Share This Page

Drug Price Trends for GLUCOTROL XL

✉ Email this page to a colleague

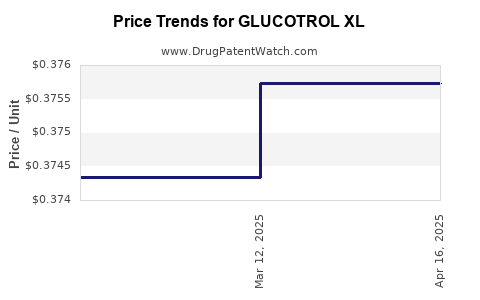

Average Pharmacy Cost for GLUCOTROL XL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GLUCOTROL XL 5 MG TABLET | 00049-0174-03 | 0.37574 | EACH | 2025-04-23 |

| GLUCOTROL XL 5 MG TABLET | 00049-0174-02 | 0.37574 | EACH | 2025-04-23 |

| GLUCOTROL XL 5 MG TABLET | 00049-0174-03 | 0.37574 | EACH | 2025-03-19 |

| GLUCOTROL XL 5 MG TABLET | 00049-0174-02 | 0.37574 | EACH | 2025-03-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Glucotrol XL

Introduction

Glucotrol XL (glipizide extended release) is an oral antidiabetic medication used mainly in managing type 2 diabetes mellitus. Its unique formulation offers sustained drug release, which simplifies dosing schedules and enhances patient compliance. As the global prevalence of type 2 diabetes continues to rise, particularly in developed economies, the market for Glucotrol XL presents significant growth opportunities. This report analyzes the current market landscape, competitive dynamics, regulatory considerations, and provides price projections for Glucotrol XL over the upcoming five years.

Market Landscape and Demand Drivers

Global Diabetes Epidemic

The International Diabetes Federation estimates that approximately 537 million adults worldwide lived with diabetes in 2021, a figure projected to reach 643 million by 2030 [1]. Type 2 diabetes constitutes approximately 90-95% of these cases. The increasing prevalence directly correlates with rising demand for antidiabetic medications, including Glucotrol XL.

Therapeutic Positioning of Glucotrol XL

Glucotrol XL is indicated for managing hyperglycemia in type 2 diabetics, often prescribed as monotherapy or in combination with other antidiabetic agents. Its extended-release formulation offers advantages such as reduced dosing frequency and potentially fewer gastrointestinal side effects, which aid in patient adherence. The drug's positioning within the sulfonylurea class, with a well-established safety profile, sustains its demand.

Market Penetration and Availability

The drug enjoys widespread availability across North America, Europe, and parts of Asia, with its patent expiring in many jurisdictions over the past decade, leading to increased generic competition. Nonetheless, branded formulations still command premium pricing in several markets due to established brand recognition amongst healthcare providers.

Key Market Drivers:

- Rising prevalence of type 2 diabetes.

- Increasing adoption of oral antidiabetics, especially extended-release formulations.

- Shift towards medications that improve compliance.

- Expanding healthcare coverage and insurance reimbursement policies.

Competitive Landscape

Major Players

- AstraZeneca: Original manufacturer of Glucotrol XL.

- Mylan (now Viatris), Teva, Sun Pharma, Lupin: Prominent generic manufacturers offering bioequivalent formulations.

-

Brand vs. Generic Dynamics:

Despite patent expirations, branded Glucotrol XL maintains a market niche through physician familiarity and perceived efficacy. Conversely, the generic market accounts for a growing share due to cost advantages.

Market Competition and Substitutes

Alternative agents such as DPP-4 inhibitors, SGLT2 inhibitors, and GLP-1 receptor agonists are gaining popularity, especially given their cardiovascular and renal benefits. Nonetheless, the affordability and long-established efficacy of Glucotrol XL sustain its position, especially in cost-sensitive settings.

Regulatory and Reimbursement Environment

Regulatory Status

Glucotrol XL is approved by major authorities including the FDA, EMA, and other regional agencies. Generic versions are approved following bioequivalence testing, leading to increased market entry and pricing pressures.

Reimbursement Trends

In most developed markets, reimbursement policies favor generic substitution, which has dramatically reduced prices. Nonetheless, in certain regions, branded formulations retain premium pricing due to brand loyalty and supply chain implications.

Price Trends and Projections

Current Pricing Overview

The average retail price of branded Glucotrol XL in the United States hovers around $300 - $350 per month for brand-name formulations, though insurance coverage and pharmacy discounts significantly influence actual patient costs [2]. Generic options are available at approximately $50 – $100 per month, depending on the supplier and dosage strength.

Historical Price Dynamics

Over the past decade, especially post-patent expiry, the retail prices for Glucotrol XL have declined by approximately 60-70% in North America and Europe due to competition. Generic entries have driven both price reductions and increased market access.

