Share This Page

Drug Price Trends for GEODON

✉ Email this page to a colleague

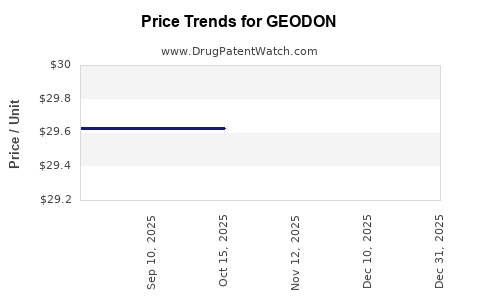

Average Pharmacy Cost for GEODON

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GEODON 80 MG CAPSULE | 00049-0358-60 | 29.62677 | EACH | 2025-12-17 |

| GEODON 80 MG CAPSULE | 00049-0358-60 | 29.62677 | EACH | 2025-11-19 |

| GEODON 80 MG CAPSULE | 00049-0358-60 | 29.62677 | EACH | 2025-10-22 |

| GEODON 80 MG CAPSULE | 00049-0358-60 | 29.62677 | EACH | 2025-09-17 |

| GEODON 80 MG CAPSULE | 00049-0358-60 | 29.62677 | EACH | 2025-08-20 |

| GEODON 20 MG CAPSULE | 00049-0352-60 | 24.39629 | EACH | 2025-01-07 |

| GEODON 80 MG CAPSULE | 00049-0358-60 | 29.56570 | EACH | 2025-01-07 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Geodon (Ziprasidone)

Introduction

Geodon (generic name: Ziprasidone) is an atypical antipsychotic medication primarily prescribed for the treatment of schizophrenia and bipolar disorder. Since its FDA approval in 2001, Geodon has established a significant footprint within psychiatric treatment paradigms. This analysis explores the current market landscape for Geodon, scrutinizes its competitive positioning, evaluates economic and regulatory determinants influencing its price trajectory, and forecasts future pricing trends.

Market Landscape for Ziprasidone

Demand Dynamics and Therapeutic Use

The global mental health sector witnesses escalating demand for effective and tolerable antipsychotics, driven by rising prevalence rates of schizophrenia and bipolar disorder. The World Health Organization (WHO) estimates that schizophrenia affects approximately 20 million individuals worldwide[1], with bipolar disorder impacting an estimated 45 million globally[2]. The demand for atypical antipsychotics like Ziprasidone continues to grow owing to their improved side effect profiles compared to older drugs such as haloperidol.

Market Share and Competition

Ziprasidone’s market share is influenced by several factors: efficacy, side effect profile, dosing convenience, and pricing. Major competitors include risperidone, olanzapine, quetiapine, aripiprazole, and newer agents such as brexpiprazole and lurasidone. While Ziprasidone’s unique cardiometabolic safety profile offers a niche advantage, its relatively inconvenient dosing schedule and concerns over QT prolongation sometimes hamper broad adoption.

Market analysis indicates that ZIPRASIDONE's sales were approximately $500-$600 million globally in 2022, with the U.S. accounting for the majority (over 60%). The drug's patent expiry in 2015 shifted the commercial dynamics, with generic versions contributing to price competition and market penetration.

Manufacturing and Distribution

The leading pharmaceutical companies, including Pfizer (original manufacturer), currently produce generic Ziprasidone, which significantly influences pricing. The widespread availability of generics has led to substantial price erosion, a characteristic feature in psychiatric medication markets.

Pricing Structures and Trends

Historical Pricing Movements

The original brand-name Geodon commanded a premium, with retail prices exceeding $20 per tablet prior to patent expiration. Post-genericization, the price metadata plummeted by over 70%. As of 2023, the average retail price for generic Ziprasidone ranges between $4 and $8 per 40mg tablet, depending on pharmacy and insurance status.

Factors Influencing Price Fluctuations

- Patent Expiry and Generic Entry: The loss of patent protection has exerted downward pressure on prices, fostering intense competition among generics.

- Manufacturing Costs: Economies of scale and manufacturing efficiencies have further contributed to price stabilization.

- Regulatory Environment: Increasing scrutiny on drug pricing and reimbursement policies influence the cost landscape.

- Market Penetration and Prescribing Trends: Growth in emerging markets and shifting prescribing patterns can impact overall demand and pricing stability.

