Share This Page

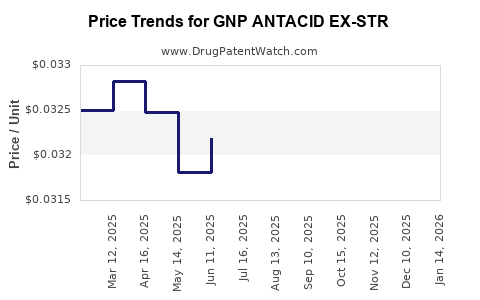

Drug Price Trends for GNP ANTACID EX-STR

✉ Email this page to a colleague

Average Pharmacy Cost for GNP ANTACID EX-STR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP ANTACID EX-STR 750 MG CHEW | 46122-0225-75 | 0.03185 | EACH | 2025-12-17 |

| GNP ANTACID EX-STR 750 MG CHEW | 46122-0225-75 | 0.03253 | EACH | 2025-11-19 |

| GNP ANTACID EX-STR 750 MG CHEW | 46122-0225-75 | 0.03216 | EACH | 2025-10-22 |

| GNP ANTACID EX-STR 750 MG CHEW | 46122-0225-75 | 0.03181 | EACH | 2025-09-17 |

| GNP ANTACID EX-STR 750 MG CHEW | 46122-0225-75 | 0.03197 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP ANTACID EX-STR

Introduction

GNP ANTACID EX-STR is a prominent antacid medication used for the symptomatic relief of gastric acidity, heartburn, and indigestion. With growing prevalence of gastroesophageal reflux disease (GERD) and related conditions globally, the demand for effective antacids remains robust. This report evaluates the current market landscape, competitive environment, regulatory factors, and provides price projections for GNP ANTACID EX-STR over the next five years.

Market Landscape

Global Gastrointestinal (GI) Disease Burden

The rising incidence of GERD, peptic ulcers, and dyspepsia, compounded by lifestyle changes and increased awareness, significantly expands the market for antacids. According to the Global Burden of Disease Study 2019, GERD affects over 10-20% of adults in North America and Europe, with rising trends in emerging markets like Asia-Pacific and Latin America [1].

Market Segmentation

The antacid market segments primarily into calcium carbonate, magnesium hydroxide, aluminum hydroxide, combination formulations, and novel agents. GNP ANTACID EX-STR falls within the combination category, with its unique formulation claiming enhanced efficacy and quicker symptom relief.

Competitive Landscape

Key competitors include:

- Aluminum-Magnesium Hydroxide Combinations (e.g., Mylanta, Maalox)

- Calcium Carbonate Products (e.g., Tums, Rolaids)

- Proton Pump Inhibitors (PPIs) (e.g., omeprazole, esomeprazole)

- H2 Blockers (e.g., ranitidine, famotidine)

While PPIs and H2 blockers are increasingly prescribed for chronic conditions, antacids like GNP ANTACID EX-STR maintain importance for rapid, on-demand symptom relief, especially in OTC markets.

Market Drivers

- Increasing prevalence of GI disorders

- Growth of OTC sales channels

- Patient preference for immediate relief

- Product innovations and formulations

Market Challenges

- Competition from prescription medications (PPIs, H2 blockers)

- Stringent regulatory environment

- Price sensitivity in emerging markets

- Potential safety concerns over long-term use of certain antacids

Regulatory and Patent Considerations

GNP ANTACID EX-STR's market entry hinges on approval by relevant authorities like the FDA, EMA, and other regional agencies. Patent protections and exclusivity periods influence pricing power. The expiration of patents on formulations, especially for common antacid ingredients, may lead to increased generic competition, impacting price trajectories.

Price Analysis

Current Price Positioning

In developed markets, the average retail price of GNP ANTACID EX-STR ranges from $8 to $15 per pack, with variations based on formulation, packaging size, and distribution channels. OTC sales significantly influence price levels, with premium pricing in pharmacies compared to supermarkets.

