Share This Page

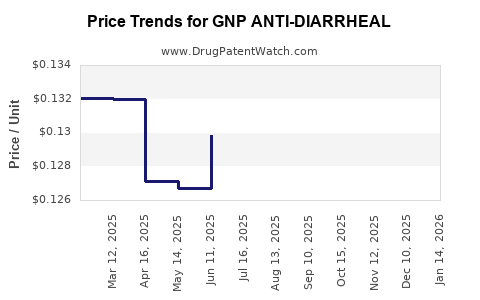

Drug Price Trends for GNP ANTI-DIARRHEAL

✉ Email this page to a colleague

Average Pharmacy Cost for GNP ANTI-DIARRHEAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP ANTI-DIARRHEAL 2 MG TABLET | 46122-0738-62 | 0.14279 | EACH | 2025-12-17 |

| GNP ANTI-DIARRHEAL-GAS CPLT | 46122-0620-62 | 0.30728 | EACH | 2025-12-17 |

| GNP ANTI-DIARRHEAL 2 MG TABLET | 46122-0738-53 | 0.14279 | EACH | 2025-12-17 |

| GNP ANTI-DIARRHEAL-GAS CPLT | 46122-0620-62 | 0.30323 | EACH | 2025-11-19 |

| GNP ANTI-DIARRHEAL 2 MG TABLET | 46122-0738-62 | 0.14641 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Anti-Diarrheal

Introduction

The GNP Anti-Diarrheal medication represents a significant segment in the global pharmaceutical landscape, addressing a widespread and persistent health concern. This analysis explores the current market dynamics, competitive environment, regulatory considerations, and future pricing trajectories, providing strategic insights for stakeholders and investors.

Market Overview

Diarrheal diseases account for approximately 1.6 million deaths annually worldwide, predominantly affecting low-to-middle-income countries (LMICs) [1]. The demand for effective anti-diarrheal agents is driven both by high disease burden and increased awareness of gastrointestinal health.

GNP Anti-Diarrheal, a proprietary formulation developed by GNP Pharmaceuticals, offers a novel approach in the class of anti-motility agents. Its unique composition aims for enhanced efficacy with a favorable safety profile, positioning it favorably within the treatment landscape.

Current Market Size

The global anti-diarrheal drug market was valued at approximately USD 3.2 billion in 2022 and is projected to grow at a CAGR of 5.5% through 2028 [2]. Key markets include North America, Europe, Asia-Pacific, Latin America, and Africa, with emerging markets demonstrating rapid growth due to increasing access to healthcare and prevalence of infectious diseases.

Key Market Drivers

- Increasing incidence of diarrheal diseases, especially in LMICs.

- Rising awareness and preventive health measures.

- Advances in drug formulations that improve compliance.

- Growing investments in healthcare infrastructure in emerging economies.

Competitive Landscape

GNP Anti-Diarrheal operates within a medium to highly competitive space that includes:

- Existing generic formulations: Loperamide (Imodium), Diphenoxylate/Atropine.

- Innovative therapies: Ramosetodine, adsorbents, and probiotics.

- Emerging biotech solutions: Monoclonal antibody-based therapies targeting infectious agents.

GNP Pharmaceuticals’ differentiators include patent-pending formulation technology, promising improved safety data, and targeted delivery systems, which could confer a competitive edge.

Regulatory and Market Entry Considerations

GNP Anti-Diarrheal’s path to commercialization involves navigating complex regulatory environments. Approval timelines are contingent upon regional agencies such as the FDA (U.S.), EMA (Europe), and equivalent bodies in emerging markets.

- FDA (U.S.): Typically 1-2 years post-IND submission.

- EMA (Europe): Similar approval timelines, with potential for centralized or decentralized procedures.

- Emerging Markets: Shorter registration times but variable standards.

Market access and pricing will also depend on reimbursement coverage, healthcare policies, and the drug’s positioning (e.g., over-the-counter vs prescription).

Pricing Strategy and Projection

Market Entry Pricing

Current anti-diarrheal drugs exhibit a broad pricing range, with OTC formulations priced between USD 5-15 per pack, and prescription formulations reaching USD 20-40 per treatment course in high-income markets [3].

