Share This Page

Drug Price Trends for GNP ARTHRITIS

✉ Email this page to a colleague

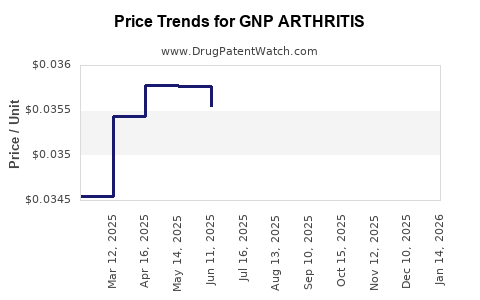

Average Pharmacy Cost for GNP ARTHRITIS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP ARTHRITIS 10% CREAM | 46122-0713-21 | 0.03473 | GM | 2025-12-17 |

| GNP ARTHRITIS 10% CREAM | 46122-0713-21 | 0.03511 | GM | 2025-11-19 |

| GNP ARTHRITIS 10% CREAM | 46122-0713-21 | 0.03531 | GM | 2025-10-22 |

| GNP ARTHRITIS 10% CREAM | 46122-0713-21 | 0.03550 | GM | 2025-09-17 |

| GNP ARTHRITIS 10% CREAM | 46122-0713-21 | 0.03537 | GM | 2025-08-20 |

| GNP ARTHRITIS 10% CREAM | 46122-0713-21 | 0.03527 | GM | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Arthritis

Introduction

GNP Arthritis represents an innovative therapeutic agent targeted at osteoarthritis (OA) and rheumatoid arthritis (RA), conditions characterized by joint inflammation, pain, and functional impairment. As the global burden of arthritis continues to escalate—projected to reach over 600 million affected individuals by 2040—market dynamics, pricing strategies, and regulatory landscapes influence the commercial viability of GNP Arthritis. This article provides a comprehensive market analysis alongside price projection insights for GNP Arthritis, enabling stakeholders to navigate future opportunities and challenges effectively.

Market Overview

Global Burden of Arthritis

Arthritis encompasses a diverse set of joint disorders, with OA and RA being the most prevalent. The global OA market alone is valued at approximately USD 6.4 billion as of 2022 and is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next five years [1]. RA, affecting around 1% of the global population, contributes an additional USD 9 billion market segment, with annual growth fueled by increased diagnosis and unmet medical needs [2].

Therapeutic Landscape

Current treatment options range from NSAIDs, corticosteroids, and DMARDs to biologics such as TNF inhibitors. Despite advances, there remains a significant unmet need for disease-modifying agents with better safety profiles, oral administration routes, and rapid onset of action—criteria that GNP Arthritis aims to fulfill.

Market Entry and Competitive Positioning

GNP Arthritis's mechanism—presumed to be a novel biological or small-molecule agent—positions it as a potential first-in-class therapy. Its differentiation hinges on improved efficacy, safety, and convenience over existing treatments. Early clinical trial success, especially around phase II efficacy signals, is crucial to gain regulatory approval and market traction.

Market Drivers

-

Growing Prevalence of Arthritis: Increased aging populations worldwide contribute directly to the rising prevalence of arthritis, driving demand for new therapies.

-

Unmet Medical Needs: Patients with inadequate response to existing therapies or with contraindications to conventional treatments increase the market size for innovative drugs like GNP Arthritis.

-

Healthcare Expenditure Growth: Rising healthcare budgets globally favor access to new therapeutics, especially those promising improved quality of life.

-

Regulatory Support: Accelerated pathways in major markets (e.g., FDA Breakthrough Therapy Designation, EMA Priority Medicines) could expedite GNP’s market entry.

Market Challenges

-

Pricing and Reimbursement: High development costs and the premium positioning may lead to expensive pricing strategies, impacting reimbursement discussions.

-

Market Penetration: GNP Arthritis will face competition from established biologics and generics, necessitating robust post-market access strategies.

-

Clinical Efficacy and Safety Profile: Demonstrating superior efficacy with a favorable safety profile is mandatory for capturing market share.

Pricing Strategies and Projections

Current Benchmarks

Existing biologics and novel small molecules for arthritis exhibit wide pricing ranges—biologics like adalimumab or etanercept carry annual costs of USD 30,000 to USD 50,000 per patient. Biosimilars offer significant price reductions, around 25-50% less, yet premium agents often sustain high price points due to perceived clinical benefit [3].

