Share This Page

Drug Price Trends for GNP CHEST RUB

✉ Email this page to a colleague

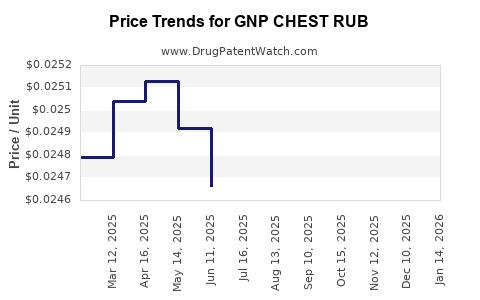

Average Pharmacy Cost for GNP CHEST RUB

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP CHEST RUB | 46122-0697-26 | 0.02576 | GM | 2025-11-19 |

| GNP CHEST RUB | 46122-0697-26 | 0.02535 | GM | 2025-10-22 |

| GNP CHEST RUB | 46122-0697-26 | 0.02491 | GM | 2025-09-17 |

| GNP CHEST RUB | 46122-0697-26 | 0.02451 | GM | 2025-08-20 |

| GNP CHEST RUB | 46122-0697-26 | 0.02440 | GM | 2025-07-23 |

| GNP CHEST RUB | 46122-0697-26 | 0.02466 | GM | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP CHEST RUB

Introduction

GNP CHEST RUB, an over-the-counter topical analgesic, is widely used for symptomatic relief of cough and chest congestion. Its role in respiratory therapy, combined with its established consumer base, underscores its significance within pharmaceutical OTC markets. This report provides a comprehensive analysis of its market landscape, competitive positioning, regulatory environment, and price trajectory forecasts to assist stakeholders in strategic decision-making.

Market Overview

Global and Regional Demand

The demand for rubefacients like GNP CHEST RUB remains robust, driven by the prevalence of respiratory illnesses, seasonal cold and flu outbreaks, and consumer preference for OTC remedies due to their convenience and perceived safety. The global OTC cough and cold remedies market was valued at approximately USD 10.5 billion in 2021, with expected compound annual growth rate (CAGR) of around 3.5% through 2028 [1]. GNP CHEST RUB, predominantly marketed across Asia, the Middle East, and parts of Africa, benefits from high consumer awareness in these regions owing to longstanding brand presence.

Consumer Demographics

The core demographic includes adults and children experiencing cough or chest discomfort. In emerging markets, urban populations with rapid adoption of Western medicines and increasing disposable incomes fuel sales. In developed markets, brand loyalty and OTC accessibility sustain its market share, although increasing competition from natural or herbal alternatives influences consumer choices.

Competitive Landscape

Key competitors encompass brands like Vicks VapoRub, Tiger Balm, and various regional equivalents. Innovators focus on formulation improvements, natural ingredient incorporation, and eco-friendly packaging strategies to differentiate. GNP CHEST RUB's positioning relies on affordability, familiarity, and trust established through years of branding.

Regulatory Environment

Regulatory scrutiny varies globally. In regions like the US and EU, active ingredients must comply with strict safety assessments, with over-the-counter classifications requiring specific labeling and approval processes. GNP CHEST RUB's compliance supports its continued market presence, but potential regulatory changes could impact pricing and distribution strategies.

Price Analysis

Historical Pricing Trends

Over the past five years, GNP CHEST RUB has maintained stable pricing in most markets, with minor fluctuations attributable to inflation, packaging costs, and competitive pressures. Average retail prices range from USD 2 to USD 4 per 25g tube, depending on regional economic factors.

Factors Affecting Price Dynamics

- Raw Material Costs: Fluctuations in menthol, eucalyptus oil, and other essential oils influence production costs.

- Regulatory Compliance: Meeting new safety standards may increase manufacturing expenses, impacting retail pricing.

- Market Competition: Entry of premium or herbal formulations can exert downward pressure on prices of traditional brands.

- Distribution Channels: Retail chains, pharmacies, and online platforms each carry different margin structures, affecting final consumer prices.

- Brand Positioning and Promotions: Discount campaigns or bundle offers impact average selling prices temporarily.

Price Projections (2023–2028)

Short-term Outlook

In the next 1–2 years, GNP CHEST RUB’s price is expected to remain relatively stable with a slight upward trajectory of approximately 2–3% annually. Factors supporting this include steady raw material costs, stable demand, and minimal regulatory shifts. Promotional activities and market saturation may slightly temper price increases.

Mid- to Long-term Outlook

From 2023 to 2028, projected price growth may range between 4–6% annually, primarily driven by:

- Inflation adjustments in raw material procurement.

- Regulatory upgrades demanding reformulation or enhanced safety features.

- Market expansion into emerging markets with higher disposable incomes and increased health awareness.

- Innovation leading to premium product lines commanding higher retail prices.

Potential disruptors include:

- Rising consumer preference for herbal or natural alternatives, which may be priced competitively or at a premium.

- Shifts toward digital sales channels, potentially altering traditional retail pricing structures.

Regional Variability

- Asia-Pacific: Prices may increase modestly due to high demand and modest inflation; competitive pressures could temper increases.

- Middle East & Africa: Price stability might prevail; however, currency fluctuations could impact local pricing.

- Europe & North America: Due to tightened regulations and consumer preferences, prices might see a marginal increase, especially if product reformulation is required to meet new standards.

Strategic Implications

Stakeholders should monitor input costs and regulatory developments closely. Leveraging brand loyalty through marketing and product differentiation will help sustain optimal price points. Entry into emerging markets presents opportunities for volume growth, albeit at potentially lower initial price points. Adoption of e-commerce channels can reduce distribution costs and expand reach, positively influencing pricing strategies.

Key Takeaways

- GNP CHEST RUB maintains a stable market presence with modest price growth projections aligned with inflation and regulatory trends.

- Competitive dynamics, regional demand, and ingredient costs are primary factors influencing pricing.

- Strategic differentiation, including product innovation and market diversification, will be critical for maintaining profitability.

- Expansion into emerging markets offers volume opportunities but may require flexible pricing strategies to align with purchasing power.

- Ongoing regulatory compliance and consumer preferences for herbal/natural products could influence future pricing trajectories.

Conclusion

The outlook for GNP CHEST RUB’s pricing remains cautiously optimistic, with incremental increases expected over the next five years. Market stability, coupled with regulatory adherence and product innovation, will be vital for maximizing profitability and market share. Businesses should adopt a nuanced approach that balances cost management, consumer preferences, and regional dynamics to optimize pricing strategies.

FAQs

1. What are the key factors influencing GNP CHEST RUB's pricing?

Raw material costs, regulatory compliance, competitive landscape, distribution channels, and consumer demand primarily determine its price.

2. How does regional variability affect the drug's price?

Developed markets may see marginal increases due to regulatory standards, whereas emerging markets might experience stable or slightly lower prices due to different economic conditions and competition.

3. Will natural ingredient trends impact GNP CHEST RUB's pricing?

Yes. If consumer demand shifts toward herbal or organic alternatives, GNP CHEST RUB may need to adjust its formulation or marketing, affecting pricing either positively (premium pricing) or negatively (price competition).

4. What is the forecasted price growth for GNP CHEST RUB from 2023 to 2028?

An estimated annual increase of approximately 4–6% is expected, driven by inflation, market expansion, and regulatory factors.

5. How can companies maintain profitability amid competitive pressures?

By innovating product formulations, enhancing brand loyalty through marketing, optimizing supply chains, and expanding into emerging markets with tailored pricing strategies.

References

[1] Grand View Research. (2022). Over-the-Counter (OTC) Cough and Cold Remedies Market Size, Share & Trends Analysis Report.

More… ↓