Share This Page

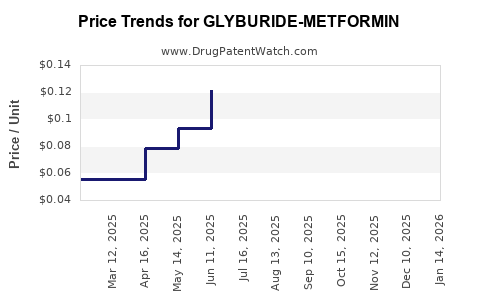

Drug Price Trends for GLYBURIDE-METFORMIN

✉ Email this page to a colleague

Average Pharmacy Cost for GLYBURIDE-METFORMIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GLYBURIDE-METFORMIN 2.5-500 MG | 65862-0081-01 | 0.19088 | EACH | 2025-12-17 |

| GLYBURIDE-METFORMIN 5-500 MG | 65862-0082-05 | 0.20130 | EACH | 2025-12-17 |

| GLYBURIDE-METFORMIN 2.5-500 MG | 23155-0234-01 | 0.19088 | EACH | 2025-12-17 |

| GLYBURIDE-METFORMIN 2.5-500 MG | 57237-0024-01 | 0.19088 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Glyburide-Metformin

Introduction

Glyburide-metformin is a combination oral antidiabetic medication primarily prescribed for managing type 2 diabetes mellitus. Combining glyburide, a sulfonylurea, with metformin, a biguanide, offers a synergistic approach in controlling blood glucose levels. The global demand for this drug is driven by rising diabetes prevalence, shifts toward combination therapies for improved compliance, and the drug’s established efficacy profile. This analysis provides a comprehensive review of current market dynamics, future growth forecasts, and pricing trends for glyburide-metformin, relevant for stakeholders across pharmaceutical, healthcare, and investment sectors.

Market Landscape

Global Diabetes Epidemic and Impact on Demand

The increasing incidence of type 2 diabetes across both developed and emerging economies significantly influences the glyburide-metformin market. According to the International Diabetes Federation (IDF), approximately 537 million adults globally live with diabetes as of 2021, expected to rise to 700 million by 2045 [1]. This surge propels the need for effective, convenient, and affordable medication regimes, underpinning the demand for fixed-dose combinations like glyburide-metformin.

Market Penetration and Adoption

Glyburide-metformin is predominantly prescribed in North America, Europe, and Asia-Pacific regions, where healthcare infrastructure and awareness levels support widespread adoption. However, regulatory variations influence availability; in certain countries, glyburide formulations face generic competition with lower-cost alternatives, impacting sales volume and pricing strategies.

Competitive Landscape

The market features numerous manufacturers, including generic drug producers and branded pharmaceutical companies. Key players include Mankind Pharma, Sun Pharmaceutical Industries, and Lupin Ltd. These companies offer generic glyburide-metformin formulations, contributing to robust price competition and market saturation. In contrast, innovative drug combinations with improved safety profiles, such as newer biguanide or sulfonylurea derivatives, pose competitive threats.

Regulatory Environment

Regulatory approval processes, particularly concerning safety profiles associated with glyburide—linked to hypoglycemia risks—affect market strategies [2]. Consequently, regions like the European Union have strict guidelines, influencing product availability and promotional practices.

Market Size and Growth Projections

Current Market Valuation

The glyburide-metformin market was valued at approximately USD 2.3 billion in 2021, with the North American segment constituting a significant share due to high diabetes prevalence and treatment rates (estimated at 45%). Asia-Pacific follows, driven by economic growth and expanding healthcare infrastructure.

Forecasted Growth Trends

With an estimated Compound Annual Growth Rate (CAGR) of 4-6% over the next five years, driven by increasing diabetes prevalence, expanding access in emerging economies, and patient preference for combination pills, the market could reach USD 3.0–3.4 billion by 2026 [3].

Market Drivers

- Rising global diabetes burden.

- Patient preference for simplified regimens improving compliance.

- Cost-effectiveness of generic formulations.

- Government initiatives to improve access to essential medicines.

