Share This Page

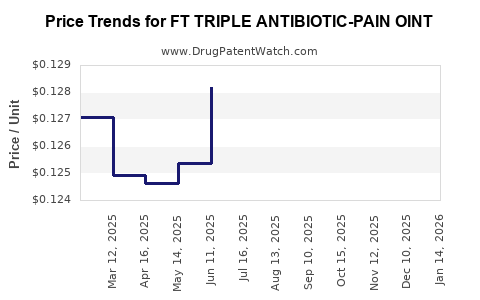

Drug Price Trends for FT TRIPLE ANTIBIOTIC-PAIN OINT

✉ Email this page to a colleague

Average Pharmacy Cost for FT TRIPLE ANTIBIOTIC-PAIN OINT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT TRIPLE ANTIBIOTIC-PAIN OINT | 70677-1219-01 | 0.12771 | GM | 2025-12-17 |

| FT TRIPLE ANTIBIOTIC-PAIN OINT | 70677-1219-01 | 0.12834 | GM | 2025-11-19 |

| FT TRIPLE ANTIBIOTIC-PAIN OINT | 70677-1219-01 | 0.12843 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Triple Antibiotic-Pain Ointment

Introduction

FT Triple Antibiotic-Pain Ointment represents a topical pharmaceutical combining broad-spectrum antibiotics with analgesic components aimed at effectively treating minor skin infections and associated pain. As the healthcare landscape emphasizes outpatient management and rapid wound care, OTC and prescription formulations like FT Triple Antibiotic-Pain Ointment have gained prominence. This analysis evaluates current market dynamics, competitive positioning, regulatory factors, and projects future pricing trajectories within this segment.

Market Overview

Therapeutic Landscape

FT Triple Antibiotic-Pain Ointment integrates three primary antibiotics—bacitracin, polymyxin B, and neomycin—with an analgesic agent (often lidocaine or similar) to provide both antimicrobial activity and pain relief. Its indications include minor cuts, abrasions, and superficial infections, positioning it within an over-the-counter (OTC) and prescription topical category valued for quick symptomatic relief.

Market Size and Growth Drivers

The global topical antibiotics market was valued at approximately USD 5.2 billion in 2022, with a compounded annual growth rate (CAGR) projected at ~4.5% through 2030 [1]. The upward trend is fueled by increased prevalence of skin infections, rising outpatient care, and consumer preference for OTC wound management solutions.

In North America and Europe, high healthcare spending, regulatory approvals, and consumer awareness facilitate market penetration. Meanwhile, emerging markets such as Asia-Pacific exhibit growth potential driven by urbanization, improving healthcare infrastructure, and demand for affordable wound care options.

Key Stakeholders and Competitive Dynamics

Major players in topical antibiotics include Johnson & Johnson (Neosporin), GlaxoSmithKline (Polysporin), and local/regional manufacturers. FT Triple Antibiotic-Pain Ointment competes within a niche—offering combined antimicrobial and analgesic benefits, which differentiates it from traditional antibiotics alone.

Several products combine antibiotics with topical analgesics, but market share remains fragmented. Realistically, innovation and formulations tailored for OTC use are strategic opportunities for market entrants.

Regulatory Environment

In the U.S., the FDA regulates topical antibiotics as OTC drugs with specific monographs, requiring rigorous testing for safety and efficacy [2]. Marketing approvals depend upon compliance with these standards. Emerging markets may have variable regulatory frameworks, influencing early-stage market access and pricing assumptions.

Market Challenges

- Antimicrobial Resistance (AMR): Growing concern over resistance limits the long-term efficacy of topical antibiotics, potentially impacting growth and formulary acceptance.

- Regulatory Scrutiny: Increasing regulation for combination OTC drugs may prolong approval timelines and elevate compliance costs.

- Consumer Safety: Reports of hypersensitivity reactions (e.g., neomycin allergy) impact formulary formulation and marketing claims.

Pricing Dynamics

Current Pricing Landscape

The retail price of topical antibiotic ointments varies depending on formulation, brand, and region. For example, Neosporin (a leading OTC triple antibiotic ointment) retails at approximately USD 4–7 for a 1 oz tube in the U.S. [3].

FT Triple Antibiotic-Pain Ointment, given its combination of antibiotics and analgesics, is positioned in a similar or slightly higher price tier, with typical retail prices ranging from USD 6–10 per tube, contingent on branding and formulation specifics.

