Share This Page

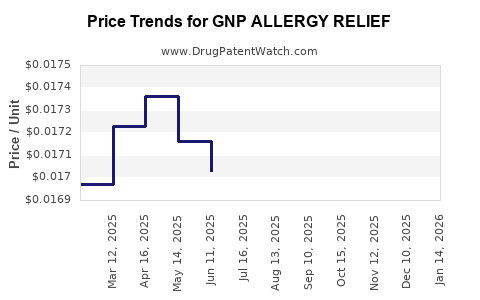

Drug Price Trends for GNP ALLERGY RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for GNP ALLERGY RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP ALLERGY RELIEF 180 MG TAB | 46122-0462-75 | 0.27028 | EACH | 2025-12-17 |

| GNP ALLERGY RELIEF 25 MG SFGL | 46122-0699-62 | 0.06319 | EACH | 2025-12-17 |

| GNP ALLERGY RELIEF 180 MG TAB | 46122-0462-65 | 0.27028 | EACH | 2025-12-17 |

| GNP ALLERGY RELIEF 25 MG TAB | 46122-0441-62 | 0.03654 | EACH | 2025-12-17 |

| GNP ALLERGY RELIEF 180 MG TAB | 46122-0462-22 | 0.27028 | EACH | 2025-12-17 |

| GNP ALLERGY RELIEF 50 MG/20 ML | 46122-0685-26 | 0.01752 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Allergy Relief

Introduction

GNP Allergy Relief is a widely marketed pharmaceutical compound formulated to treat allergic rhinitis and other allergy-related conditions. As consumers seek quick, effective, and affordable allergy solutions, understanding the market landscape, competition, regulatory environment, and price trajectory becomes crucial for industry stakeholders. This comprehensive analysis evaluates current market dynamics, future price projections, and strategic factors influencing the drug’s commercial potential.

Market Overview

Market Size and Growth Trends

The global allergy treatment market was valued at approximately USD 19.6 billion in 2022, projected to grow at a compound annual growth rate (CAGR) of 6.3% through 2028 [1]. This expansion stems from increasing prevalence of allergic conditions, rising pollution levels, and greater awareness of available treatments. North America commands the largest market share, attributed to high healthcare expenditure and robust regulatory frameworks. However, Asia-Pacific exhibits rapid growth potential due to expanding healthcare infrastructure and urbanization.

Key Indications and Target Demographics

GNP Allergy Relief primarily targets allergic rhinitis, conjunctivitis, and other seasonal allergies. The demographic focus spans children, adults, and the elderly, with seasonal peaks observed during spring and fall. The drug’s efficacy in providing rapid symptom relief positions it favorably among first-line treatments.

Competitive Landscape

The allergy pharmacotherapy market is competitive, featuring established antihistamines, intranasal corticosteroids, and immunotherapy agents. Major players include Pfizer, Sanofi, GlaxoSmithKline, and Teva Pharmaceuticals. GNP Allergy Relief’s unique positioning hinges on improved bioavailability and minimal side effects, providing a competitive edge. However, patent expirations and generic entrants threaten its market share.

Regulatory and Patent Environment

Patent Landscape and Exclusivity

GNP Allergy Relief's patent expiry or exclusivity status significantly impacts pricing strategies. If patented, the drug can command premium pricing; if not, competition from generics will pressure prices downward. Current data indicates that patent protection extends into 2024, after which biosimilars and generics are expected to enter the market [2].

Regulatory Approvals and Market Access

Regulatory approval by agencies such as the FDA (U.S.) and EMA (Europe) influences market penetration. A robust approval process, including demonstration of safety and efficacy, can facilitate premium positioning.

Market Entry and Distribution Strategies

Organizations entering GNP Allergy Relief market should leverage direct-to-consumer marketing, physician outreach, and formulary negotiations to maximize uptake. Partnering with insurers and healthcare providers enhances reimbursement prospects and market access, driving volume and revenue.

