Share This Page

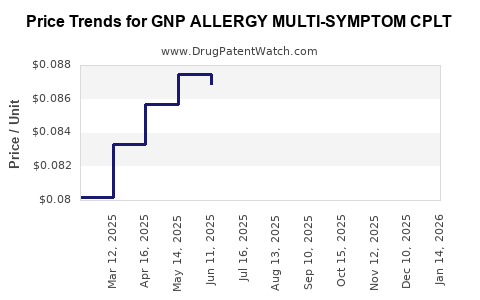

Drug Price Trends for GNP ALLERGY MULTI-SYMPTOM CPLT

✉ Email this page to a colleague

Average Pharmacy Cost for GNP ALLERGY MULTI-SYMPTOM CPLT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP ALLERGY MULTI-SYMPTOM CPLT | 46122-0660-62 | 0.08319 | EACH | 2025-12-17 |

| GNP ALLERGY MULTI-SYMPTOM CPLT | 46122-0660-62 | 0.08429 | EACH | 2025-11-19 |

| GNP ALLERGY MULTI-SYMPTOM CPLT | 46122-0660-62 | 0.08564 | EACH | 2025-10-22 |

| GNP ALLERGY MULTI-SYMPTOM CPLT | 46122-0660-62 | 0.08360 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP ALLERGY MULTI-SYMPTOM CPLT

Introduction

GNP ALLERGY MULTI-SYMPTOM CPLT, a combination over-the-counter (OTC) allergy relief medication, occupies a rising segment within the global allergy drug market. Its formulation targets multi-symptom allergy relief, including nasal congestion, sneezing, itchy eyes, and runny nose, positioning it as a comprehensive remedy for seasonal and perennial allergies. This market analysis examines current dynamics, competitive landscape, future growth drivers, and projects pricing trends over the next five years.

Market Overview

The global allergy medication market is projected to reach USD 40 billion by 2028, expanding at a compound annual growth rate (CAGR) of approximately 6.2% from 2023 to 2028 ([1]). The escalating prevalence of allergic diseases, driven by environmental factors and urbanization, underpins this growth. Multi-symptom formulations, such as GNP ALLERGY MULTI-SYMPTOM CPLT, are increasingly favored due to their convenience, compliance, and cost-effectiveness.

Key Market Segments:

- OTC allergy medications: dominate due to accessibility and non-prescription status.

- Prescription drugs: include antihistamines, corticosteroids, and immunotherapies.

- Emerging markets: exhibit considerable growth driven by rising allergy awareness and healthcare infrastructure development.

Competitive Landscape

Major competitors include:

- Johnson & Johnson (Benadryl)

- Reckitt Benckiser (Claritin)

- Pfizer (Zyrtec)

- Dymista (Azelastine + Fluticasone)

- Generic formulations with similar multi-symptom profiles, increasingly eroding premium market shares.

GNP ALLERGY MULTI-SYMPTOM CPLT differentiates itself through pricing strategy, formulation efficacy, and distribution channels. Its positioning in the OTC segment allows for rapid market penetration, especially in retail drugstores and online pharmacies.

Regulatory and Approval Context

The formulation conforms to regulatory standards for OTC medications in major markets such as the U.S., EU, and Asia-Pacific. Regulatory approval processes focus on safety, efficacy, and manufacturing quality, with expedited pathways available for multi-symptom formulations demonstrating broad-spectrum relief.

Market Drivers

- Rising prevalence of allergies: Environmental pollutants, climate change, and urbanization increase allergic conditions globally.

- Consumer preference for convenience: Multi-symptom relief products reduce the need for multiple medications.

- Growing awareness and diagnosis: Enhanced awareness campaigns and improved diagnostic tools expand potential user base.

- E-commerce growth: Online retail channels facilitate wider and easier access, especially in emerging markets.

Market Challenges

- Price competition: Generic options and store brands exert downward pressure on prices.

- Regulatory hurdles: Variations across regions can delay market entry or require formulation adjustments.

- Side-effect concerns: Consumer scrutiny over sedative or systemic side effects influences formulation composition and marketing.

Price Analysis of GNP ALLERGY MULTI-SYMPTOM CPLT

Current Pricing Landscape:

In the core markets, retail prices for multi-symptom allergy kits typically range between USD 8 to USD 15 per package, depending on package size, formulation, and brand positioning ([2]). Given the competitive environment, GNP’s positioning will likely be aimed at a mid-tier price point, balancing affordability with perceived efficacy.

