Share This Page

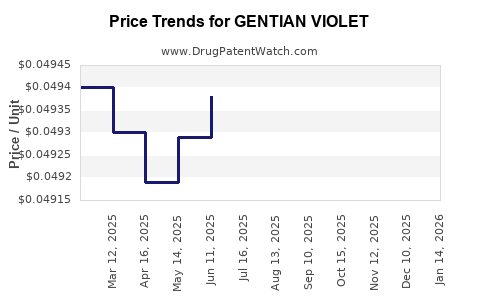

Drug Price Trends for GENTIAN VIOLET

✉ Email this page to a colleague

Average Pharmacy Cost for GENTIAN VIOLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GENTIAN VIOLET 1% SOLUTION | 24385-0003-46 | 0.04949 | ML | 2025-11-19 |

| GENTIAN VIOLET 1% SOLUTION | 24385-0003-46 | 0.04949 | ML | 2025-10-22 |

| GENTIAN VIOLET 1% SOLUTION | 24385-0003-46 | 0.04949 | ML | 2025-09-17 |

| GENTIAN VIOLET 1% SOLUTION | 24385-0003-46 | 0.04949 | ML | 2025-08-20 |

| GENTIAN VIOLET 1% SOLUTION | 24385-0003-46 | 0.04949 | ML | 2025-07-23 |

| GENTIAN VIOLET 1% SOLUTION | 24385-0003-46 | 0.04938 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Gentian Violet

Introduction

Gentian violet, also known as crystal violet or hexamethyl pararosaniline chloride, is a triphenylmethane dye with antimicrobial properties. Historically employed in dermatology for infections and wound antisepsis, it has maintained niche use cases despite the emergence of modern pharmaceuticals. This analysis explores the current market landscape, assesses competitive factors, and offers price projections for gentian violet, considering regulatory dynamics, demand drivers, and manufacturing considerations.

Market Landscape and Current Usage

Gentian violet has established relevance in developing regions primarily due to its cost-effectiveness and broad-spectrum antimicrobial activity. It is approved by the U.S. Food and Drug Administration (FDA) in specific indications, notably for topical use in thrush and certain skin infections, but its primary application remains primarily off-label or within traditional practices. According to industry reports, the global market for antimicrobial dyes like gentian violet remains modest, estimated at approximately $20-25 million annually, with significant regional variation.

Regional Market Dynamics

-

North America and Europe: Limited demand driven by stringent regulatory standards and preference for approved pharmaceuticals. Usage largely confined to dermatological practitioners familiar with traditional remedies.

-

Asia-Pacific: Dominates the market owing to widespread traditional medicinal practices and a higher prevalence of dermatological infections. Emerging demand for affordable antimicrobial agents sustains steady procurement levels.

-

Africa and Latin America: Reliant on cost-effective treatments; gentian violet remains a frontline antiseptic in rural and under-resourced healthcare settings.

Regulatory Environment

Gentian violet’s regulatory status varies by country. Its classification as a carcinogen in some jurisdictions (notably within the U.S.) limits formal approval for some indications. However, in many emerging markets, it is classified as an over-the-counter (OTC) product, facilitating continued use. The ongoing debate over safety concerns influences future regulatory policies, potentially constraining market growth.

Manufacturing and Supply Chain

Key manufacturers include domestic producers in India, China, and Brazil, supplying both local and export markets. Industry consolidation and quality variations impact pricing strategies. Regulatory compliance, quality standards, and purity levels affect manufacturing costs, thereby influencing market pricing.

Competitive Landscape

Alternative antimicrobials such as povidone-iodine, chlorhexidine, and topical antibiotics (e.g., mupirocin) compete with gentian violet, especially in regions with high regulatory scrutiny. Despite this, gentian violet’s affordability sustains its status in underserved healthcare settings. The absence of patents maintains low barriers for generic manufacturers, exerting downward pressure on prices.

Price Trends and Projections

Historical Pricing:

-

Typical bulk procurement prices for pharmaceutical-grade gentian violet range from $0.50 to $2.00 per gram, depending on purity, volume, and supplier.

-

Retail prices vary but generally hover around $0.10 to $0.50 per gram in developing markets.

Projected Price Trajectory (Next 5 Years):

-

Stability in Traditional Markets: Prices are expected to remain stable within existing supply volumes, with minor fluctuations driven by raw material costs and quality standards.

-

Potential Price Decline: An intensified focus on affordability and increased generic competition could drive prices downward, potentially reaching $0.20 per gram for bulk supplies.

-

Impact of Regulatory Shifts: Heightened safety concerns may lead to tighter regulations, constraining supply and possibly elevating unit prices in markets where use persists, potentially up to $1.00 per gram in regulated environments.

-

Emerging Market Opportunities: Increased adoption in public health initiatives, particularly in antimicrobial stewardship programs in low-resource settings, could expand demand modestly, stabilizing prices.

Influencing Factors

-

Safety and Regulatory Changes: Growing evidence of carcinogenicity could restrict certain uses, impact supply, and cause price volatility.

-

Supply Chain Dynamics: Raw material availability, especially of certain dyes used in manufacturing, influences production costs.

-

Demand in Public Health Programs: Initiatives addressing neglected tropical diseases or wound care could temporarily boost procurement volumes and influence prices.

-

Development of Alternatives: Novel antimicrobials entering the market could diminish demand and pressure prices downward.

Conclusion and Future Outlook

Gentian violet remains a niche yet essential antiseptic in specific healthcare segments, particularly in low-resource and rural settings. Its pricing is expected to stay relatively low, with minor fluctuations driven by regulatory stances and manufacturing costs. While large-scale market expansion appears unlikely in developed countries, steady demand persists in emerging markets due to economic advantages and longstanding traditional use.

Key Takeaways

-

Gentian violet’s global market is modest but stable, primarily driven by developing regions.

-

Regulatory concerns regarding safety may influence future use and pricing dynamics.

-

Prices are anticipated to decrease marginally due to generic competition and cost efficiencies, with bulk prices potentially falling below $0.20 per gram.

-

Emerging public health applications could sustain demand, but overall market volume remains limited.

-

Manufacturers should monitor regulatory trends and safety evidence, as these could significantly influence market structure and pricing.

FAQs

-

Is gentian violet approved for medical use globally?

Approval varies; it is approved by the FDA for specific uses but often employed off-label worldwide, especially in developing countries where regulatory oversight is less stringent. -

What factors most significantly impact the price of gentian violet?

Manufacturing costs, raw material availability, regulatory restrictions, regional demand, and competition from alternative antimicrobials are key factors. -

Are there safety concerns affecting the market?

Yes; concerns about carcinogenicity in certain formulations have led to regulatory restrictions in some regions, potentially constraining use and influencing prices. -

Which regions are the primary markets for gentian violet?

Asia-Pacific, Africa, and Latin America represent the primary markets due to their reliance on affordable, accessible antiseptics. -

What is the outlook for new formulations or derivatives of gentian violet?

There is limited activity around derivatives due to safety issues and efficacy concerns; most focus remains on traditional formulations given their socio-economic appeal.

References

- Industry analysis reports, global antimicrobial agents market, 2022-2027.

- Regulatory status updates from FDA and WHO publications.

- Market pricing data from international procurement agencies and pharmaceutical suppliers.

- Scientific literature on safety and efficacy of gentian violet compounds.

More… ↓