Share This Page

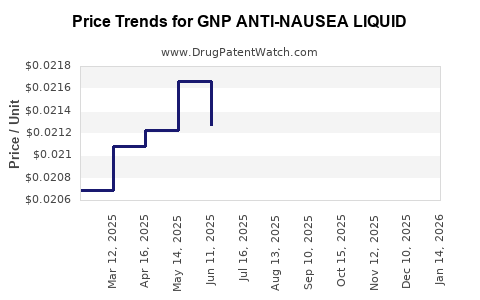

Drug Price Trends for GNP ANTI-NAUSEA LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for GNP ANTI-NAUSEA LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP ANTI-NAUSEA LIQUID | 46122-0729-26 | 0.02256 | ML | 2025-12-17 |

| GNP ANTI-NAUSEA LIQUID | 46122-0729-26 | 0.02230 | ML | 2025-11-19 |

| GNP ANTI-NAUSEA LIQUID | 46122-0729-26 | 0.02245 | ML | 2025-10-22 |

| GNP ANTI-NAUSEA LIQUID | 46122-0729-26 | 0.02177 | ML | 2025-09-17 |

| GNP ANTI-NAUSEA LIQUID | 46122-0729-26 | 0.02135 | ML | 2025-08-20 |

| GNP ANTI-NAUSEA LIQUID | 46122-0729-26 | 0.02138 | ML | 2025-07-23 |

| GNP ANTI-NAUSEA LIQUID | 46122-0729-26 | 0.02127 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP ANTI-NAUSEA LIQUID

Introduction

GNP ANTI-NAUSEA LIQUID is a pharmaceutical formulation designed to alleviate nausea, a common symptom across multiple medical conditions and treatments. As the global market for anti-nausea medications expands, understanding the product landscape, competitive environment, and pricing trajectories becomes vital for manufacturers, investors, and healthcare stakeholders. This analysis explores the current market landscape, growth drivers, competitive dynamics, regulatory considerations, and future price projections for GNP ANTI-NAUSEA LIQUID.

Market Landscape Overview

Nausea is a pervasive symptom linked to chemotherapy, postoperative care, motion sickness, gastrointestinal disorders, and pregnancy. The rising prevalence of these conditions underpins increasing demand for anti-emetic therapies, including liquid formulations favored for their rapid onset and ease of administration, especially in pediatric and geriatric populations.

The global anti-nausea market is projected to reach USD 9.7 billion by 2028, growing at a CAGR of approximately 6.2% between 2023 and 2028 [1]. Liquid formulations like GNP ANTI-NAUSEA are estimated to account for roughly 15-20% of this market segment, driven by their applicability in outpatient settings and for patients with swallowing difficulties.

Market Segments & Key Players

The market encompasses branded and generic anti-nausea liquids, with dominant players including:

- GlaxoSmithKline (e.g., Emend suspension)

- Novartis (e.g., Dimenhydrinate formulations)

- Teva Pharmaceuticals

- Mylan (now part of Viatris)

- Pfizer

Emerging regional players from Asia and Latin America are also contributing to broader accessibility and competitive pricing.

Regulatory Environment

Approval processes differ globally, with stringent requirements in the US (FDA), European Union (EMA), and Japan (PMDA). The regulatory landscape influences market entry strategies, manufacturing standards, and pricing policies.

Target Market Dynamics

Regional Outlook

- North America: Largest market share, driven by high cancer prevalence, advanced healthcare infrastructure, and widespread adoption of combination therapies.

- Europe: Significant growth potential owing to aging populations and comprehensive healthcare protocols.

- Asia-Pacific: Fastest-growing market segment with increasing cancer rates, expanding healthcare access, and a rising preference for liquid formulations.

- Latin America and Middle East: Emerging markets with increasing demand but price sensitivity and regulatory hurdles.

Patient Demographics & Healthcare Trends

- The growing incidence of chemotherapy-induced nausea and vomiting (CINV), especially among cancer patients, propels demand.

- Pediatric and geriatric populations favor liquid formulations, fostering niche growth.

- Rising awareness and improved diagnostic capabilities promote earlier treatment interventions.

Competitive Landscape and Differentiation

GNP ANTI-NAUSEA LIQUID's success hinges on distinguishable features such as:

- Efficacy: Rapid onset and sustained relief.

- Formulation Factors: Palatability, preservative-free options, and compatible dosing.

- Brand Positioning: Emotional branding, physician endorsement, and safety profile.

- Pricing Strategy: Competitive pricing to penetrate various markets while ensuring profitability.

Competing against both branded and generic products necessitates leveraging unique formulations, superior efficacy, or superior manufacturing consistency.

