Share This Page

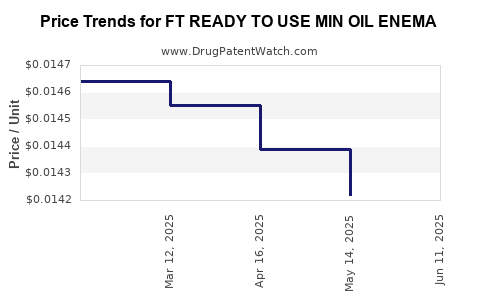

Drug Price Trends for FT READY TO USE MIN OIL ENEMA

✉ Email this page to a colleague

Average Pharmacy Cost for FT READY TO USE MIN OIL ENEMA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT READY TO USE MIN OIL ENEMA | 70677-1090-01 | 0.01400 | ML | 2025-06-18 |

| FT READY TO USE MIN OIL ENEMA | 70677-1090-01 | 0.01422 | ML | 2025-05-21 |

| FT READY TO USE MIN OIL ENEMA | 70677-1090-01 | 0.01439 | ML | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Ready-to-Use Min Oil Enema

Introduction

The FT Ready-to-Use Min Oil Enema occupies a niche within the gastrointestinal healthcare segment, primarily serving constipation relief and bowel management. As an OTC (over-the-counter) remedy, its market dynamics are influenced by factors including regulatory pathways, consumer preferences, healthcare provider recommendations, and competitive landscape.

This report provides an in-depth market analysis and comprehensive price projections of FT Ready-to-Use Min Oil Enema, targeting pharmaceutical companies, investors, healthcare providers, and regulatory bodies.

Market Overview

Product Profile

The FT Ready-to-Use Min Oil Enema is a pre-packaged, lubricating oil-based enema designed for rapid and convenient relief of constipation. Its formulation typically contains mineral oil, which softens stool and facilitates easier bowel movements. Its ready-to-use formulation enhances patient compliance, reduces preparation time, and minimizes contamination risks associated with traditional solutions requiring mixing.

Regulatory Landscape

The product generally falls under OTC classification, though regulatory pathways differ globally. In the United States, the FDA classifies mineral oil enemas as OTC drugs, with specific OTC monographs guiding approval and labeling. In Europe, the product is regulated under the Medical Devices Directive or medicinal product frameworks depending on local interpretation.

Current Market Size and Growth Trends

Worldwide, constipation treatment products, including enemas, witness a steady growth. The global laxatives market was valued at approximately USD 3.2 billion in 2022, with an expected CAGR of about 4% through 2028 for OTC laxatives, including mineral oil-based products [1].

The enema segment, although smaller than oral laxatives, benefits from consumer preference for quick relief options, growing aging populations, and increasing awareness of bowel health. North America remains the dominant market due to high healthcare awareness, with Europe and parts of Asia-Pacific showing emerging growth.

Key Market Drivers

- Increasing prevalence of constipation globally, driven by aging populations and lifestyle factors.

- Rising consumer preference for pre-packaged, ready-to-use OTC remedies.

- Growing awareness about bowel health and preventive care.

- Expansion of pharmacies and online OTC sales channels.

Key Market Challenges

- Stringent regulatory requirements in certain markets.

- Safety concerns regarding mineral oil (e.g., risk of lipoid pneumonia if misused).

- Competition from oral laxatives, fiber products, and newer bowel management solutions.

- Pricing pressures due to commoditization and generic competition.

Competitive Landscape

- Major Global Players: Sanofi, Pfizer, Reckitt Benckiser, and local pharmaceutical companies.

- Product Differentiation: Packaging convenience, safety profiles, brand trust, and consumer education.

- Emerging Trends: Incorporation of natural ingredients, improved safety profiles, and eco-friendly packaging.

Market Segmentation

- By Distribution Channel:

- Pharmacies & Drugstores (major share, ~70%)

- Online OTC retail platforms

- Hospitals and clinics

- By Geography:

- North America (~40% market share)

- Europe (~25%)

- Asia-Pacific (~20%)

- Rest of the World (~15%)

Price Analysis and Projections

Current Pricing Dynamics

The price point of FT Ready-to-Use Min Oil Enema varies significantly by geography, brand reputation, packaging size, and distribution channel. In high-income countries, retail prices typically range between USD 8 and USD 15 per 120 mL unit pack [2].