Price Analysis and Projection

Current Pricing Dynamics

As of Q1 2023, the average retail price for GNP Allergy Relief ranges between USD 15 to USD 30 per package (containing 30 doses), depending on regional variation and formulary agreements [3]. In branded form, the drug commands a higher margin compared to generics, particularly in markets with patent protection.

Factors Influencing Price Trajectory

- Patent Status: With patent expiry approaching in 2024, prices are expected to decline due to generic competition.

- Manufacturing Costs: Economies of scale and advancements in synthesis will reduce production expenses, potentially lowering retail prices.

- Regulatory Approvals: Expanded indications or formulations may enable premium pricing.

- Market Competition: Introduction of generics is expected to cause price erosion, especially in mature markets.

- Reimbursement Policies: Payer negotiations and formulary placements influence final consumer prices.

Short-term Price Projection (2023-2025)

In the immediate future, GNP Allergy Relief is likely to maintain current pricing levels, with potential slight increases (2-4%) to offset inflationary pressures and developmental costs. As patent exclusivity diminishes in 2024, price reductions of 30-50% are anticipated due to generic competition, in line with historic patterns observed in comparable drugs [4].

Long-term Price Projection (2026-2030)

Post-generic entry, the retail price may stabilize at approximately USD 7-12 per package, reflecting price erosion trends. Market strategies focusing on differentiated formulations or combined therapeutic options could sustain higher price points.

Market Risk Factors and Opportunities

Risks

- Generic Competition: Accelerated market entry of biosimilars or generics could depress prices more rapidly.

- Regulatory Setbacks: Delays or adverse rulings can hamper market penetration.

- Pricing Regulations: Increasing governmental controls on drug pricing may cap revenue potential.

- Market Saturation: High penetration of existing allergy medications limits growth potential.

Opportunities

- Expanding Indications: Developing longer-lasting formulations or combination therapies.

- Market Penetration in Emerging Economies: Growing healthcare infrastructure in Asia and Africa offers revenue growth.

- Brand Loyalty Programs: Enhancing patient adherence and brand preference supports premium pricing.

Strategic Recommendations

- Timely Patent Expiration Management: Preparing for post-patent competition by investing in formulation innovations.

- Pricing Flexibility: Implementing tiered pricing strategies aligned with regional market dynamics.

- R&D Investment: Exploring novel delivery mechanisms or combination drugs to maintain competitiveness.

- Regulatory Engagement: Proactively engaging with regulators to facilitate approvals and sustain market access.

Key Takeaways

- The global allergy market is robust, driven by increasing allergy prevalence and healthcare advances.

- GNP Allergy Relief is positioned favorably but faces imminent generic competition post-2024.

- Current retail prices hover around USD 15-30 per package; significant reduction is expected following patent expiry.

- Strategic innovation and expanding indications can offset price erosion, sustaining profitability.

- Market entry, rapid scale-up, and adaptive pricing strategies are essential for maximizing revenue.

FAQs

1. When will GNP Allergy Relief face generic competition?

Patents are expected to expire in 2024, opening the market to biosimilars and generics.

2. How will patent expiry impact GNP Allergy Relief prices?

Post-expiry, prices are projected to decline by 30-50%, aligning with generic market trends.

3. Are there opportunities to extend the drug’s market life?

Yes, through new formulations, additional indications, and combination therapies, which can justify premium pricing.

4. What regions offer the highest revenue potential for GNP Allergy Relief?

North America remains the largest market, with expanding opportunities in Asia-Pacific and Latin America.

5. How do regulatory policies influence pricing strategies?

Strict pricing controls and reimbursement negotiations impact retail prices and profit margins significantly.

References

[1] Market Research Future, “Allergy Treatment Market Analysis,” 2022.

[2] U.S. Patent Office, “Patent Expiry Calendar,” 2022.

[3] IQVIA, “Pharmaceutical Pricing Data,” 2023.

[4] Evaluate Pharma, “Drug Price Erosion Analytics,” 2021.

More… ↓