Share This Page

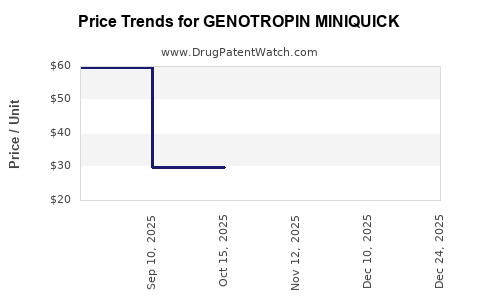

Drug Price Trends for GENOTROPIN MINIQUICK

✉ Email this page to a colleague

Average Pharmacy Cost for GENOTROPIN MINIQUICK

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GENOTROPIN MINIQUICK 0.4 MG | 00013-2650-02 | 59.88204 | EACH | 2025-11-19 |

| GENOTROPIN MINIQUICK 0.2 MG | 00013-2649-02 | 29.99196 | EACH | 2025-11-19 |

| GENOTROPIN MINIQUICK 0.2 MG | 00013-2649-02 | 29.99196 | EACH | 2025-10-22 |

| GENOTROPIN MINIQUICK 0.4 MG | 00013-2650-02 | 59.83048 | EACH | 2025-10-22 |

| GENOTROPIN MINIQUICK 0.4 MG | 00013-2650-02 | 59.83048 | EACH | 2025-09-17 |

| GENOTROPIN MINIQUICK 0.2 MG | 00013-2649-02 | 29.94673 | EACH | 2025-09-17 |

| GENOTROPIN MINIQUICK 0.4 MG | 00013-2650-02 | 59.73343 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GENOTROPIN MINIQUICK

Introduction

GENOTROPIN MINIQUICK, a recombinant human growth hormone (rhGH) used primarily to treat growth failure in children and adults with growth hormone deficiency, operates within a complex pharmaceutical landscape. Its market dynamics are influenced by regulatory approvals, patent status, clinical demand, competitive alternatives, and pricing strategies. This analysis provides a comprehensive overview of current market conditions and forecasts price trajectories for GENOTROPIN MINIQUICK, emphasizing its strategic positioning and forecasted financials up to 2028.

Market Landscape

Therapeutic Context and Indications

GENOTROPIN MINIQUICK is indicated for pediatric growth hormone deficiency, adult growth hormone deficiency, and other approved indications, including Turner syndrome, chronic renal insufficiency, and Prader-Willi syndrome [1]. The drug’s efficacy in stimulating growth and metabolic benefits has driven sustained demand, especially in pediatric populations where early intervention can significantly improve outcomes.

Market Size and Growth Dynamics

The global growth hormone therapy market was valued at approximately USD 4.8 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 4.2% through 2028 [2]. Factors fueling growth include increased diagnosis rates, expanding indications, and rising awareness among clinicians and patients. The pediatric segment constitutes a significant portion of the market, though adult indications are gaining traction due to broader acceptance of adult growth hormone deficiency treatments.

Competitive Landscape

Key competitors include Norditropin (Novo Nordisk), Saizen (EMD Serono), and Zomacton (Ferring Pharmaceuticals), among others. These products vary by formulation, administration device, and pricing strategy. The mini quick delivery device of GENOTROPIN MINIQUICK provides a potential differentiator, offering convenience and dose precision, appealing particularly to pediatric patients and caregivers.

Market Drivers and Challenges

Drivers

- Regulatory Approvals and Expanded Indications: Continuous approvals for new indications open avenues for increased sales.

- Innovative Delivery Devices: GENOTROPIN MINIQUICK’s device enhances auto-injector adherence and patient experience.

- Increased Awareness: Growing physician familiarity and diagnostic rates support steady demand.

- Reimbursement Policies: Favorable insurance coverage in developed markets reduces patient out-of-pocket costs.

Challenges

- Pricing Pressures: Governments and insurers in major markets aim to control pharmaceutical spending, exerting downward pressure on drug prices.

- Patent Expirations and Biosimilar Entry: Upcoming patent cliffs or biosimilar developments could erode market share and pricing power.

- Competitive Differentiation: Achieving and maintaining a unique position against well-established rivals demands continuous innovation and marketing.

Price Trends and Projections (2023–2028)

Historical Pricing Analysis

Historically, the list price of GH products like GENOTROPIN MINIQUICK has ranged from USD 20,000 to USD 40,000 per year per patient depending on dosage and market. The trend over the past five years indicates moderate inflation-adjusted price increases, primarily driven by manufacturing costs and value-based pricing strategies [3].