Factors Influencing Price

- Formulation Complexity: Inclusion of pain-relief agents like lidocaine increases manufacturing costs.

- Regulatory Status: Prescribed formulations may command premium pricing based on formulary inclusion and physician preference.

- Distribution Channels: OTC products benefit from mass retail distribution, minimizing margins, but high volume sustains profitability.

- Patent and Exclusivity: Patent protections can sustain premium pricing; however, patent expirations typically lead to price reductions due to generics.

Price Projection Analysis

Based on historical trends and market fundamentals, future pricing for FT Triple Antibiotic-Pain Ointment can be modeled considering several factors:

1. Patent and Competition Outlook

The patent lifecycle influences pricing strategy; with patent expiration, generic competitors are likely to enter the market, exerting downward pressure on prices.

2. Cost of Goods Sold (COGS) and Manufacturing efficiencies are expected to improve with scale, potentially enabling price compression.

3. Regulatory and Safety Considerations

Enhanced safety profiles and compliance costs may sustain or slightly increase prices initially, especially if the formulation includes proprietary analgesic compounds.

4. Consumer Demand

Shifts toward OTC self-care and demand for combination products might allow premium pricing, especially if marketed effectively.

Projected Price Range (2023–2030):

- Short-term (1–3 years): USD 6–9 per tube, maintaining current positioning amid modest inflation and cost adjustments.

- Mid-term (4–6 years): USD 5–8, assuming entry of generics and increased competition.

- Long-term (7+ years): USD 4–6 per tube, contingent on patent expiration, market saturation, and generics prevalence.

Market Entry and Strategic Positioning

New entrants aiming for FT Triple Antibiotic-Pain Ointment’s market share should focus on:

- Developing formulations with improved safety profiles to mitigate hypersensitivity risks.

- Leveraging cost efficiencies for competitive pricing.

- Innovating with delivery mechanisms (e.g., patches) or combination therapy.

- Targeting emerging markets where affordable over-the-counter options are prioritized.

Key Takeaways

- The global topical antibiotics market, valued at USD 5.2 billion in 2022, exhibits steady growth driven by outpatient wound care needs.

- FT Triple Antibiotic-Pain Ointment occupies a niche combining antimicrobial and analgesic functions, with competitive pricing currently around USD 6–10 per tube.

- Future pricing will decline modestly with the advent of generics post-patent expiry but may sustain higher margins if protected by proprietary formulations or strong branding.

- Market challenges include antimicrobial resistance concerns and regulatory scrutiny, which could influence formulation strategies and pricing.

- Strategic positioning for manufacturers should emphasize safety, innovation, and cost competitiveness to maximize market share.

FAQs

1. How does antimicrobial resistance impact pricing strategies for topical antibiotics like FT Triple Antibiotic-Pain Ointment?

Antimicrobial resistance risks may lead to regulatory restrictions and lower usage, prompting manufacturers to invest in formulations with enhanced efficacy or safety—potentially increasing upfront costs and influencing pricing. Over time, resistance issues could also reduce demand, pressuring prices downward.

2. What are the regulatory hurdles for launching a new triple antibiotic-pain ointment?

Manufacturers must adhere to FDA OTC monographs or file New Drug Applications (NDAs), demonstrating safety, efficacy, stability, and manufacturing quality. Regulatory approval timelines depend on the complexity of formulation and existing data.

3. How does patent protection influence the price outlook for FT Triple Antibiotic-Pain Ointment?

Patents enable premium pricing and market exclusivity. Post-expiration, generics typically enter, exerting downward pressure on prices, often by 50% or more within a few years.

4. Are there regional variations in pricing expectations for this drug?

Yes. Developed markets like North America and Europe tend to have higher prices due to stricter regulations and consumer expectations, whereas emerging markets may have lower prices driven by affordability and regulatory differences.

5. What are the main factors driving demand for topical antibiotics with analgesic properties?

The demand is driven by the rising incidence of minor skin injuries, consumer preference for OTC solutions, and the convenience of combined antimicrobial and pain relief formulations, especially in outpatient care settings.

References

[1] Market Research Future. "Topical Antibiotics Market Size & Share, Analysis." 2022.

[2] U.S. Food and Drug Administration. "OTC Drug Review: Monographs."

[3] Retail Pharmacy Insights. "Pricing Trends for Topical Antibiotics." 2022.

More… ↓