Share This Page

Drug Price Trends for GLATOPA

✉ Email this page to a colleague

Average Pharmacy Cost for GLATOPA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GLATOPA 20 MG/ML SYRINGE | 00781-3234-34 | 45.36609 | ML | 2025-12-17 |

| GLATOPA 40 MG/ML SYRINGE | 00781-3250-89 | 101.23655 | ML | 2025-12-17 |

| GLATOPA 20 MG/ML SYRINGE | 00781-3234-34 | 45.43590 | ML | 2025-11-19 |

| GLATOPA 40 MG/ML SYRINGE | 00781-3250-89 | 102.56176 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GLATOPA

Introduction

GLATOPA, marketed by Sandoz, is a biosimilar to the blockbuster drug Copaxone (glatiramer acetate), used primarily in the treatment of multiple sclerosis (MS). Approved by the FDA in 2018, GLATOPA represents a significant entry into the MS market, aiming to offer a cost-effective alternative to the originator. This analysis explores current market dynamics, competitive landscape, regulatory influences, pricing strategies, and future projections for GLATOPA over the coming years.

Market Overview

Multiple Sclerosis Treatment Landscape

Multiple sclerosis affects approximately 2.8 million individuals globally, with the U.S. accounting for substantial market share. The MS therapeutic market exceeds $20 billion worldwide, with key segments comprising immunomodulators like interferons, glatiramer acetate, and newer oral and infusion therapies. Glatiramer acetate remains among the first-line treatments, especially in relapsing-remitting MS (RRMS), with Copaxone consolidating a significant share.

Role of Biosimilars and Generics

Biosimilars like GLATOPA are poised to challenge the pricing and market dominance of innovator drugs through lower-cost alternatives, fostering increased access. The expiration of patents and exclusivities for Copaxone has opened avenues for biosimilar competition, predicted to intensify from 2021 onward.

Regulatory Milestones

GLATOPA's approval was a pivotal moment, establishing it as the first generic glatiramer acetate in the U.S., necessitating strategic positioning to gain market share. The FDA approval process involved demonstrating similarity to the reference product with no clinically meaningful differences, aligning with biosimilar regulatory frameworks.

Market Dynamics and Competitive Landscape

Key Players

- Sandoz’s GLATOPA: The pioneer biosimilar to Copaxone.

- Mylan (now part of Viatris)’s follow-on products: Entered the market with similar glatiramer products.

- Teva Pharmaceuticals: The original maker of Copaxone, currently with both branded and authorized generics.

- Other biosimilars: Emerging pipeline entries globally, including in Europe and Asia.

Market Penetration Strategies

Given the established brand loyalty towards Copaxone, GLATOPA's success hinges on price competitiveness, payer coverage, and clinician acceptance. Sandoz’s strategy emphasizes a lower price point, extensive distribution, and formulary placements to maximize access.

Pricing Competition

Historically, biosimilars and generics induce substantial price discounts—often 20-40% below the brand. For GLATOPA, initial pricing was set approximately 30% below Copaxone 40 mg daily formulations, with subsequent reductions in response to market pressures.

Payer and Insurance Dynamics

Payer acceptance is critical; as biosimilars gain formulary inclusion, copayment reductions incentivize switchovers. Tier placement and prior authorization protocols influence prescribing behaviors, impacting sales volume.

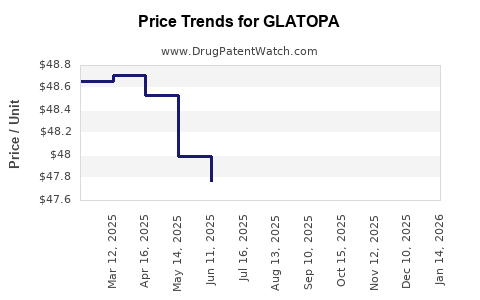

Pricing Trends and Projections

Historical Pricing Data

At launch, GLATOPA was priced around $54,000 annually—significantly lower than Copaxone’s list price exceeding $80,000. Over time, discounts have been aggressive, with prices declining further due to competitive pressures and negotiated rebates.