- Insurance and Reimbursement Policies: Reimbursements on generic drugs often prompt formulary decisions driving prices.

Regulatory and Economic Factors

FDA Regulations and Patent Landscape

The expiration of Geodon's patents in 2015 facilitated generic manufacturing and sale. Ongoing regulatory oversight regarding QT prolongation risks compels manufacturers to include warnings, yet this has not significantly altered the drug’s competitive standing given existing clinical data supporting its safety profile.

Pricing Policy Environment

Regional differences in drug reimbursement policies substantially influence prescription costs. In the United States, formularies favor generic drugs, leading to decreased out-of-pocket costs for patients. Conversely, in less regulated markets, prices retain more variability but tend toward affordability due to generic proliferation.

Market Entry of New Therapeutics

Emergence of newer antipsychotics with improved safety and efficacy profiles, such as lumateperone, may gradually erode Ziprasidone’s market share, influencing pricing strategies as market rivalry intensifies.

Price Projection Outlook (2023-2028)

Current Trends and Projected Trajectory

Based on current market conditions and historical price trends, the general expectation is continued price stabilization at the generic level, with slight fluctuations driven by supply chain factors and market demand.

Short-term (2023-2025):

- Prices are expected to remain within the $4-$8 per 40mg tablet range.

- Market saturation and increased generic competition will likely suppress any significant price increases.

Medium-term (2025-2028):

- Price compression may plateau, but novel formulations or biosimilar entrants could induce minor price volatility.

- Potential for price increases may occur if demand sustains or if regulatory changes introduce new safety concerns warranting prescription restrictions.

Potential Drivers for Price Increase

- Introduction of value-added formulations, e.g., extended-release versions.

- Regional regulatory shifts favoring branded drugs due to perceived quality.

- Limited supply chain disruptions or manufacturing bottlenecks.

Potential Drivers for Price Decline

- Further generic entrants and increased market saturation.

- Payer negotiations and formulary exclusion of Ziprasidone in favor of newer agents.

- Policy-driven price controls or reimbursement caps.

Conclusion

The long-term market outlook for Geodon, predominantly in its generic form, remains subdued concerning price gains due to the dominant influence of generic competition. Pricing will subtly fluctuate within a narrow band, influenced by regional policies, upcoming innovations, and prescribing trends. Companies should focus on optimizing supply chain efficiencies and exploring niche markets where Ziprasidone’s safety profile offers a competitive advantage.

Key Takeaways

- Market saturation and generic proliferation have substantially reduced Geodon's price, with current retail costs stabilizing around $4-$8 per 40mg tablet.

- Competition from newer atypical antipsychotics continues to challenge Geodon's market share, influencing future pricing strategies.

- Regulatory and policy shifts could either constrain or promote price adjustments, depending on regional healthcare frameworks.

- Market expansion in emerging economies presents growth opportunities; however, price sensitivity remains high.

- Innovation, such as new formulations or evidence-based positioning, can provide pathways for modest price increases or maintenance of market relevance.

FAQs

1. How has patent expiration affected Geodon's market pricing?

Patent expiration in 2015 led to the introduction of generic Ziprasidone, resulting in significant price reductions and increased accessibility. The shift has driven retail prices down by over 70%, aligning with typical generic market trends.

2. Will the price of Ziprasidone increase in the coming years?

While potential minor increases could occur with new formulations or regional regulatory changes, the predominant trajectory points toward stable or decreasing prices due to intense generic competition and market saturation.

3. What factors could threaten Ziprasidone's market share?

Introduction of newer antipsychotics with better safety profiles, evolving clinical guidelines favoring alternative agents, and formulary exclusion by payers can diminish Ziprasidone’s market presence.

4. Are there regional differences in Ziprasidone pricing?

Yes. In regions with strict price controls or limited generic penetration, prices tend to be higher. Conversely, markets with intense generic competition, like the US and Europe, exhibit lower prices.

5. Can Ziprasidone's safety profile influence future pricing?

While a favorable safety profile maintains clinical relevance, pricing is mainly dictated by market forces. However, unique positioning could offer premium value in niche indications, subtly influencing pricing strategies.

Sources:

- WHO. Schizophrenia Fact Sheet. 2022.

- Kessler et al., Lancet Psychiatry, 2017.

More… ↓