Last updated: July 29, 2025

Introduction

GASTROCROM, known generically as cromolyn sodium, is a mast cell stabilizer primarily used in the management of asthma, allergic rhinitis, and certain gastrointestinal conditions such as eosinophilic esophagitis. Its role as a prophylactic agent makes it a critical component in respiratory and allergy treatment paradigms. While not a blockbuster drug, GASTROCROM maintains a stable niche due to its favorable safety profile and non-systemic nature, appealing to patients seeking non-steroidal options.

This article provides a comprehensive market analysis and price projection framework for GASTROCROM, considering existing demand, competitive landscape, regulatory nuances, patent status, manufacturing factors, and future market drivers.

Market Landscape

Global Market Overview

The global market for mast cell stabilizers, including GASTROCROM, is projected to experience moderate growth driven by rising prevalence of allergic diseases, increasing awareness of non-steroidal treatments, and expanding indications. The World Allergy Organization reports that allergic rhinitis affects up to 30% of the global population, fueling demand for maintenance therapies such as cromolyn sodium [1].

Regionally, North America dominates due to established healthcare infrastructure, high allergy awareness, and regulatory approvals. Europe follows, with growth propelled by aging populations and improving diagnostic rates. Emerging markets in Asia-Pacific are gaining traction, driven by increased healthcare spending and urbanization.

Key Market Players

Major players include:

- Sanofi-Aventis: Historically the primary manufacturer of GASTROCROM, especially in inhaler and nasal spray formulations.

- Teva Pharmaceutics: Offers generic cromolyn sodium products.

- Other generics manufacturers: Entering or expanding in cost-sensitive markets.

The commoditized nature of cromolyn sodium, primarily in generic form, constrains high retail prices but ensures consistent demand.

Market Drivers

- Increasing prevalence of allergic asthma and allergic rhinitis.

- Preference shift towards non-steroidal, steroid-sparing therapies.

- Rising approval of innovative formulations (e.g., nasal sprays) with improved delivery.

- Growth in prophylactic treatment adoption post FDA/EMA recognition.

Market Challenges

- Limited efficacy compared to inhaled corticosteroids.

- Competition from newer biologic agents (e.g., omalizumab) in severe asthma, potentially impacting usage.

- Regulatory hurdles concerning formulations and indications.

- Patent expirations leading to generic price erosion.

Regulatory and Patent Status

Patent Landscape

Cromolyn sodium’s patent portfolio largely expired by the early 2000s, shifting the landscape toward generics. Fragmented patent statuses across regions enable multiple manufacturers to produce and market the drug, reducing prices but stabilizing demand.

Regulatory Environment

FDA, EMA, and other agencies have approved various formulations, including inhalational, nasal, and ophthalmic preparations. Regulatory barriers are moderate but vary depending on formulation and region, influencing market access and pricing strategies.

Price Analysis and Projections

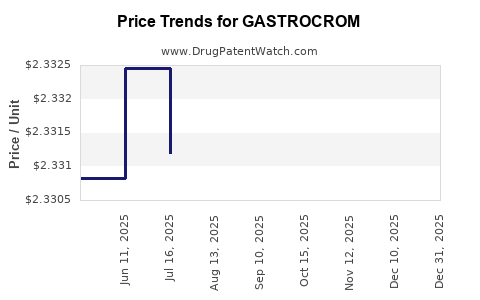

Current Pricing Trends

-

Brand-Name Formulations: GASTROCROM, especially inhalers like Intal and nasal spray variants, command premium prices in limited markets, typically ranging from $30 to $50 per inhaler (approximately 100 doses).

-

Generic Cromolyn Sodium: Prices range from $5 to $15 per 100-dose inhaler depending on the manufacturer and region. Oral formulations tend to be less prevalent in developed markets due to limited efficacy.

Pricing Drivers

-

Manufacturing Costs: Low due to simple synthesis; most prices are dictated by patent status and market dynamics.