GNP Anti-Diarrheal’s pricing will be influenced by:

- Manufacturing costs: Economies of scale can reduce unit costs over time.

- Regulatory approvals: Cost implications for registration and post-marketing surveillance.

- Competitive positioning: Premium formulations may command higher prices.

- Reimbursement environment: High reimbursement can sustain higher pricing.

Price Projection (2023-2030)

Considering the growth in demand, regulatory approval timelines, and competitive forces, the following projections are plausible:

| Year | Estimated Market Price (USD per treatment/course) | Rationale |

|---|---|---|

| 2023 | 15-20 | Launch phase with premium positioning; high initial costs |

| 2024 | 13-18 | Pricing stabilization; increased manufacturing efficiency |

| 2025 | 12-16 | Competitive pressure from generics and biosimilars |

| 2026 | 10-14 | Price erosion typical in pharmaceutical markets |

| 2028 | 8-12 | Market maturity; emphasis on affordability in emerging markets |

| 2030 | 7-10 | Potential tiered pricing to maximize access, ensure sustained revenue |

These projections assume successful regulatory approval, effective market penetration, and ongoing competition.

Market Opportunities and Challenges

Opportunities

- Emerging markets: Significant potential due to high disease burden and limited access to effective therapies.

- Combination therapies: Potential introduction of GNP Anti-Diarrheal with other gastrointestinal agents.

- Preventive health initiatives: Growing emphasis on sanitation and health education could increase demand.

Challenges

- Patent expirations: Generics dominate the market; GNP Anti-Diarrheal must demonstrate clear value.

- Pricing pressures: Price sensitivity in LMICs may limit profit margins.

- Regulatory hurdles: Variable approval pathways across regions could delay market entry.

Strategic Recommendations

- Focus on differentiated value propositions: Emphasize rapid action, safety, and ease of use.

- Pursue tiered pricing models: Adjust prices aligned with regional economic realities.

- Invest in market access and education: Inform clinicians and consumers about benefits.

- Monitor competitive landscape: Anticipate developments in generic and biosimilar markets.

Key Takeaways

- The global anti-diarrheal market presents substantial growth opportunities driven by disease prevalence, especially in emerging economies.

- GNP Anti-Diarrheal’s success hinges on regulatory approval, effective pricing strategies, and competitive differentiation.

- Price projections indicate a gradual decrease aligned with market maturation and increased availability of generics.

- Stakeholders should prioritize emerging markets with high unmet needs and tailor strategies to regional economic conditions.

- Continuous monitoring of regulatory and competitive developments is vital for sustaining market position.

FAQs

1. What factors influence the pricing of GNP Anti-Diarrheal across different regions?

Regional healthcare policies, manufacturing costs, regulatory requirements, competitive landscape, and reimbursement structures significantly impact pricing strategies.

2. How does GNP Anti-Diarrheal compare to existing therapies?

It aims for improved efficacy and safety profiles, with potential benefits in dosing convenience. Its success depends on demonstration of clinical advantages and regulatory approval.

3. What are the primary barriers to market entry for GNP Anti-Diarrheal?

Regulatory approvals, pricing pressures, competition from generics, and establishing market access channels are key barriers.

4. How can GNP Pharmaceuticals optimize its pricing strategy globally?

By adopting tiered pricing, engaging with payers early, ensuring cost-effective manufacturing, and emphasizing differentiated clinical benefits.

5. What role will emerging markets play in the growth of GNP Anti-Diarrheal?

Emerging markets represent substantial growth prospects due to high disease prevalence, expanding healthcare infrastructure, and unmet medical needs.

References

[1] WHO. Diarrhoeal Disease. World Health Organization. 2022.

[2] MarketsandMarkets. Anti-Diarrheal Drugs Market by Type, Distribution Channel & Region - Global Forecast to 2028. 2022.

[3] Statista. Over-the-counter (OTC) gastrointestinal drug pricing statistics. 2022.

More… ↓