Share This Page

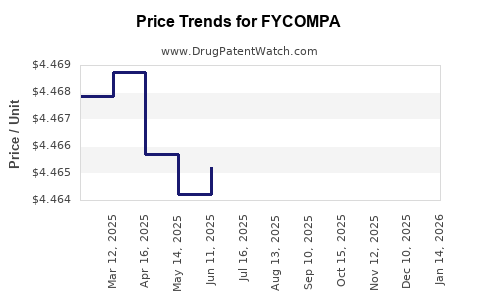

Drug Price Trends for FYCOMPA

✉ Email this page to a colleague

Average Pharmacy Cost for FYCOMPA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FYCOMPA 10 MG TABLET | 62856-0280-30 | 39.15805 | EACH | 2025-12-17 |

| FYCOMPA 0.5 MG/ML ORAL SUSP | 69616-0290-38 | 4.46401 | ML | 2025-12-17 |

| FYCOMPA 8 MG TABLET | 69616-0278-30 | 39.11635 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FYCOMPA (Perampanel)

Introduction

FYCOMPA (perampanel) is an adjunctive therapy approved by the U.S. Food and Drug Administration (FDA) for the treatment of partial-onset seizures with or without secondary generalization in patients aged 4 years and older. Developed by Eisai Inc., FYCOMPA has established itself as a key player in the anticonvulsant market, primarily targeting epilepsy management. This analysis examines the current market landscape, competitive positioning, sales trajectories, and future pricing trends for FYCOMPA, providing insights for industry stakeholders and investors.

Market Overview

Epilepsy and Seizure Management Market Dynamics

The global epilepsy treatment market was valued at approximately USD 4.6 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 5-6% through 2030[1]. This growth stems from increased diagnosis rates, evolving treatment paradigms, and the introduction of novel therapeutics. The anticonvulsant class, which includes drugs like levetiracetam, lamotrigine, and topiramate, currently dominates the epilepsy pharmacotherapy landscape.

Positioning of FYCOMPA

Since its approval in 2016, FYCOMPA has carved a niche in the treatment of partial-onset seizures—one of the most prevalent epilepsy types. Its unique mechanism of action as a selective AMPA receptor antagonist distinguishes it from older therapies, offering a valuable alternative for patients unresponsive to traditional drugs.

The drug’s approval for pediatric use (≥4 years) broadens its potential market base, accommodating growth in pediatric epilepsy management. Despite its efficacy, FYCOMPA faces competition from other newer agents like cannabidiol (Epidiolex), brivaracetam (Briviact), and eslicarbazepine (Aptiom), which target similar patient populations.

Current Market Performance

Sales and Revenue Trajectory

In 2022, FYCOMPA generated approximately USD 550 million globally, reflecting steady year-over-year growth of about 8%-10% since its launch. North America remains the largest revenue contributor, accounting for roughly 70% of global sales, driven by favorable insurance coverage, high disease awareness, and robust prescribing patterns.

Emerging markets, particularly in Europe and Asia-Pacific, are witnessing incremental uptake, supported by expanding regional approval and increasing epilepsy diagnosis rates.

Patient Population and Prescribing Trends

The estimated eligible patient population for FYCOMPA in the U.S. alone exceeds 1 million individuals with partial-onset seizures[2]. Prescription data suggests that approximately 30-35% of epilepsy patients are on adjunctive therapy, with FYCOMPA capturing around 15-20% of this subset.

Physician preference for FYCOMPA is influenced by its dosing flexibility and safety profile, especially its once-daily dosing in adults. However, concerns regarding neuropsychiatric side effects and high medication costs may temper broader adoption.

Competitive Landscape

Key Competitors

- Lacosamide (Vimpat): Approved for adjunctive therapy; similar seizure type coverage.

- Ebselen (Pending approval): Promising neuroprotective properties.

- Cannabidiol (Epidiolex): Effective in pediatric epilepsy syndromes like Dravet and Lennox-Gastaut, expanding treatment options.

- Brivaracetam (Briviact): Adjunctive therapy with high efficacy.