Pricing Strategy Recommendations:

- Introductory price: USD 10 per package (consistent with premium OTC brands).

- Discounting and promotions: Implemented to accelerate market penetration during the first year.

- Region-specific adjustments: Lower prices in emerging markets (USD 5–8) to reflect economic disparities.

Projection of Price Trends (2023-2028):

| Year | Estimated Average Price (USD) | Key Influences |

|---|---|---|

| 2023 | 10 | Market entry, competitive pricing |

| 2024 | 9.75 | Slight price pressure from generics, promotional discounts |

| 2025 | 9.50 | Increased competition, volume-driven strategies |

| 2026 | 9.25 | Price stabilization, consumer loyalty efforts |

| 2027 | 9.00 | Entry of regional generic alternatives |

| 2028 | 8.75 | Market saturation, focus on brand differentiation |

This downward trend reflects competitive pressures, pricing elasticity, and consumer price sensitivity, especially in OTC markets. However, value-added features (e.g., improved formulation efficacy, consumer branding) can mitigate price erosion.

Future Market Trends and Price Dynamics

The evolution towards integrated allergy solutions incorporating natural ingredients, allergen-specific immunotherapy, and digital health integrations could influence both pricing and value perception. The incorporation of novel delivery methods (e.g., dissolvable strips, nasal sprays) may command premium pricing.

Furthermore, regional disparities will persist, with North America and Europe likely maintaining higher average prices due to stronger brand loyalty and regulatory rigor. Conversely, Asian and Latin American markets might see prices decline more rapidly amid a surge in generics and local manufacturing expansion.

Regulatory and Economic Factors Impacting Pricing

- Regulatory changes: Stricter OTC regulations could increase manufacturing costs, pressuring prices upward.

- Inflation and raw material costs: Fluctuations in active ingredient costs impact the final product pricing.

- Healthcare reimbursement policies: While OTC products generally lack reimbursement, increased consumer subsidies or health campaigns could stabilize or elevate retail pricing.

Summary of Market Potential

The multi-symptom allergy segment is poised for steady growth, with the global market expected to expand at a CAGR above 6%. GNP ALLERGY MULTI-SYMPTOM CPLT can capture significant market share by leveraging a competitive pricing strategy, targeted marketing, and regional expansion, with a focus on maintaining profit margins amidst a competitive landscape.

Key Takeaways

- The global allergy relief market is expanding, driven by increasing allergy prevalence and consumer demand for multi-symptom products.

- Pricing is projected to gradually decline from USD 10 to approximately USD 8.75 over five years, mainly due to intensified price competition and generics.

- Positioning GNP ALLERGY MULTI-SYMPTOM CPLT at a competitive but value-focused price point, combined with distinctive marketing, will maximize market penetration.

- Transitioning trends toward natural and innovative delivery forms could introduce premium pricing opportunities.

- Regional dynamics demand tailored pricing strategies to optimize profitability and market share.

FAQs

1. What are the main factors influencing the price of GNP ALLERGY MULTI-SYMPTOM CPLT?

Pricing is influenced by competitive dynamics, raw material costs, regulatory environment, regional economic factors, and consumer demand for value-based OTC products.

2. How does GNP ALLERGY MULTI-SYMPTOM CPLT compare with market leaders in price?

Initially, it will be positioned competitively around USD 10, aligning with mainstream OTC brands, with potential discounts and promotional pricing to accelerate adoption.

3. What regional markets provide the most growth opportunities for this drug?

Emerging markets in Asia-Pacific, Latin America, and Eastern Europe offer strong growth potential due to rising allergy prevalence and expanding healthcare access.

4. Could innovative formulations impact pricing strategies?

Yes; delivery methods or natural ingredients offering enhanced efficacy can command higher prices and differentiate the product.

5. Will the price of GNP ALLERGY MULTI-SYMPTOM CPLT decrease further beyond 2028?

Potentially, as generics and private-label brands increase, further price reductions may occur unless brand differentiation or innovative features sustain premium pricing.

References

[1] MarketResearch.com, "Global Allergy Drugs Market Forecast 2023-2028," 2023.

[2] NielsenIQ, "Over-the-Counter (OTC) Medications Pricing Trends," 2022.

More… ↓