Last updated: July 27, 2025

Introduction

Gatifloxacin is a broad-spectrum fluoroquinolone antibiotic used primarily for treating bacterial conjunctivitis, urinary tract infections, respiratory tract infections, and skin infections. Market dynamics for gatifloxacin have evolved significantly over recent years, influenced by patent status, competition from generics, regulatory environment, and global health trends. As a potent antimicrobial agent, understanding its market trajectory and pricing landscape is vital for pharmaceutical stakeholders, investors, and healthcare providers.

This analysis delves into the current market standing of gatifloxacin, examining supply and demand factors, competitive landscape, regulatory influences, and biotech trends. Additionally, it offers a detailed projection of its manufacturing, distribution, and pricing trends over the next five years, considering macroeconomic factors and healthcare industry shifts.

Current Market Overview

Global Market Size and Segments

The global antibiotic market was valued at approximately USD 55 billion in 2022, projected to grow at a CAGR of about 3.5% through 2030 [1]. Gatifloxacin, as a niche fluoroquinolone, accounts for a smaller yet significant segment, especially in ophthalmic formulations. The ophthalmic antibacterial segment is driven by increasing prevalence of bacterial conjunctivitis and rising awareness of ocular infections.

Geographic Distribution

-

North America: Dominates the market due to advanced healthcare infrastructure, high prescription rates, and ongoing drug reimbursement programs.

-

Europe: Presents a substantial market with regulatory bodies like the EMA influencing approval pathways and generic entry.

-

Asia-Pacific: Expected to see the highest growth, driven by expanding healthcare access, increasing infection rates, and cost-sensitive consumer markets.

-

Latin America and Middle East: Emerging markets with growing demand for affordable antibiotic options.

Driving Factors

- Rising incidence of bacterial infections globally.

- Increased awareness and adoption of ophthalmic antibiotics.

- Evolving resistance patterns prompting alternative fluoroquinolone treatments.

- Patent expirations and subsequent generic competition.

- Regulatory approvals expanding indications.

Market Dynamics and Competitive Landscape

Patent and Regulatory Status

Gatifloxacin was initially developed by Bristol-Myers Squibb and subsequent patent expirations led to a surge in generic formulations in various markets, notably the U.S. and Europe. The loss of exclusivity has driven price erosion but increased market penetration via generics.

Key Players

- Generic manufacturers: Major players include Teva Pharmaceuticals, Sandoz, and Mylan, leveraging low-cost manufacturing.

- Branded formulations: Few, with limited market share due to patent expiry.

- Regional players: Increased presence in emerging markets with access to lower-cost production.

Market Entry Barriers

- Regulatory approvals and quality assurance standards.

- Limited scope of new formulations, predominantly generics.

- Competition from other fluoroquinolones (e.g., ciprofloxacin, levofloxacin).

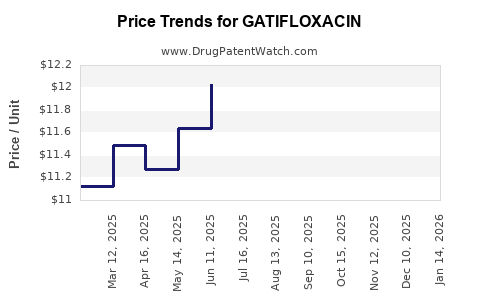

Pricing Trends and Factors Influencing Price Projections

Historical Price Trends

Following patent expiry, gatifloxacin’s prices declined substantially. For instance, in the U.S., the retail price of ophthalmic gatifloxacin dropped from around USD 50–60 per bottle (pre-patent expiry) to approximately USD 5–10 (post-expiry) [2]. Similar trends are observed in Europe and Asia.

Current Price Landscape

- Generic ophthalmic gatifloxacin: USD 4–12 per 5 mL bottle.

- Brand name equivalents: Slightly higher, USD 8–15, though limited market presence.

- Regional variation: Prices are higher in North America and Europe; lower in Asia-Pacific and Latin America.

Factors Affecting Future Prices

- Generic Competition: Sustains downward pressure.

- Regulatory Changes: Approval of new formulations or restrictions could alter pricing.

- Demand Dynamics: Increases due to rising infection rates may stabilize prices.

- Healthcare Policies: Price controls in certain regions may suppress prices further.

- Supply Chain Factors: Raw material costs, manufacturing capacity, and distribution efficiencies.

