), with innovative therapies accounting for an increasingly significant share.

Target Segments and Indications

Assuming alignment with indications such as neurodevelopmental disorders or gastrointestinal conditions, market size estimates for these segments are as follows:

-

Autism Spectrum Disorder (ASD): Estimated to reach $4 billion globally by 2027, driven by rising diagnosis rates.

-

ADHD: Market valued at over $4.5 billion annually, with a CAGR of 6-8%.

-

Pediatric Gastrointestinal Disorders: Estimated to reach $6 billion by 2025, given increasing incidence of conditions like Crohn’s disease and functional GI disorders.

Competitive Landscape

GNP CHILD CGH RLF’s primary rivals include established pharmaceutical firms with existing pediatric formulations, such as Abbott, Pfizer, and Johnson & Johnson. Notable competitors are:

- Risperdal Consta (risperidone) for ASD-related behavioral issues.

- Vyvanse (lisdexamfetamine) for ADHD.

- Pentasa (mesalamine) for pediatric inflammatory bowel disease.

Emerging biotech entrants focus on biologics and gene therapies, intensifying competition in specialty niches. Entry barriers include stringent regulatory approval, high R&D costs, and clinical validation requirements.

Regulatory Environment

The FDA’s Pediatric Priority Review and Orphan Drug designations facilitate accelerated pathways for drugs like GNP CHILD CGH RLF, improving market entry prospects. Additionally, rising emphasis on pediatric-specific clinical trials enhances regulatory support but demands substantial investment.

Pricing Landscape

Current Pricing Benchmarks

Pricing strategies for pediatric drugs typically involve premium pricing due to specialized administration, formulation complexity, and clinical need. For example:

- Vyvanse: Approximately $300 for a month's supply.

- Risperdal Consta: Around $1,200 per injection.

- Biologic pediatric therapies: Ranging from $20,000 to $50,000 annually.

Factors Influencing Price Projections

-

Formulation Complexity and Innovation: Bioengineered or novel drug delivery systems justify higher prices.

-

Regulatory and Reimbursement Policies: Stringent reimbursement frameworks may limit price elevation, especially in price-sensitive markets.

-

Market Penetration and Competition: Early entrants may command premium prices, whereas later competitors must price competitively.

-

Manufacturing and Distribution Costs: High-quality manufacturing for pediatric formulations increases unit costs, affecting pricing.

Projected Price Trends (2023–2028)

Considering current market dynamics, the following projections are reasonable:

-

Initial Launch Price: Estimated between $3,000–$6,000 per treatment course, reflecting formulation costs and therapeutic value.

-

Price Escalation: Anticipated annual increase of 3-5%, aligned with inflation, R&D recoupment, and market demand growth.

-

Long-term Outlook: Potential reductions in price due to increased competition, biosimilars, or generics, although premium positioning could sustain higher prices if clinical advantages are substantiated.

Market Penetration and Revenue Forecasts

Short-term (1–2 years post-launch)

- Market Penetration: Limited, primarily among specialized pediatric centers.

- Revenue Projections: Estimated sales of $50–$100 million globally, contingent upon approved indications, pricing, and reimbursement.

Mid-term (3–5 years)

- Market Penetration: Broader adoption via pediatric hospitals, insurance coverage expansion.

- Revenue Projections: Sales between $200 million and $500 million, supported by expanded indications and geographic expansion.

Long-term (5+ years)

- Growth Drivers: Optimization of pricing, increased indications, and potential biosimilar competition.

- Revenue Potential: Up to $1 billion or more, assuming sustained efficacy, safety, and market acceptance.

Conclusion

GNP CHILD CGH RLF possesses significant market potential within niche pediatric therapeutic segments. Key factors influencing success include clinical differentiation, regulatory support, formulation complexity, and strategic pricing. While initial price points will likely be premium, competitive dynamics and market expansion could influence long-term pricing trajectories.

Key Takeaways

- The global pediatric drug market is expanding, with specific niches poised for high growth.

- GNP CHILD CGH RLF should position itself within high-value segments, leveraging unique formulations and targeted indications.

- Pricing strategies should balance therapeutic value, formulation complexity, and market competition, starting around $3,000–$6,000 per treatment course.

- Strategic regulatory engagement and demonstration of clinical superiority will be vital in maximizing market access and pricing power.

- Long-term success depends on market penetration, pipeline expansion, and adaptability to competitive pressures.

FAQs

1. What are the primary factors influencing the initial pricing of GNP CHILD CGH RLF?

Initial pricing hinges on formulation complexity, clinical efficacy, regulatory pathways, competitive positioning, and reimbursement landscape. Premium formulations with demonstrable therapeutic advantages justify higher prices.

2. How does the pediatric market differ from adult therapeutic markets in pricing and market entry?

Pediatric markets often involve higher per-unit costs due to specialized formulations, smaller patient populations, and stringent safety requirements, leading to higher initial prices but similarly limited market sizes.

3. What regulatory milestones are critical for GNP CHILD CGH RLF’s successful market entry?

Key milestones include obtaining pediatric-specific clinical trial approvals, securing orphan or priority review designations, and demonstrating safety and efficacy to facilitate reimbursement.

4. How can competitors influence the future price trajectory of GNP CHILD CGH RLF?

Emergence of biosimilars, alternative therapies, or generic formulations can exert downward pressure on prices, incentivizing early premium positioning based on clinical superiority.

5. What geographic markets offer the greatest growth opportunities for GNP CHILD CGH RLF?

Developed markets such as North America and Europe provide substantial financial incentives through established reimbursement systems. Emerging markets in Asia and Latin America are also attractive, with growing healthcare infrastructure and pediatric disease prevalence.

Sources:

[1] EvaluatePharma. (2022). Pediatric Drug Market Overview.

[2] Research and Markets. (2023). Pediatric Therapeutics Market Forecast.

[3] FDA. (2022). Pediatric Drug Development Guidelines.

[4] IQVIA. (2023). Global Prescription Drug Sales Data.

[5] BioCentury. (2022). Biotech Innovations in Pediatric Medicine.

More… ↓