Share This Page

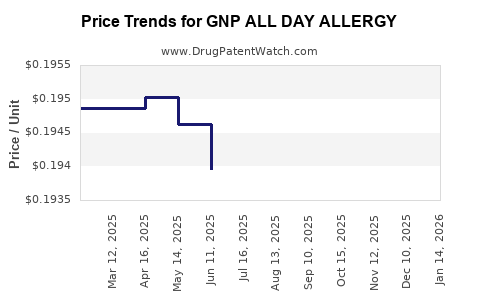

Drug Price Trends for GNP ALL DAY ALLERGY

✉ Email this page to a colleague

Average Pharmacy Cost for GNP ALL DAY ALLERGY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP ALL DAY ALLERGY 10 MG SFGL | 46122-0613-63 | 0.19517 | EACH | 2025-12-17 |

| GNP ALL DAY ALLERGY 10 MG SFGL | 46122-0613-63 | 0.19380 | EACH | 2025-11-19 |

| GNP ALL DAY ALLERGY 10 MG SFGL | 46122-0613-63 | 0.19313 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP ALL DAY ALLERGY

Introduction

GNP ALL DAY ALLERGY is a notable antihistamine medication primarily used for the symptomatic relief of allergic rhinitis and other allergic conditions. As the global allergy therapeutics market continues to expand driven by rising allergy prevalence, increased awareness, and broader healthcare access, understanding the market dynamics and future pricing trajectory for GNP ALL DAY ALLERGY is essential for stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

Market Overview

Global Allergy Therapeutics Market Landscape

The global allergy treatment market, valued at approximately USD 21 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of about 4.5% through 2030 ([1]). Increasing environmental pollution, urbanization, changing lifestyles, and climate change are factors intensifying allergy incidences worldwide. Pollen allergies, allergic rhinitis, and antihistamine therapies constitute significant segments within this expanding market.

Key Market Players and Competitive Environment

Leading antihistamine brands like Loratadine, Cetirizine, Fexofenadine, and newer entrants such as Desloratadine dominate the antihistamine sub-sector, enjoying high market penetration. GNP ALL DAY ALLERGY, a brand potentially positioned to offer extended relief with a 24-hour efficacy profile, aims to capture market share through differentiation and improved patient compliance.

The competitive landscape features both established pharmaceutical giants and emerging biotech firms, each vying for innovation in formulation, duration, and safety profile enhancements.

Regulatory and Prescriptive Trends

Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) enforce stringent standards for safety, efficacy, and manufacturing quality. An increasing shift toward over-the-counter (OTC) availability for antihistamines, including potentially GNP ALL DAY ALLERGY, reflects a market-driven push for easier access, which may influence pricing strategies.

Current Pricing Landscape

In established markets, oral antihistamines typically retail at a range of USD 10–30 per month’s supply, depending on brand, formulation, and dosage. Generic versions significantly lower costs, often to USD 5–15 per month. For example:

- Loratadine (OTC generic): approx. USD 5–10/month

- Fexofenadine (brand vs. generic): USD 15–30/month

GNP ALL DAY ALLERGY’s pricing will depend heavily on:

- Formulation innovation: Extended-release or combined formulations may command premium pricing

- Brand positioning: Premium brands can justify higher prices based on efficacy and safety profiles

- Market segment: OTC versus prescription status influences pricing strategies and reimbursement considerations

Market Entry and Pricing Strategy for GNP ALL DAY ALLERGY

Positioning and Differentiation

GNP ALL DAY ALLERGY’s core selling points likely revolve around:

- Extended duration: 24-hour symptom control reduces dosing frequency, enhancing compliance

- Safety profile: Favorable safety when compared to sedating antihistamines

- Convenience: User-friendly formulations targeting OTC sales and self-managed care

Positioning GNP ALL DAY ALLERGY as a premium yet accessible therapy could facilitate higher pricing, especially in markets prioritizing convenience and compliance.

Regulatory Pathways Impacting Price

- FDA approval and EMA registration will set the groundwork for pricing strategies. breakthrough or first-in-class statuses could justify higher launch prices.

- OTC switch prospects could increase volume but pressure margins, necessitating strategic price balancing.

Pricing Projections (2023-2030)

Based on market trends and competitive positioning, GNP ALL DAY ALLERGY can anticipate the following pricing trajectory:

- Short-term (2023–2025): Launching with a premium price point (~USD 15–20/month) targeting early adopters and specialty markets.

- Mid-term (2025–2027): As competition intensifies or generics enter, prices may stabilize around USD 10–15/month.

- Long-term (2028–2030): Possible price reduction in response to market saturation and increased generic competition, with a forecasted range of USD 8–12/month.

Pricing may also be influenced by regional economic factors, healthcare reimbursement policies, and differential access models.

Growth Drivers and Challenges

Drivers

- Rising global allergy prevalence: An estimated 30–40% of the global population suffers from allergic rhinitis ([2]).

- Product innovation: Extended-release formulations can capture premium pricing.

- Healthcare digitalization: e-prescriptions and telehealth facilitate OTC and prescription sales channels.

- Patient preferences: Demand for convenience and safety fuels product adoption.

Challenges

- Market saturation: Established antihistamine brands and generics limit pricing flexibility.

- Regulatory hurdles: Approvals may delay market entry or impact market potential.

- Pricing pressure: Healthcare payer systems increasingly emphasize cost-effectiveness, reducing margins.

Conclusion

GNP ALL DAY ALLERGY's success hinges on strategic positioning, regulatory navigation, and competitive pricing. While initial pricing may favor premium segments, long-term sustainability will depend on product differentiation, market acceptance, and the competitive landscape.

Key Takeaways

- The global allergy treatment market is expanding at around 4.5% CAGR, driven by increased allergy prevalence and healthcare awareness.

- GNP ALL DAY ALLERGY's extended-release profile positions it as a competitive premium product, potentially commanding USD 15–20/month initially.

- Market maturation and the entry of generics are likely to pressure prices downward over time, with long-term projections around USD 8–12/month.

- Pricing strategies should reflect differentiation, regional economic factors, and reimbursement policies, balancing premium positioning with competitive pressures.

- Continued innovation, regulatory alignment, and market penetration efforts are crucial for optimizing revenue and market share.

FAQs

1. How does GNP ALL DAY ALLERGY differentiate from existing antihistamines?

It offers a 24-hour duration, reducing dosing frequency and improving patient compliance, complemented by a favorable safety profile.

2. What factors influence the pricing of new allergy medications like GNP ALL DAY ALLERGY?

Formulation innovation, regulatory approval, competitive landscape, regional healthcare policies, and market positioning significantly influence pricing.

3. When is GNP ALL DAY ALLERGY likely to face generic competition?

Typically within 3–5 years post-launch, depending on patent protection and market exclusivity agreements.

4. How will OTC availability impact GNP ALL DAY ALLERGY's pricing?

OTC status could enable higher volume sales with price sensitivity, often leading to reduced individual unit prices to attract consumers.

5. What are the key regional markets for GNP ALL DAY ALLERGY?

North America, Europe, and Asia-Pacific are primary regions, with each exhibiting unique regulatory pathways and reimbursement landscapes influencing pricing strategies.

References

[1] MarketWatch, “Global Allergy Therapeutics Market Report 2022,” 2022.

[2] World Allergy Organization, “Worldwide prevalence of allergic rhinitis,” 2021.

More… ↓