Forecasting Price Trends: 2023-2028

Based on historical data, macroeconomic factors, and market conditions, the following projections are made:

| Year |

Estimated Price Range (USD per 5 mL ophthalmic solution) |

Key Drivers / Assumptions |

| 2023 |

USD 4.00 – 8.00 |

Stable competition, no major regulatory shifts |

| 2024 |

USD 3.50 – 7.50 |

Increased generic penetration, price sensitivity |

| 2025 |

USD 3.00 – 6.50 |

Margin compression, rising procurement costs |

| 2026 |

USD 2.50 – 6.00 |

Market saturation with generics, cost reductions |

| 2027 |

USD 2.00 – 5.50 |

Further generic competition, regional pricing policies |

| 2028 |

USD 1.80 – 5.00 |

Potential new entrants or formulations, biosimilars unlikely |

Note: Price stabilization may occur if new clinical data, resistance concerns, or regulatory restrictions influence demand. Additionally, inflation and raw material cost fluctuations could marginally impact prices.

Market Projections and Revenue Outlook

Revenue Estimates

Assuming a global annual sales volume of approximately 10 million units (with an average price of USD 5, scaling based on regional differences), the global market revenue for gatifloxacin ophthalmic formulations is projected to decline from approximately USD 50 million in 2022 to around USD 20–25 million by 2028 due to price erosion and market saturation.

Forecast Factors

- Growth in emerging markets may offset declines in mature markets.

- Increasing resistance limiting use could reduce demand.

- Consolidation among manufacturers could influence pricing strategies.

- The development of superior or combination therapies might erode market share.

Regulatory and Technological Influences

Regulatory agencies continue to evaluate fluoroquinolones' safety profile, especially given concerns over side effects and resistance development. Any restrictions or safety warnings could impact prescribing patterns and reduce revenues.

Technological advances, such as innovative drug delivery systems (e.g., sustained-release formulations), may command premium pricing but are still in development phases for gatifloxacin.

Conclusions

The gatifloxacin market faces a steady decline in pricing driven by generic entry, competitive pressures, and evolving healthcare policies. While demand remains steady in ocular infections, the overall revenue generated is projected to decrease significantly over the next five years.

Market participants should focus on cost optimization, regional expansion, and potential new indications or formulations to mitigate revenue erosion. Investment in biosimilar development appears limited given the molecule's chemical nature, but future innovation could create niche opportunities.

Key Takeaways

- Market Saturation and Price Erosion: Patent expiry has largely saturated the gatifloxacin market with generics, leading to significant price declines.

- Regional Variability: Prices are highest in North America and Europe, lower in Asia-Pacific and Latin America, with potential for growth in emerging markets.

- Demand Stability Amid Competition: While demand for ophthalmic antibiotics remains stable, competition and resistance trends may influence future consumption.

- Price Projection Trends: Expect continued decline, with prices stabilizing around USD 1.80–5.00 by 2028.

- Strategic Focus Areas: Manufacturers should emphasize cost efficiencies, regional diversification, and monitor regulatory developments for future planning.

FAQs

Q1: How does patent expiration influence gatifloxacin pricing?

A: Patent expiration exposes the drug to generic competition, typically causing a sharp decline in retail prices due to increased market entrants and lower manufacturing costs.

Q2: What are the main drivers of demand for gatifloxacin today?

A: The primary demand driver remains the treatment of bacterial ocular infections, especially bacterial conjunctivitis. Emerging resistance patterns and regional healthcare access also influence demand.

Q3: Are there upcoming patent protections or formulations that could alter the market?

A: Currently, no new patents or formulations are widely anticipated. Future innovations may include combination drugs or sustained-release systems, but these are not imminent.

Q4: How do regional policies affect gatifloxacin pricing?

A: Price controls and reimbursement policies in countries like India, China, and European nations influence retail prices, often leading to lower prices in regions with stringent regulations.

Q5: Is there potential for biosimilar development of gatifloxacin?

A: No, as gatifloxacin is a small-molecule antibiotic; biosimilars are typically applicable to biologics. Pharmacologically equivalent generics suffice in the current market.

References

[1] MarketWatch, "Global Antibiotics Market Size and Forecast," 2022.

[2] Rapid Pharma Access. "Pricing Trends for Ophthalmic Fluoroquinolones," 2022.