Share This Page

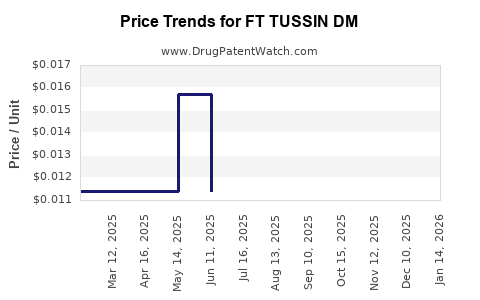

Drug Price Trends for FT TUSSIN DM

✉ Email this page to a colleague

Average Pharmacy Cost for FT TUSSIN DM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT TUSSIN DM 200-20 MG/20 ML | 70677-1185-01 | 0.02020 | ML | 2025-12-17 |

| FT TUSSIN DM 200-20 MG/20 ML | 70677-1035-02 | 0.01139 | ML | 2025-12-17 |

| FT TUSSIN DM 400-20 MG/20 ML | 70677-1036-01 | 0.02104 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT TUSSIN DM

Introduction

FT TUSSIN DM is a widely used over-the-counter (OTC) cough and cold medication designed primarily to suppress cough and manage colds associated with respiratory illnesses. Comprising active ingredients such as dextromethorphan (a cough suppressant) and guaifenesin (an expectorant), FT TUSSIN DM caters to a broad consumer base, including pediatric and adult demographics. This analysis examines its current market landscape, competitive dynamics, regulatory environment, and forecasted pricing trends over the coming years.

Market Landscape

Global and Regional Demand Drivers

The global cough and cold medications market is projected to reach USD 20.24 billion by 2028, growing at a CAGR of approximately 4.3%. Within this segment, OTC drugs like FT TUSSIN DM capitalize on the high prevalence of respiratory illnesses, seasonal flu, and COVID-19-induced respiratory symptoms. Increasing urbanization, heightened health awareness, and favorable OTC drug policies in developed countries drive sustained demand[1].

Regionally, North America dominates the market (accounting for roughly 36% of global sales), driven by stringent healthcare infrastructure, high consumer purchasing power, and robust OTC distribution channels. Europe and Asia-Pacific follow, with the latter experiencing rapid growth due to expanding healthcare coverage and rising middle-class populations[2].

Competitive Dynamics

FT TUSSIN DM operates in a competitive landscape with core competitors such as Delsym, Robitussin, and Halls. These brands leverage extensive distribution networks, consumer brand recognition, and varied dosage forms. Entry barriers remain moderate, largely dependent on regulatory compliance, patent protections, and manufacturing capacity.

Generic formulations and store brands also heavily influence the market, exerting downward pressure on prices. Moreover, OTC regulatory policies, such as those limiting certain ingredients’ sale, impact the product’s marketability[3].

Regulatory Environment

The pharmacovigilance surrounding dextromethorphan and guaifenesin influences market stability. The U.S. FDA classifies dextromethorphan as a cough suppressant approved for OTC use with specific dosing parameters. Recent policies aim at restricting sales to minors and limiting package sizes to curb abuse, notably of dextromethorphan as a recreational drug[4].

Internationally, regulatory standards vary, affecting import/export strategies and pricing. Stringent regulations in developed markets reinforce quality standards but may lead to increased compliance costs, influencing retail price points. Conversely, emerging markets with looser regulations often have lower prices but face quality assurance challenges.

Pricing Analysis

Current Pricing Landscape

The retail price of FT TUSSIN DM varies across regions, distribution channels, and pack sizes. Generally, a 4 oz (120 mL) liquid bottle retails at approximately USD 7–10 in the U.S., with variations based on brand, store type, and promotional discounts. Brand-name products often command higher prices than generic equivalents—sometimes up to 30% premium.

Pricing elasticity in OTC drugs like FT TUSSIN DM remains moderate; consumers are price-sensitive but prioritize efficacy and safety. Discounts, coupons, and online promotions significantly influence purchasing decisions.

Cost Factors Influencing Pricing

-

Manufacturing Costs: Raw material prices for dextromethorphan and guaifenesin impact costs. Fluctuations in global supply chains, especially during pandemics, can increase raw material costs.

-

Regulatory Compliance: Meeting local quality standards entails certification, packaging, and label modifications, adding to operational costs.