Market Constraints

- Safety concerns related to hypoglycemia with glyburide.

- Stringent regulatory hurdles.

- Competition from newer antidiabetic agents (e.g., SGLT2 inhibitors, GLP-1 receptor agonists).

- Price erosion due to generic competition.

Pricing Trends and Projections

Current Price Range

The average wholesale price (AWP) for a standard 30-day supply of glyburide-metformin (5 mg/500 mg) in the United States is approximately USD 10–USD 30, depending on formulation, dosage, and supplier [4]. Generic products dominate the market, exerting downward pressure on prices.

Influencing Factors on Pricing

- Generic Competition: Leads to significant price reductions; prices can decrease by 50-70% within a few years of patent expiry.

- Manufacturing Costs: Lower in emerging markets, enabling aggressive pricing.

- Regulatory and Approval Delays: May temporarily inflate prices in regions with limited generic presence.

- Reimbursement Policies: Depending on health plans and government programs, influence retail pricing and patient out-of-pocket costs.

Projected Price Trends

Given historical data, the price of glyburide-metformin is expected to decline further, with estimates suggesting a 10–20% decrease over the next three years in mature markets. As patent protections diminish or expire (dependent on regional regulatory timelines), generic prices could fall by an additional 30–50%. In emerging markets, prices are likely to remain relatively stable or decline slightly, owing to lower manufacturing costs and higher generic market penetration.

Market Opportunities and Challenges

Opportunities:

- Expanding into emerging markets with high diabetes prevalence.

- Developing formulations with improved safety profiles.

- Leveraging cost-effective manufacturing to gain market share.

Challenges:

- Declining demand in regions where newer antidiabetic agents gain favor.

- Regulatory restrictions due to safety concerns.

- Price erosion owing to intensified generic competition.

Conclusion

The glyburide-metformin market remains robust amid the global diabetes epidemic, with steady growth driven by demographic shifts and medication adherence trends. Price projections indicate continued downward pressure primarily from generics, particularly over the next five years. Stakeholders should focus on cost advantages, regulatory strategies, and expanding access in emerging markets to optimize market share.

Key Takeaways

- Growing Demand: The global rise in type 2 diabetes sustains demand, especially in Asia-Pacific and North America.

- Market Stagnation but Growth: Total market value projected to grow at a CAGR of 4–6%, reaching USD 3.4 billion by 2026.

- Pricing Decline: Prices expected to decrease by up to 50% in mature markets due to generic competition.

- Strategic Focus: Companies should prioritize cost efficiencies, regulatory navigation, and market expansion into emerging economies.

- Safety and Innovation: Addressing safety concerns regarding glyburide may influence future formulations and market positioning.

FAQs

1. What factors influence the pricing of glyburide-metformin globally?

Pricing is affected by generic market entry, manufacturing costs, regulatory considerations, and regional reimbursement policies. Generic competition exerts the most significant downward pressure on prices.

2. How will patent expirations impact the glyburide-metformin market?

Patent expirations lead to increased generic availability, substantially reducing prices and enabling broader access but potentially diminishing revenues for brand-name manufacturers.

3. Are newer antidiabetic agents threatening the glyburide-metformin market?

Yes. Drugs like SGLT2 inhibitors and GLP-1 receptor agonists offer safety and efficacy advantages, capturing market share, especially among high-risk patient populations.

4. Which regions hold the highest growth potential for glyburide-metformin?

Emerging economies in Asia-Pacific and Latin America present significant growth opportunities due to rising diabetes prevalence and expanding healthcare infrastructure.

5. How can manufacturers differentiate glyburide-metformin products amidst price competition?

By emphasizing manufacturing quality, safety profiles, patient adherence benefits, and expanding access programs in underserved regions, manufacturers can sustain market relevance.

References

- IDF Diabetes Atlas, 9th Edition, 2021.

- European Medicines Agency. Assessment of sulfonylurea safety profiles, 2020.

- MarketWatch. "Global Antidiabetic Drugs Market Forecast," 2022.

- RedBook. Price Data for Oral Antidiabetics, 2023.

More… ↓