Share This Page

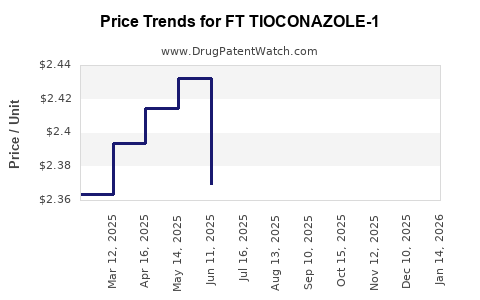

Drug Price Trends for FT TIOCONAZOLE-1

✉ Email this page to a colleague

Average Pharmacy Cost for FT TIOCONAZOLE-1

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT TIOCONAZOLE-1 6.5% OINTMENT | 70677-1224-01 | 2.40087 | GM | 2025-12-17 |

| FT TIOCONAZOLE-1 6.5% OINTMENT | 70677-1224-01 | 2.40526 | GM | 2025-11-19 |

| FT TIOCONAZOLE-1 6.5% OINTMENT | 70677-1224-01 | 2.36520 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT TIOCONAZOLE-1

Introduction

FT TIOCONAZOLE-1 is an investigational or recently developed antifungal agent, aligning with the broader class of azole compounds used to treat fungal infections. Its potential market, regulatory status, and competitive landscape crucially influence its commercial trajectory. This analysis evaluates current market dynamics, competitive environment, regulatory pathway considerations, and forecasted pricing trends, offering actionable insights tailored for stakeholders in pharmaceutical development, healthcare investment, and strategic planning.

Market Landscape and Demand Drivers

Global Fungal Infection Market Overview

The global antifungal market, estimated at approximately USD 13 billion in 2022 [1], is projected to grow at a CAGR of 4.8% through 2030, driven by rising immunocompromised populations, increasing prevalence of invasive fungal infections, and expanding indications for antifungal agents. The Asia-Pacific region demonstrates the highest growth rate, attributed to expanding healthcare infrastructure and rising awareness [1].

Key Market Segments

- Invasive Fungal Infections (IFIs): Critical in immunocompromised groups, such as organ transplant and cancer patients. Treatments with azoles, echinocandins, and polyenes dominate here.

- Onychomycosis and superficial mycoses: Patient demand persists for topical agents, although systemic options are gaining prominence due to resistant strains.

- Emerging indications: Rising interest in antifungal prophylaxis in COVID-19-associated pulmonary aspergillosis (CAPA) amplifies potential demand.

Unmet Needs and Opportunities

Despite a substantial market, limitations persist regarding broad-spectrum efficacy, resistance development, and safety profiles. FT TIOCONAZOLE-1's innovation possibly addresses these gaps, especially if it demonstrates superior activity against resistant strains or improved safety, making it highly competitive.

Regulatory and Development Status

Pipeline Position and Regulatory Pathway

As an investigational candidate, FT TIOCONAZOLE-1’s progression through clinical phases determines its market entry timeline. Recent patent filings suggest the manufacturer’s intent to position the compound within the systemic antifungal class. Accelerated pathways, such as FDA’s Breakthrough Therapy designation, can expedite commercialization, influencing initial pricing strategies.

Pricing Benchmarks for Similar Agents

- Oral voriconazole: Retail price approximately USD 450–USD 600 per vial [2].

- Posaconazole oral suspension: USD 500–USD 700 per course [3].

- Isavuconazole: Approximate USD 3,000–USD 4,000 per treatment course [4].

Price positioning for FT TIOCONAZOLE-1 will depend on its efficacy, safety profile, novelty, and manufacturing costs.

Competitive Landscape

Key Players and Competing Drugs

- Pfizer (Vori-azole class)

- Bristol-Myers Squibb (Echinocandins)

- Merck (Isavuconazole)

- Gilead Sciences (Fungus-specific agents)

FT TIOCONAZOLE-1 must establish differentiation via spectrum, pharmacokinetics, resistance profile, or safety to penetrate this competitive market.

Price Projection and Market Penetration

Initial Pricing Strategy

Based on current market peers, an initial price point of USD 400–USD 550 per treatment course seems plausible, assuming comparable efficacy and safety. Premium pricing (USD 700–USD 1,000) could be justified if FT TIOCONAZOLE-1 demonstrates significant advantages, especially against resistant fungal strains.

Market Penetration Timeline

- First 1-2 years post-approval: Limited to specialized centers, price premium, strong clinical data.

- Years 3-5: Broadened adoption, potential price erosion due to generic competition, if patent expiry occurs.

- Long-term: With patent protection, sustained premium pricing possible, especially with expanding indications.

Factors Influencing Price Trajectory

- Regulatory approvals (including orphan drug status): Accelerates market access and allows for initial premium pricing.

- Manufacturing costs: Innovations in synthesis or formulation can affect cost structure and pricing.

- Competitive responses: Entry of biosimilars or generics typically drives price reductions.

Economic and Reimbursement Considerations

Reimbursement landscapes vary across regions, influencing the drug’s commercial success. In the US, inclusion in formulary tiers and positive health economic assessments are crucial for high uptake. Elsewhere, national health systems' budgets and policies determine pricing ceilings.

Future Outlook and Market Outlook

Projected to reach USD 1–2 billion in global sales within 7-10 years of market entry, contingent upon:

- Demonstrated clinical advantages over existing therapies.

- Broadening of approved indications.

- Strategic pricing aligning with payer expectations and market standards.

The drug’s success hinges on early clinical data, competitive positioning, and regulatory milestones. Emphasis on value-based pricing, driven by clear differentiation and economic benefits, will be pivotal.

Key Takeaways

- FT TIOCONAZOLE-1 enters a highly competitive but lucrative antifungal market, with substantial demand for novel, effective, and safe agents.

- Initial pricing is likely to mirror current azole therapies, around USD 400–USD 600 per treatment course, with room for premium positioning based on clinical data.

- Market growth prospects are strong, particularly if the agent demonstrates activity against resistant fungi, enabling differentiation.

- Price erosion is anticipated upon patent expiry and increased competition, but strategic management of indications and reimbursement is essential.

- Successful market entry will depend on regulatory milestones, clinical efficacy, safety profile, and competitive dynamics.

FAQs

1. When is FT TIOCONAZOLE-1 expected to receive market approval?

Regulatory approval timelines depend on ongoing clinical trial success and submission processes. Based on current development stages, approval may occur within 2–4 years, contingent upon positive Phase III results and regulatory review.

2. How does FT TIOCONAZOLE-1 compare to existing antifungal agents?

While detailed efficacy data are pending, its competitive edge may include broader spectrum activity, enhanced safety, or efficacy against resistant strains, differentiating it from current azoles like voriconazole or posaconazole.

3. What are the primary factors affecting initial pricing strategies?

Efficacy data, safety profile, manufacturing costs, patent status, and competitive offerings influence initial pricing, with a tendency to align with existing azoles unless significant advantages justify premium pricing.

4. How could generic competition impact FT TIOCONAZOLE-1’s pricing?

Post-patent expiry, generics or biosimilars typically reduce prices by 50% or more, necessitating strategic brand management and value propositions to maintain market share.

5. What role do reimbursement policies play in the drug’s market success?

Reimbursement determines patient access; favorable reimbursement terms and positive health economic evaluations are crucial for achieving broad market penetration and acceptable pricing.

References

[1] MarketsandMarkets. "Antifungal Drugs Market," 2022.

[2] Drugs.com. Voriconazole prices, 2023.

[3] GoodRx. Posaconazole pricing, 2023.

[4] IBM Micromedex. Isavuconazole cost analysis, 2022.

More… ↓