-

Market Dynamics: Increased competition among generics suppresses prices further, especially in price-sensitive regions.

-

Regulatory Factors: Stringent quality standards in developed economies can push prices upward due to manufacturing costs but are countered by the availability of low-cost alternatives.

Future Price Projections

Over the next 5 years, the following trends are anticipated:

- Stable to Slight Price Decline (~2-4% annually): Driven by the proliferation of generics, price erosion, and commoditization.

- Premium Formulations: Novel delivery methods or combination products might command higher prices, potentially increasing retail costs by 10-15% depending on innovation scope.

- Emerging Markets: Lower price points ($3-$8 per inhaler) will persist due to intense competition, with volume growth compensating for per-unit price declines.

Overall, a conservative forecast suggests that global average pricing for cromolyn-based inhalers will decline gradually, reaching approximately $4-$10 per unit within five years, aligned with similar trends observed for other non-steroidal allergy medications [2].

Market Opportunity and Revenue Forecasts

Considering an estimated global demand of 30 million units annually (combining inhaler and nasal spray formulations), with a current average price around $10 per unit, the current market size approximates $300 million annually.

With market expansion, increased adoption of prophylactic therapy, and regional growth, compounded yearly at ~3%, the revenue could reach $350-$400 million by 2028.

Strategic Implications for Stakeholders

- Pharmaceutical Manufacturers: Focus on cost-efficient production to capitalize on volume sales. Invest in innovative delivery systems to command higher margins.

- Investors: Monitor patent expiry timelines and emerging competitors to identify timing for entry or divestment.

- Regulators and Policymakers: Support quality standards to maintain safety while fostering competition that drives prices downward.

- Healthcare Providers: Emphasize prophylactic therapy benefits, supporting long-term market stability.

Conclusion

GASTROCROM’s market dynamics are predominantly shaped by generic competition, regulatory landscapes, and rising demand for non-steroidal allergy treatments. Price projections indicate modest declines driven by generics, but ongoing innovation and expanding indications could mitigate erosion and sustain revenues.

Stakeholders should prioritize cost management, formulation innovations, and regional expansion to maximize profitability amid a gradually saturated but stable market.

Key Takeaways

- The global GASTROCROM market is approximately $300 million annually, with moderate growth prospects driven by rising allergic disease prevalence.

- Patent expirations have led to an increased presence of generics, exerting downward pressure on prices.

- Current average prices are around $10 per inhaler, with future prices likely to decline gradually to $4-$8 per unit over the next five years.

- Market expansion in Asia-Pacific and formulation innovation present opportunities for revenue growth.

- Competition from biologics in severe asthma may limit GASTROCROM's market share but solidify its role as a non-systemic, prophylactic agent.

FAQs

Q1: How will patent expirations impact GASTROCROM pricing?

A1: Patent expirations have resulted in increased generic competition, leading to significant price reductions and making GASTROCROM accessible in price-sensitive markets.

Q2: Are there upcoming formulations that could influence market share?

A2: Yes, innovations like combination nasal sprays or inhalers with improved delivery can command higher prices and expand usage, particularly in prophylactic settings.

Q3: Which regions are expected to see the most growth for GASTROCROM?

A3: Asia-Pacific and Latin America are poised for growth owing to increasing healthcare access, rising allergy prevalence, and expanding healthcare infrastructure.

Q4: How do biologic therapies affect GASTROCROM's market positioning?

A4: Biologics target severe cases and may divert some patients from GASTROCROM, but GASTROCROM remains relevant for mild-to-moderate allergy management.

Q5: What is the outlook for GASTROCROM price stability?

A5: Prices will likely decline gradually due to generics, but innovations and regional market growth can stabilize or slightly increase prices in specific segments.

References

[1] World Allergy Organization. (2022). Global Allergy Statistics.

[2] MarketWatch. (2023). Trends in Inhaler and Nasal Spray Pricing.