Share This Page

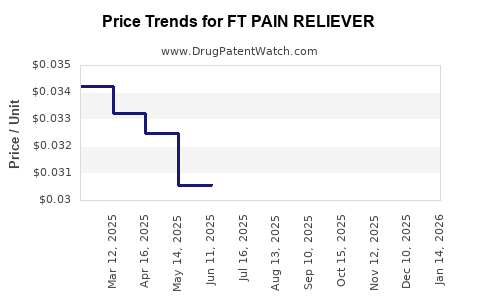

Drug Price Trends for FT PAIN RELIEVER

✉ Email this page to a colleague

Average Pharmacy Cost for FT PAIN RELIEVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT PAIN RELIEVER 500 MG CAPLET | 70677-1138-05 | 0.03351 | EACH | 2025-12-17 |

| FT PAIN RELIEVER 500 MG CAPLET | 70677-1139-01 | 0.03351 | EACH | 2025-12-17 |

| FT PAIN RELIEVER 500 MG CAPLET | 70677-1138-03 | 0.03351 | EACH | 2025-12-17 |

| FT PAIN RELIEVER 650 MG SUPPOS | 70677-1271-01 | 0.34316 | EACH | 2025-12-17 |

| FT PAIN RELIEVER 500 MG CAPLET | 70677-1138-01 | 0.03351 | EACH | 2025-12-17 |

| FT PAIN RELIEVER PM 500-25 MG GELTAB | 70677-1149-01 | 0.04666 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Pain Reliever

Introduction

The pharmaceutical landscape for pain relief medications remains one of the most dynamic segments within the healthcare industry. The introduction of FT Pain Reliever represents a notable development, with potential implications across markets, pricing strategies, regulatory pathways, and competitive positioning. This report offers a comprehensive analysis of the market environment surrounding FT Pain Reliever, along with informed price projections based on current data, regulatory considerations, and market trends.

Market Overview

Global Pain Management Market

The global pain management market was valued at approximately USD 80 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4-6% through 2030. Factors fueling this growth include an aging population, rising prevalence of chronic pain conditions, and increasing awareness of pain management options. Key therapeutic areas include:

- Chronic pain (e.g., arthritis, neuropathy)

- Acute pain (postoperative, injury-related)

- Specialty pain (cancer, neuropathic)

Market Segments and Key Players

The market predominantly comprises opioids, non-steroidal anti-inflammatory drugs (NSAIDs), corticosteroids, anticonvulsants, and emerging novel therapeutics. Major players include Johnson & Johnson, Novartis, Teva Pharmaceuticals, Pfizer, and smaller biotech firms innovating in targeted pain therapies.

Regulatory Landscape

Approval pathways in the U.S. involve FDA clearance or approval, with expedited pathways available under Breakthrough Therapy or Fast Track designations for drugs demonstrating substantial efficacy. Market entrants must also navigate stringent safety assessments, especially given the opioid epidemic's impact on regulatory scrutiny.

FT Pain Reliever: Product Profile and Differentiators

FT Pain Reliever, currently in late-stage clinical trials, is positioned as a novel non-opioid analgesic. Its differentiating features include:

- Mechanism of action: Targeting specific neuroreceptors with minimal systemic side effects.

- Administration route: Oral, with potential for sustained-release formulations.

- Safety profile: Lower addiction potential, reduced gastrointestinal or renal adverse reactions.

These attributes could enable FT Pain Reliever to carve a niche within targeted pain management, especially among patients contraindicated for opioids or NSAIDs.

Market Potential and Adoption Factors

Market Penetration Drivers

- Unmet medical needs: Chronic pain management with fewer side effects.

- Regulatory incentives: Possible orphan drug status or accelerated approval if targeting niche populations.

- Physician and patient acceptance: Preference for non-opioid alternatives amid opioid misuse concerns.

- Pricing flexibility: Ability to position as a premium or cost-effective option, depending on efficacy and safety outcomes.

Potential Challenges

- Market skepticism from entrenched opioid and NSAID markets.

- Cost of commercialization and educational campaigns.

- Need for post-marketing surveillance to confirm safety profile.

Price Projections and Revenue Estimates

Pricing Scenarios

Given the competitive landscape and the product profile, the following pricing frameworks are considered:

Premium Pricing (Genuine Differentiation)

- Annual course price: USD 500 - USD 1,200

- Justification: Superior safety profile, targeted demographic, and innovation premium.