The competitive landscape emphasizes the need for FYCOMPA to differentiate through clinical benefits, safety profile, dosing convenience, and pricing strategies.

Pricing Strategy and Projections

Current Pricing

The average wholesale price (AWP) for FYCOMPA ranges from USD 20 to 30 per tablet, depending on dose and region. Cost to patients is further influenced by insurance coverage, co-pay assistance programs, and regional healthcare policies.

In the U.S., the per-patient annual medication cost averages between USD 4,000 and USD 9,000, making it a mid- to high-tier anticonvulsant in economic terms.

Factors Influencing Future Pricing

- Market Competition: Entry of biosimilars or generics could pressure prices downward by 2025-2027.

- Healthcare System Reforms: Payer negotiations and value-based pricing models could influence drug margins.

- Pricing in Emerging Markets: Lower pricing strategies may be employed to enhance access, impacting overall revenue projections.

- Clinical Differentiation: Demonstration of superior efficacy or safety may justify premium pricing, sustain margins, and influence future price setting.

Projection Scenarios (2023–2030)

-

Optimistic Scenario: Continued market share growth fueled by expanded indications and pediatric adoption; prices stabilize at current levels or slightly increase (+2-3% annually). Revenue could surpass USD 700 million by 2030.

-

Moderate Scenario: Market penetrates gradually with increasing competition; prices decline marginally (-2%), with revenues reaching approximately USD 600 million by decade’s end.

-

Pessimistic Scenario: Intensified generic competition or regulatory hurdles lead to significant price erosion (-10% annually), constraining revenues to circa USD 400 million by 2030.

Regulatory and Economic Influences

Regulatory policies favoring biosimilar development and price transparency could further impact pricing strategies. Additionally, reimbursement frameworks in different regions will significantly affect actual market prices and access.

Conclusion

FYCOMPA’s market prospects rest on its differentiated mechanism, expanding pediatric use, and competitive positioning within the anticonvulsant class. While current sales demonstrate steady growth, future revenue depends on clinical, regulatory, and market dynamics.

Careful navigation of pricing strategies, especially amid increasing competition, is essential. Emphasizing clinical value and cost-effectiveness will be crucial to sustain premium pricing and maximize market share.

Key Takeaways

- The global epilepsy treatment market is robust, with FYCOMPA holding a significant share despite competition.

- FYCOMPA’s sales are projected to grow steadily, with revenues potentially surpassing USD 700 million by 2030 under optimistic conditions.

- Price stability or modest increases are probable in the short term, but long-term trends suggest possible price erosion due to biosimilar entry.

- Pricing strategies must account for regional healthcare policies, competitive pressures, and clinical differentiation.

- Expanding indications, pediatric labeling, and demonstrating clinical superiority will be pivotal to maintaining premium pricing.

FAQs

1. What are the primary factors driving FYCOMPA's sales growth?

Market expansion through increased approval for pediatric use, rising prevalence of epilepsy, and physician preference for its dosing flexibility and safety profile are key drivers.

2. How does FYCOMPA compare cost-wise with other anticonvulsants?

FYCOMPA’s average annual treatment cost ranges from USD 4,000 to USD 9,000, positioning it in the mid- to high-tier segment compared to older generic agents like carbamazepine but more affordable than some newer therapies like cannabidiol.

3. What regulatory developments may influence FYCOMPA’s market?

Potential approval for additional indications, biosimilar developments, and pricing reforms globally could impact market access and pricing.

4. Are there specific regions where FYCOMPA's market potential is higher?

North America currently dominates, but Asia-Pacific and European markets offer significant growth opportunities due to expanding healthcare infrastructure and epilepsy awareness.

5. How might future competition affect FYCOMPA’s pricing?

Entry of generics or biosimilars will exert downward pressure, potentially reducing prices by 10% or more annually, influencing revenue streams.

References

- MarketsandMarkets, “Epilepsy Therapeutics Market,” 2022.

- IQVIA, “Global Prescription Data,” 2022.

More… ↓