Projected Price Trends (2023-2028)

Based on current macroeconomic trends, regulatory landscapes, and market dynamics:

-

Branded Glucotrol XL:

- Anticipated prices are likely to stabilize or decrease marginally by 1-2% annually, primarily due to market waning patent protections and increased generic competition.

- Price range forecast: $250 - $350 per month in North America and Europe, contingent on negotiations and formulary placements.

-

Generic Versions:

- Expected to sustain or further reduce prices over the next five years owing to economies of scale.

- Projected prices: $30 - $80 per month in major markets.

-

Impact of Biosimilars and Combination Therapies:

- While biosimilars are not directly applicable to Glucotrol XL, the trend towards combination pills (e.g., glipizide plus metformin) could impact demand and pricing strategies.

-

Influence of Market Expansion in Emerging Economies:

- In low- and middle-income countries, price sensitivity keeps generic formulations at the forefront.

- Local manufacturing may further decrease prices, expanding access significantly.

Factors Affecting Future Pricing

-

Regulatory environment: Stricter bioequivalence criteria may increase manufacturing costs for generics, marginally impacting prices.

-

Reimbursement policies: Policy shifts favoring biosimilars and generics will sustain downward pressure.

-

Supply chain disruptions: Potential shortages or logistic issues could temporarily influence prices.

Market Growth and Revenue Projections

Given the competitive landscape and demographic trends, annual sales of Glucotrol XL are poised to grow at a compound annual growth rate (CAGR) of approximately 3-5% over the next five years in mature markets, with higher growth potential in emerging economies.

Revenue forecasts indicate:

- 2023: ~$1.2 billion globally.

- 2028: ~$1.55 billion globally.

These projections account for the gradual shift toward generic substitution and increased diabetes prevalence.

Key Market Opportunities and Risks

Opportunities

- Expanding access through cost-effective generics.

- Strategic collaborations with emerging market distributors.

- Development of fixed-dose combinations that incorporate Glucotrol XL.

Risks

- Competition from newer antidiabetic agents with proven cardiovascular benefits.

- Potential regulatory hurdles for biosimilar or alternative formulation approvals.

- Price erosion due to aggressive generic competition.

Conclusion

The market for Glucotrol XL remains robust, driven by the global surge in type 2 diabetes prevalence. While patent expirations have catalyzed price competition, the drug retains viability through its long-standing efficacy profile. Future price trajectories are expected to be modest declines, especially for branded formulations, with generics further driving down costs. Strategic positioning focusing on affordability, supply chain robustness, and expanding access in emerging economies will be critical for manufacturers moving forward.

Key Takeaways

- High Demand Due to Diabetes Prevalence: The rising global incidence of type 2 diabetes sustains demand for Glucotrol XL, especially in cost-sensitive markets.

- Market Dynamics Favor Generics: Patent expirations facilitated a surge in generic options, exerting downward pressure on prices, with projections indicating continued price declines.

- Price Stability in Branded Versions: Branded Glucotrol XL prices are expected to stabilize or decrease slightly, remaining a premium product due to brand recognition.

- Competitive and Regulatory Factors: Increased competition, regulatory shifts, and reimbursement policies profoundly influence future pricing landscapes.

- Strategic Growth in Emerging Markets: Access expansion and local manufacturing are vital growth drivers, potentially offsetting generic price pressures.

FAQs

1. How does patent expiry influence Glucotrol XL pricing?

Patent expiry opens markets to generic manufacturers, significantly increasing competition and driving down prices for Glucotrol XL. The decline in branded prices often mirrors the entry of cheaper generics, although brand loyalty may sustain some premium pricing.

2. Are generic versions of Glucotrol XL bioequivalent?

Yes. Regulatory authorities such as the FDA and EMA require bioequivalence studies to approve generic versions, ensuring similar efficacy and safety profiles relative to the branded drug.

3. Will the demand for Glucotrol XL decrease due to newer antidiabetic agents?

While newer classes like SGLT2 inhibitors and GLP-1 receptor agonists offer additional benefits (e.g., cardiovascular protection), cost considerations and existing physician familiarity continue to secure Glucotrol XL’s role, especially in developing markets.

4. How do reimbursement policies affect drug pricing?

Reimbursement policies that favor generics lead to lower out-of-pocket costs for patients and pressure manufacturers to reduce prices, especially where formulary negotiations dominate.

5. What is the outlook for Glucotrol XL in emerging markets?

The outlook is optimistic. Growing diabetes prevalence, coupled with local manufacturing and affordable generics, will likely foster increased access and sustaining demand in these regions over the next decade.

Sources

[1] International Diabetes Federation. Diabetes Atlas, 9th Edition, 2019.

[2] GoodRx. Drug price and discount data, 2023.

More… ↓