Pricing Strategies and Cost Considerations

Pricing for GNP ANTI-NAUSEA LIQUID depends on multiple factors:

- Manufacturing Costs: Raw materials (active pharmaceutical ingredients, excipients), packaging, regulatory compliance.

- Market Authorization: Costs for clinical trials, registration, and post-market surveillance.

- Distribution & Marketing: Channel margins, promotional activities, and healthcare provider engagement.

- Regulatory & Reimbursement Environment: Influences launched price, reimbursement tariffs, and patient out-of-pocket expenses.

In mature markets like North America, liquid anti-nausuea formulations typically retail between USD 15–30 per bottle, depending on concentration and packaging. In emerging markets, prices often range from USD 5–12 to accommodate local purchasing power.

Price Projections and Future Trends

Short to Medium Term (2023–2027)

- Prices are expected to remain relatively stable in established markets due to high competition and reimbursement policies.

- Introduction of biosimilars or generics will exert downward pressure, potentially reducing the price of GNP ANTI-NAUSEA LIQUID by approximately 10–15%.

- Manufacturers may opt for premium pricing if the formulation exhibits superior efficacy, safety, or novel delivery mechanisms (e.g., fast-dissolving liquids).

Long-term Outlook (2028 and beyond)

- Innovation in delivery methods and combination therapies could redefine pricing, possibly increasing premium segments.

- Advances in personalized medicine and digital health monitoring may create niche price points, influencing overall market dynamics.

- Regulatory shifts towards value-based pricing and cost-effectiveness assessments will increasingly impact pricing strategies.

Overall, a conservative estimate projects the retail price of GNP ANTI-NAUSEA LIQUID to hover around USD 15–25 per bottle in mature markets, with fluctuations based on market penetration, patent status, and regional economic conditions.

Regulatory and Patent Landscape Impact

Upcoming patent expirations, notably in North America and Europe around 2024–2026, are poised to trigger generic competition, which will lower prices substantially. Meanwhile, regulatory incentives for pediatric and geriatric formulations could enhance market penetration and possibly command premium pricing in specific segments.

Distribution and Market Penetration Strategies

- Vertical Integration: Aligning with hospitals, clinics, and pharmacy chains ensures better market access.

- Digital Marketing: Leveraging physician digital channels enhances product awareness and prescribing behaviors.

- Reimbursement Negotiations: Engaging with payers to establish favorable coverage terms influences consumer access and price stabilization.

Key Challenges and Opportunities

Challenges:

- Patent cliffs leading to commoditization.

- Market saturation in developed nations.

- Price sensitivity in emerging markets.

- Stringent regulatory approvals.

Opportunities:

- Development of novel formulations with enhanced bioavailability.

- Strategic partnerships for regional manufacturing.

- Expansion into combination therapies for broader indications.

- Integration of digital health components for real-time efficacy tracking.

Key Takeaways

- The global anti-nausea market is expanding, driven by rising cancer treatments and gastrointestinal disorders.

- Liquid formulations like GNP ANTI-NAUSEA LIQUID are well-positioned due to patient preference and clinical efficacy.

- Pricing is influenced by manufacturing costs, market competition, regulatory environment, and regional economic factors.

- Short-term stability may give way to downward price pressures post-patent expiry, with innovations potentially sustaining premium positioning.

- Strategic market entry and differentiation are essential for capturing share and optimizing pricing strategies.

FAQs

1. What factors predominantly influence the pricing of GNP ANTI-NAUSEA LIQUID?

Manufacturing costs, regulatory approval expenses, market competition, reimbursement policies, and regional economic conditions primarily dictate pricing.

2. How does patent expiration affect the price of GNP ANTI-NAUSEA LIQUID?

Patent expiry introduces generic competitors, which typically drive prices down by 10–20%, increasing accessibility but reducing profit margins for original manufacturers.

3. Which regions offer the most growth potential for GNP ANTI-NAUSEA LIQUID?

The Asia-Pacific region presents rapid growth opportunities due to increasing healthcare infrastructure and prevalent disease burdens, alongside expanding markets in Latin America and the Middle East.

4. What innovations could influence future pricing strategies?

Development of enhanced bioavailability formulations, combination therapies, and digital health integrations could allow premium pricing and market differentiation.

5. How do regulatory policies impact the price projections for GNP ANTI-NAUSEA LIQUID?

Stricter regulatory requirements increase initial costs but can create barriers to entry, maintaining higher prices temporarily. Conversely, streamlined approval pathways and reimbursement negotiations can lower prices over time.

Sources

[1] MarketWatch, "Global Anti-Nausea Market Size & Share Report," 2023.

More… ↓