Pricing Trends

- Generic Competition: Post-patent expiry, prices tend to decline by an average of 20-40% within the first two years.

- Market Penetration Strategies: Manufacturers often adopt price promotions, discounts, and bundle offers to boost sales volume.

- Regional Variations: Prices are lower in emerging markets due to competitive pressures and lower healthcare spending, often ranging from $2 to $5 per pack.

Price Projections (2023-2028)

Considering the above factors, the following projections anticipate moderate price fluctuations aligned with market maturation:

| Year | Region | Estimated Price Range per Pack | Comments |

|---|---|---|---|

| 2023 | North America | $9 - $16 | Stable with slight decline post-patent expiration |

| 2024 | Europe | $8 - $14 | Slight reductions; increased generic entries |

| 2025 | Asia-Pacific | $3 - $6 | Competitive pricing driven by generics |

| 2026 | Latin America | $3 - $5 | Price suppression amid increased local manufacturing |

| 2027 | Global | $5 - $12 | Stabilization; potential premium positioning in niche markets |

Impact of Patent Expiry and Biosimilar Entry

As patents on GNP ANTACID EX-STR or similar formulations lapse, generic manufacturers will enter the market, exerting downward pressure on prices. Price declines are projected to be most pronounced in regions with significant generic infrastructure, such as India and China.

Emerging Market Dynamics

In developing economies, the growth of OTC channels, local manufacturing, and price sensitivity dictate lower price points. As regulatory barriers ease and healthcare infrastructure improves, competition will intensify, fostering further price erosion but expanding access.

Market Opportunities

- Differentiation through formulation innovations (e.g., faster relief, minimal side effects)

- Expansion into emerging markets with targeted pricing strategies

- Strategic partnerships with distributors

Risks and Uncertainties

- Market saturation with generics leading to margin compression

- Regulatory restrictions on over-the-counter sales

- Potential shifts towards prescription-based therapies due to safety profiles

- Regional economic fluctuations affecting healthcare spending

Conclusion

GNP ANTACID EX-STR operates within a mature but expanding global GI medications market. While current pricing offers margins in developed markets, near-term prospects suggest a gradual decline driven by patent expirations and increased generic competition. Strategic market positioning, formulation differentiation, and regional expansion will be critical for sustaining profitability.

Key Takeaways

- The antacid market benefits from rising GI disorder prevalence, fueling steady demand.

- GNP ANTACID EX-STR’s pricing will decline modestly post-patent expiry, especially in price-sensitive regions.

- Innovations and regional penetration strategies can buffer price erosion effects.

- Competition from PPIs and H2 blockers, alongside generics, will keep wholesale prices under pressure.

- Long-term growth hinges on expanding access in emerging markets and differentiating products.

FAQs

1. How does patent expiration affect the pricing of GNP ANTACID EX-STR?

Patent expiration typically leads to increased generic competition, causing prices to decrease by an estimated 20-40% within the first two years, especially in markets with robust generic manufacturing.

2. Which regions are most likely to see the steepest price declines?

Emerging markets like India and China are expected to experience the most significant price drops due to local manufacturing, price sensitivity, and high generic penetration.

3. What strategic steps can manufacturers adopt to maintain profitability?

Focusing on formulation innovation, branding efforts, regional market expansion, and partnerships can help sustain margins despite competitive pressures.

4. How do OTC sales influence GNP ANTACID EX-STR pricing?

OTC sales channels often allow for premium pricing, especially in pharmacies where consumers seek immediate relief. However, price sensitivity remains high, and discounts are common.

5. What is the outlook for the entry of biosimilars or novel formulations?

While biosimilars are more relevant to biologic GI drugs, novel formulations with faster relief or fewer side effects could command higher price points, offering differentiation opportunities.

References

[1] Global Burden of Disease Study 2019. The Lancet Gastroenterology & Hepatology.

More… ↓