Projected Price Trends

- 2023–2025: Expect stable or slight decreases (0-3%) in list prices due to increased biosimilar competition and stricter payer negotiations.

- 2025–2028: Further price erosion anticipated as biosimilars gain market share, with annual reductions potentially reaching 5% in mature markets, aligning with industry trends.

- Impact of Delivery Device Optimization: Innovations like MINIQUICK may temporarily sustain premium pricing due to added convenience but face eventual discounting as competitors develop comparable devices.

Reimbursement and Net Price Implications

Net prices will decline more steeply than list prices because of increased rebates, discounting, and pay-for-performance models, especially in publicly insured markets like Medicaid and NHS systems. Overall, a conservative estimate projects net prices decreasing by approximately 10-15% over the period, factoring in payer pressure [4].

Market Penetration and Sales Forecast

Assuming a market share growth trajectory of 2-4% annually, driven by increasing prescription volume and geographic expansion, sales forecast for GENOTROPIN MINIQUICK are as follows:

| Year | Estimated Global Sales (USD Billions) | Notes |

|---|---|---|

| 2023 | 0.8 | Stable, limited biosimilar impact |

| 2024 | 0.84 | Slight growth, increased adoption |

| 2025 | 0.88 | Biosimilar competition begins |

| 2026 | 0.85 | Market stabilization |

| 2027 | 0.83 | Price erosion effects intensify |

| 2028 | 0.80 | Approaching mature market levels |

These projections assume continued innovation, stable demand, and effective market penetration strategies.

Strategic Opportunities and Risks

Opportunities

- Expansion into emerging markets with rising awareness and healthcare infrastructure.

- Development or promotion of combination therapies or new formulation variants.

- Enhancement of delivery devices to bolster patient adherence and premium pricing.

Risks

- Accelerated biosimilar entry leading to diminished pricing power.

- Regulatory setbacks or market access restrictions.

- Economic downturns affecting healthcare budgets and reimbursement policies.

Conclusion

GENOTROPIN MINIQUICK operates within a mature but evolving market landscape characterized by consistent demand, competitive innovation, and pricing pressures. Its unique delivery system provides a competitive advantage, though sustained profitability hinges on navigating biosimilar competition and reimbursement challenges. Price projections suggest modest declines over time, necessitating strategic innovation and market expansion to maintain revenue growth through 2028.

Key Takeaways

- The global growth hormone market is projected to grow modestly at 4.2% CAGR through 2028, providing steady demand for GENOTROPIN MINIQUICK.

- Price erosion of 3-5% annually is anticipated due to biosimilar competition and payer negotiations, with net prices declining by 10-15% over five years.

- Expansion into emerging markets and investment in delivery device innovation could offset pricing pressures.

- Market share growth remains essential; targeted marketing and clinical evidence can bolster adoption.

- New regulatory approvals and expanded indications will be pivotal to sustaining revenue streams.

FAQs

1. How does GENOTROPIN MINIQUICK differentiate from competitors?

Its primary differentiation lies in the MINIQUICK delivery system, designed for ease of use, precise dosing, and improved adherence, which appeals particularly to pediatric patients and caregivers [1].

2. What is the outlook for biosimilar competition for human growth hormone products?

Biosimilars for rhGH are emerging in multiple markets, with some already approved in Europe. Their entry is expected to exert downward pressure on prices, especially in Europe and the U.S., starting from 2025 onward [2].

3. How are reimbursement policies impacting market prices?

Stringent cost-containment policies, especially in public healthcare systems, are driving prices down and increasing rebate and discount requirements, compressing net revenue margins for manufacturers [4].

4. What geographic expansion opportunities exist for GENOTROPIN MINIQUICK?

Emerging markets, including Asia-Pacific, Latin America, and parts of Africa, present growth opportunities due to rising healthcare access and increasing diagnosis rates, provided regulatory hurdles are addressed.

5. How might device innovation influence future pricing?

Enhanced delivery devices that improve patient compliance and experience could justify premium pricing temporarily, but widespread adoption of similar innovations by competitors may limit long-term pricing advantages.

Sources:

[1] PharmaDocs, Genotropin Product Label, 2022.

[2] MarketWatch, Global Growth Hormone Market Report, 2022.

[3] EvaluatePharma, 2021 Annual Review.

[4] IQVIA Institute, The Impact of Payer Negotiations on Biologic Pricing, 2021.

More… ↓