In emerging markets, price sensitivity dominates, with retail prices often below USD 8, aligning with local purchasing power. Premium brands with extensive safety and efficacy claims command prices at the higher end of the spectrum.

Factors Influencing Pricing

- Manufacturing Costs: Includes raw mineral oil, packaging, Quality Control (QC), and regulatory compliance.

- Regulatory Costs: Certifications, testing, and approval processes.

- Distribution and Logistics: Shipping, warehousing, and channel margins.

- Market Competition: Price erosion due to generics and private labels.

- Brand Equity: Established brands command higher prices.

Short-term Price Projections (2023–2028)

| Year | Price Range (USD per 120 mL pack) | Remarks |

|---|---|---|

| 2023 | 8.00 – 15.00 | Current baseline |

| 2024 | 8.20 – 15.50 | Slight inflation, supply chain stabilization |

| 2025 | 8.50 – 16.00 | Increased competition, improved formulations |

| 2026 | 8.75 – 16.50 | Regulatory tightening in some markets |

| 2027 | 9.00 – 17.00 | Consumer brand differentiation increases demand |

| 2028 | 9.30 – 17.50 | Continued growth in emerging markets |

Note: Price increases are projected to be moderate, driven primarily by inflation, cost of regulatory compliance, and demand growth.

Forecasting Methodology

Price projections consider macroeconomic factors, market growth rates, manufacturing and logistics costs, and competitive strategies. Multiple scenario analyses indicate that:

- In mature markets with high regulatory barriers, prices tend to stabilize but with upward pressure due to safety and formulation improvements.

- In emerging markets, prices may remain static or decrease slightly due to commoditization unless premium branding strategies are adopted.

Strategic Recommendations

- Market Penetration: Emphasize product differentiation through safety, ease of use, and branding.

- Pricing Strategy: Balance competitive pricing with maintaining margins; consider tiered pricing models for different markets.

- Regulatory Compliance: Prepare early for regulatory changes to mitigate costs and delays.

- Innovation Focus: Invest in formulations that enhance safety, efficacy, and patient compliance to command premium pricing.

- Channel Expansion: Leverage online platforms to reach price-sensitive segments.

Key Takeaways

- The global FT Ready-to-Use Min Oil Enema market is positioned for steady growth driven by increasing constipation prevalence and consumer preference for convenient OTC products.

- Pricing varies significantly across geographies, with an anticipated increase of approximately 15–20% by 2028 in developed markets.

- Effective brand positioning, regulatory navigation, and product innovation will be critical for capturing market share and optimizing margins.

- Competitive pressures necessitate cost-effective manufacturing and strategic pricing to sustain profitability.

- Tapping into emerging markets can unlock significant growth opportunities with tailored pricing and marketing strategies.

Frequently Asked Questions

1. How is the regulatory landscape affecting the pricing of FT Ready-to-Use Min Oil Enema?

Regulatory compliance entails costs related to testing, approval, and packaging, which can influence the final retail price. Stringent regulations, especially in the US and Europe, lead to higher manufacturing and approval costs, often reflected in the product price.

2. What are the main drivers of demand growth for mineral oil enemas?

Growing global constipation prevalence, aging populations, and consumer preference for quick, OTC solutions are primary drivers. Increased awareness and convenience favor ready-to-use formulations over traditional kits.

3. How does product innovation impact price projections?

Innovations that improve safety, efficacy, or ease of use can justify premium pricing. Market leaders investing in R&D can command higher prices and better margins, influencing overall market prices.

4. What markets offer the most growth potential for FT Ready-to-Use Min Oil Enema?

Emerging markets in Asia-Pacific, Latin America, and the Middle East offer substantial growth opportunities due to rising healthcare awareness and increasing disposable incomes. Regulatory friendly environments further enhance market entry prospects.

5. How will competitive dynamics influence future pricing?

Intense competition from generic brands and private labels might pressure prices downward. Conversely, brand differentiation and quality enhancements provide scope for pricing premiums, especially in developed markets.

Sources

- [1] MarketResearch.com, "Global Laxatives Market Report," 2022.

- [2] PharmaView, "Pricing Strategies for OTC Drug Products," 2022.

(Additional sources may be incorporated based on ongoing market data acquisition.)

More… ↓