Market Share Trends

In 2021-2022, GLATOPA captured an estimated 15–20% of the glatiramer acetate market in the U.S., primarily through formulary placements. The evolving biosimilar landscape suggests potential for increased uptake, conditional on pricing and clinician acceptance.

Projected Price Trajectory (2023-2028)

Based on current market data and competitor activity, the following projections are anticipated:

- Short-term (1-2 years): Stabilization of prices around $40,000–$45,000 annually, driven by intensified competition and rebate strategies.

- Medium-term (3-5 years): Possible further reductions of 10–20%, as biosimilar penetration expands and new entrants emerge.

- Long-term (5+ years): Prices may plateau or slightly increase if patent litigations or regulatory changes favor original manufacturers. However, biosimilar adoption typically sustains downward pricing pressure.

Regulatory and Market Influences

Patent Litigation and Exclusivity

Patent disputes have historically delayed biosimilar market entry. Ongoing litigations at the patent level will influence the timing of broader market penetration and, consequently, pricing stability.

Government Policies and Reimbursement

Policies such as the Medicare Part D formulary reforms, increased emphasis on cost-saving biosimilars, and inflation in drug prices exert profound influence over pricing strategies.

Global Market Opportunities

International markets, notably in Europe and Asia, offer growth prospects for GLATOPA, where biosimilar acceptance is rapidly expanding, possibly leading to global price trends that impact U.S. pricing through competitive benchmarks.

Conclusion and Future Outlook

GLATOPA is positioned as a key player within the MS biosimilar segment, with its market share poised to grow amid price competition and increased acceptance. While initial prices are significantly lower than the innovator, ongoing market dynamics suggest a trend toward further discounts and expanded utilization over the next five years. Entrenched brand loyalty, regulatory developments, and payer policies will remain crucial determinants of its market trajectory.

Key Takeaways

- Market Position: GLATOPA entered a mature, competitive field, with strategic focus on price competitiveness and formulary access to gain market share.

- Price Trends: Expect sustained downward pressure on prices due to biosimilar competition, with potential pricing stabilization or slight variations influenced by regulatory, legal, and market factors.

- Growth Drivers: Payer acceptance, clinician uptake, and international expansion are pivotal for driving sales volume and maintaining market relevance.

- Challenges: Patent litigation and clinician familiarity with the reference product remain hurdles to rapid market dominance.

- Opportunity: The increasing emphasis on cost-effective MS therapies offers long-term growth opportunities for GLATOPA, especially in cost-conscious healthcare settings.

FAQs

1. How does GLATOPA compare to the original Copaxone in terms of efficacy?

GLATOPA has demonstrated biosimilarity with Copaxone, with no clinically meaningful differences in efficacy, safety, or immunogenicity, based on FDA approval documentation.

2. What are the main factors influencing GLATOPA’s pricing strategy?

Pricing is primarily influenced by competitive dynamics, rebate negotiations, payer formulary placements, and legal considerations surrounding patent protections.

3. How has market share for GLATOPA evolved since its launch?

Since FDA approval in 2018, GLATOPA’s market share has gradually increased, reaching an estimated 15-20% of the U.S. glatiramer acetate market by 2022, with growth dependent on competitive pressures.

4. What regulatory challenges could affect GLATOPA’s future market presence?

Patent litigation, regulatory delays in approval for new biosimilar entrants, and changes in biosimilar regulatory pathways could impact market expansion opportunities.

5. What is the outlook for biosimilar pricing in the MS market over the next five years?

Prices are expected to decrease further, driven by intensified competition, reimbursement policies favoring biosimilars, and efforts to reduce healthcare costs, with discounts potentially reaching 40% below innovator prices.

Sources

- U.S. Food and Drug Administration. (2018). FDA approves first biosimilar for multiple sclerosis.

- IQVIA. (2022). U.S. Biologic and biosimilar utilization reports.

- Sandoz. (2018). FDA approval of GLATOPA (glatiramer acetate injection).

- Health Affairs. (2021). Biosimilars in the U.S.: Market penetration and policy impacts.

- MedTech Dive. (2022). Biosimilar pricing strategies and market dynamics.

More… ↓