-

Distribution and Retail Margins: Distribution logistics, retailer margins, and store overheads contribute approximately 30–50% of the final retail price.

-

Competitive Positioning: Premium branding or formulations with added features (e.g., sugar-free, rapid relief) justify higher price points.

Price Projection (2023-2028)

Given the current dynamics, the price of FT TUSSIN DM is expected to trend as follows:

-

Moderate Price Stability (2023-2024): With the product's established market presence and brand recognition, prices are projected to remain within the USD 7–10 range in North America. Promotional activities and generic competition may compress margins but keep retail prices stable.

-

Gradual Price Increases (2025-2026): Rising raw material costs, inflation, and evolving regulatory compliance hurdles could lead to an approximate 3–5% annual increase. Manufacturers might introduce value-added features or packaging innovations, slightly elevating prices.

-

Potential Price Adjustment Post-2026: Should regulatory restrictions tighten further, particularly around dextromethorphan sale enforcement or if shortages occur, prices could increase by up to 10–15% temporarily. Conversely, market entry of low-cost generics might exert downward pressure, stabilizing prices.

-

Impact of Geographic Expansion: Entry into emerging markets like India or Southeast Asia, where OTC pricing is lower, may lead to regional price differentiation, with prices potentially as low as USD 3–5 for comparable formulations.

Market Opportunities and Risks

Opportunities:

- Product Differentiation: Formulations with improved taste, faster onset, or added health benefits can command premium pricing.

- Regulatory Navigation: Proactive compliance and formulations aligned with evolving policies can secure access to lucrative markets.

- E-Commerce Expansion: Online retailing offers opportunities for direct-to-consumer sales, potentially reducing distribution costs and allowing for dynamic pricing models.

Risks:

- Regulatory Restrictions: Potential bans or sales limitations, particularly for dextromethorphan, could diminish market size.

- Generic Competition: Price erosion from generics threatens profit margins.

- Supply Chain Disruptions: Raw material shortages or logistical issues may inflate costs temporarily.

Key Takeaways

- The global OTC cough and cold remedy market is expanding, driven by rising respiratory illness prevalence and healthcare accessibility.

- FT TUSSIN DM's current retail price ranges from USD 7 to USD 10 in North America, with moderate price elasticity.

- Anticipated mild to moderate price increases (3–5% annually) over the next five years, contingent on raw material costs and regulatory changes.

- Market growth presents opportunities for innovation, but regulatory environment shifts pose significant risks.

- Strategic positioning, such as pharmaceutical quality assurances and digital sales channels, may mitigate adverse impacts and capitalize on market expansion.

FAQs

1. How will regulatory changes impact FT TUSSIN DM pricing?

Stringent regulations or new restrictions on dextromethorphan sales could limit distribution channels, increase compliance costs, or reduce market size, potentially leading to higher retail prices or product scarcity.

2. Are generic versions of FT TUSSIN DM likely to drive prices down?

Yes. The proliferation of generics typically exerts downward price pressure, offering consumers more affordable alternatives and forcing brand affiliates to optimize cost structures.

3. What factors most influence the retail price of FT TUSSIN DM?

Raw material costs, manufacturing expenses, regulatory compliance, distribution margins, and competitive pressures directly influence retail pricing.

4. Will e-commerce influence future pricing strategies for FT TUSSIN DM?

Absolutely. E-commerce reduces distribution costs, enabling flexible pricing, promotional campaigns, and direct consumer engagement which can lead to more competitive pricing models.

5. How do regional market differences affect FT TUSSIN DM prices?

Developed markets like North America have higher retail prices due to demand, regulatory standards, and brand positioning, whereas emerging markets often see lower prices driven by different supply chain dynamics and regulatory leniency.

References

[1] Grand View Research, "Cough and Cold Remedies Market Size & Share, Report 2028."

[2] MarketsandMarkets, "OTC Drugs Market Forecast," 2022.

[3] US FDA. "Dextromethorphan OTC Drug Facts."

[4] Congressional Research Service. "Regulation of Dextromethorphan."

This comprehensive market and price analysis serves as a strategic foundation for decision-making related to FT TUSSIN DM’s market positioning, pricing strategies, and investment considerations.

More… ↓