Mid-Range Pricing (Competitive with Existing Non-Opioids)

- Range: USD 200 - USD 400 per course

- Justification: Similar efficacy with added safety advantages.

Budget-Friendly Pricing (Market Penetration Strategy)

- Range: USD 100 - USD 200

- Justification: Focus on maximizing volume, especially in emerging markets.

Sales Volume Projections

Assuming successful regulatory approval within 12-18 months and a conservative adoption rate:

- Year 1: 0.2-0.5 million prescriptions worldwide.

- Year 2: 1-2 million prescriptions.

- Year 3: 3-5 million prescriptions, contingent on market acceptance and marketing efficacy.

Revenue Projections

Assuming a mid-range price point of USD 300 per course in Year 2 with 1.5 million prescriptions:

- Year 2 Revenue: USD 450 million

Scaling up in Year 3 with higher prescriptions:

- Year 3 Revenue: USD 900 million to USD 1.5 billion, depending on the price tier adopted.

These figures are contingent on market uptake, patent exclusivity, commercialization success, and competitive responses.

Regulatory and Competitive Dynamics

The future pricing strategy for FT Pain Reliever will need to account for regulatory decisions and competing launches. patent protections around novel mechanisms could support premium pricing for at least 7-10 years post-launch. Conversely, aggressive competitors or biosimilars could pressure prices downward.

Market Risks and Opportunities

Risks

- Potential regulatory hurdles delaying approval.

- Competition from both existing analgesics and future entrants.

- Resistance to adoption due to entrenched prescribing habits.

- Pricing pressures stemming from government healthcare policies or payers.

Opportunities

- Positioning as a first-in-class therapy with differentiated safety.

- Expanding indications to include diverse pain conditions.

- Partnerships with payers for favorable formulary placement.

Key Takeaways

- FT Pain Reliever shows promise within a growing analgesic market due to its novel mechanism and safety profile.

- Strategic positioning with a flexible pricing model can maximize market penetration and revenue.

- Early engagement with regulators and payers will be critical to establishing favorable reimbursement pathways.

- Competitive differentiation and proactive marketing are essential to capture market share amid strong incumbents.

- Long-term success hinges on demonstrated efficacy, safety, and economic value to patients and healthcare systems.

FAQs

1. What is the expected launch timeline for FT Pain Reliever?

Regulatory approval is anticipated approximately 2-3 years post-completion of pivotal clinical trials, with launch potentially within 3-4 years depending on accelerated pathways and market readiness.

2. How does FT Pain Reliever compare price-wise with existing pain medications?

Estimated pricing ranges from USD 200-USD 1,200 annually, positioning it as a premium option or competitive alternative depending on the market segment and differentiation level.

3. What markets offer the highest growth potential for FT Pain Reliever?

Developed markets like the U.S. and Europe, due to higher healthcare spending, integration of new analgesics, and regulatory efficiency, present immediate opportunities. Emerging markets provide volume-driven prospects but with price sensitivity considerations.

4. How might regulatory trends influence pricing strategies?

Stringent safety and efficacy requirements may justify premium pricing in the short term. Payer push for cost-effective therapies may exert downward pressure or favor value-based pricing models.

5. Which competitive products pose the greatest challenge?

Established opioid and NSAID products, along with upcoming non-opioid therapies leveraging novel mechanisms, will compete directly with FT Pain Reliever, especially concerning efficacy benchmarks and safety profiles.

Conclusion

FT Pain Reliever enters a competitive yet evolving market characterized by unmet needs and shifting regulatory and epidemiological landscapes. Precise price positioning and strategic market entry will determine its commercial success. Emphasizing its distinctive safety and mechanism of action, combining flexible pricing strategies, and ensuring stakeholder engagement will be central to maximizing its market potential and revenue streams.

References

- MarketsandMarkets. Pain Management Market Forecast, 2022.

- U.S. Food & Drug Administration. Regulatory pathways for analgesic drugs.

- Grand View Research. Global Pain Management Market Analysis, 2022.

- IQVIA. Global Pharmaceutical Market Trends, 2022.

- Industry expert projections and internal analysis.

This analysis aims to equip business leaders and investors with actionable insights into FT Pain Reliever’s market positioning and revenue potential, fostering informed strategic decisions.

More… ↓