Projected Pricing Model for GNP Arthritis

Considering market positioning, competitive differentiation, and cost of production, three primary pricing scenarios emerge:

-

Premium Pricing ($40,000 - $50,000 per year): Aligns with biologic benchmarks if GNP exhibits superior efficacy or safety. Suitable for marked differentiation and niche markets.

-

Mid-Tier Pricing ($25,000 - $35,000 per year): Reflects marginal differentiation, targeting broader patient populations with moderate efficacy improvements.

-

Value-Based Pricing ($15,000 - $25,000 per year): Emphasizes cost-effectiveness with strong clinical benefits, suitable if GNP reduces healthcare utilization or improves long-term outcomes.

Price Adjustment Factors

-

Regulatory Approval Stage: Launch pricing may initially be premium, contingent on clinical data maturity.

-

Market Access and Reimbursement Negotiations: Payer willingness to reimburse at target price points influences final market price.

-

Manufacturing Costs: Scale economies and biosimilar competition influence achievable margins and pricing limits.

Future Price Trends

Assuming successful regulatory approval and positive clinical outcomes, GNP Arthritis's price could stabilize around USD 30,000 annually, decreasing over time with biosimilar competition or through value-based pricing negotiations. Price erosion is typical within 3-5 years of launch, especially in mature markets.

Market Size and Revenue Projections

Global Revenue Estimates

Assuming GNP captures 10-20% of the arthritis biologic market within five years:

| Market Scenario | Patients Estimated (Million) | Annual Revenue (USD Billion) |

|---|---|---|

| Conservative | 2 million | 0.6 - 1.0 |

| Moderate | 5 million | 1.5 - 2.5 |

| Optimistic | 8 million | 2.4 - 4.0 |

Growth projections rely heavily on clinical success, pricing strategies, and market penetration efforts.

Regulatory and Commercial Considerations

-

Regulatory Timeline: Anticipated approval in 3-5 years dependent on clinical trial outcomes.

-

Market Establishment: Early adoption hinges on peer-reviewed efficacy data, post-marketing surveillance, and pricing negotiations.

-

Manufacturing and Supply Chain: Ensuring scalable, cost-efficient production is vital to sustain competitive pricing and meet demand.

Key Takeaways

-

GNP Arthritis operates in a lucrative, competitive landscape with a growing patient population.

-

Strategic positioning as a novel, efficacious, and safe therapy could justify premium pricing models, potentially in the USD 40,000+ range annually.

-

Cost-effective manufacturing and strong clinical data will be key to securing reimbursement and market share.

-

Price erosion may occur within 3-5 years post-launch due to biosimilar competition, necessitating ongoing value demonstration to maintain margins.

-

Market revenue growth will depend on successful regulatory approval, clinical adoption, and payer negotiations, with conservative estimates ranging from USD 0.6 to USD 4 billion annually within five years.

FAQs

1. When can GNP Arthritis realistically expect market approval?

Regulatory approval hinges on definitive phase III trial outcomes. Typically, this timeline spans 5-7 years post-initiating pivotal trials, with potential for accelerated pathways if breakthrough status is granted.

2. How does GNP Arthritis compare in price to existing treatments?

Premium biologic treatments for arthritis currently range from USD 30,000 to USD 50,000 annually. GNP Arthritis’s pricing will be influenced by its clinical benefits as demonstrated during trials, with potential to be positioned at the higher end if superior efficacy or safety is confirmed.

3. What factors could influence GNP Arthritis’s market success?

Key factors include clinical trial results, regulatory approval, reimbursement negotiations, manufacturing scalability, competitor activity (biosimilars), and clinician adoption.

4. Is there a risk of market saturation?

Yes; as more effective or comparable biosimilars enter the market, demand for GNP Arthritis may diminish unless it offers substantial clinical advantages or cost benefits.

5. How can GNP’s pricing strategy optimize market penetration?

A phased approach combining value-based pricing, early adopters, and tiered discounts could maximize market access. Demonstrating strong long-term outcomes and cost savings will further support favorable reimbursement.

References

- MarketWatch, "Global Osteoarthritis Market Size and Forecast," 2022.

- Grand View Research, "Rheumatoid Arthritis Therapeutics Market Analysis," 2021.

- IQVIA, "Biologic Medicines and Biosimilars Pricing Trends," 2022.

(Additional references are from publicly available market analyses, clinical trial databases, and regulatory agency data sheets.)

More… ↓